Founders of the Finiko pyramid suspected of exit scam

Investors in the Kazan-based financial pyramid Finiko, which promised returns from investments in cryptocurrency and stock markets, are flooding with complaints about being unable to withdraw funds. Independent experts estimate the total damage from the company’s activities at several hundred million dollars.

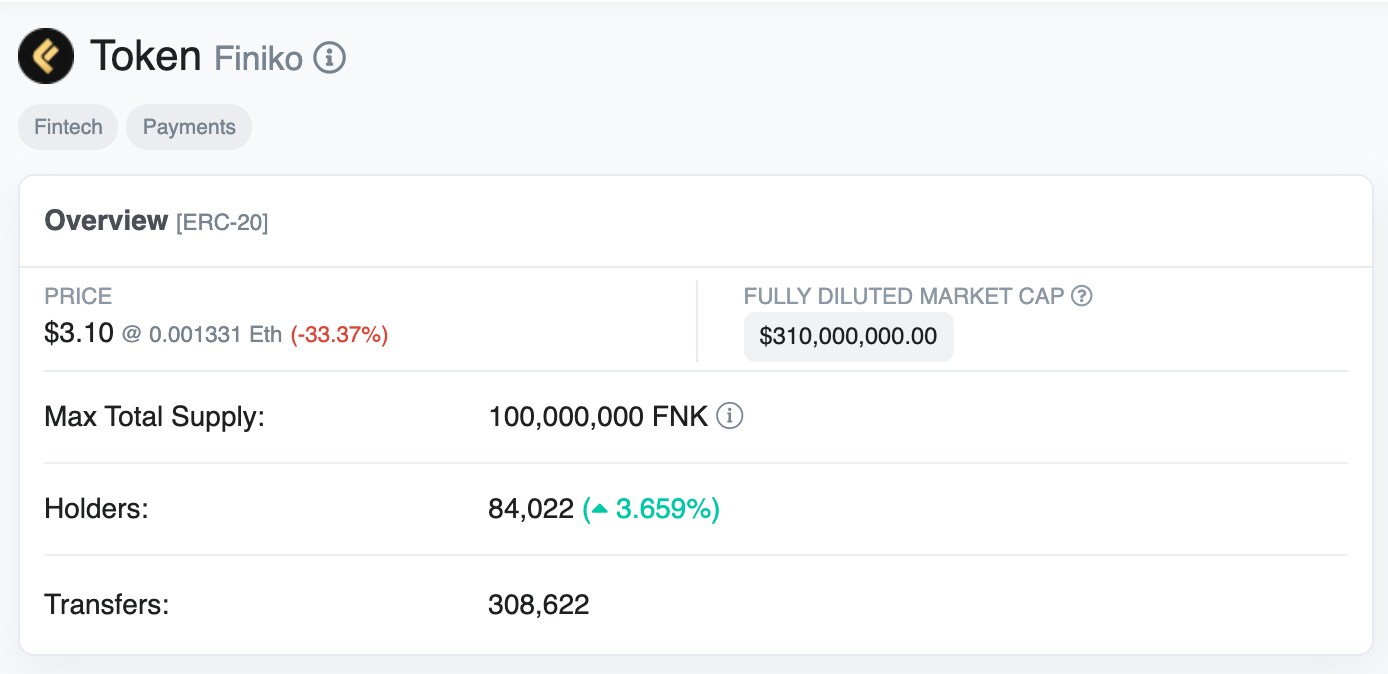

Since June 17, Finiko has decoupled all operations from the price of Bitcoin and restricted withdrawals from the platform to only the native token FNK.

At its peak, the token traded as high as $231, but in the last three weeks its price has fallen by 97%. As of writing, the token was trading around $3.17.

Screenshot from the Telegram chat “Finiko Chatterbox Best”. Data: Ghost In the Block.

On July 3, in Finiko’s Facebook group there were calls to acquire FNK tokens for any amount and thereby “drive the price up to $500.”

“Human greed and foolishness prevailed — people began withdrawing all the money at once, driving the token price down to $5 and causing colossal losses for other partners. The company is not to blame for the price drop; only the users of the platform, top leaders, who failed to convey to their networks that they should not withdraw all the money at once, are to blame.”

Finiko added that the company allegedly contributed $48 million to support FNK liquidity, but provided no evidence.

BIT.TEAM — one of the few exchanges where the token trades — announced a delisting. The platform attributed this to “huge network fees and weak demand.”

Authorities say the pyramid operated from August 2019. The organizers promised investors a guaranteed monthly return of up to 25% from investments in cryptocurrency and stock markets. They claimed to have created an “automatic profit-generation system.”

Investors were paid returns typical of pyramids — about 1% per day. Users also earned rewards for each additional referred client.

Finiko did not hold licenses to operate as a forex dealer or any registration in state registries or tax authorities in Russia had none.

Founders include Kirill Doronin, the owner of the FINIKO trademark, Zygmunt Zygmuntovich, and Edvard and Marat Sabirov.

Data: finiko.pro.

Kazan entrepreneur Kirill Doronin previously led the company Escalat, which promised help in debt relief. The business was wound down, and clients began massing to sue the company for unmet obligations.

Finiko operates a network of sites with varying content and information about the company’s registration. Some mention CyfronCapital OÜ, registered in Estonia in October 2019. Its founder is Kirill Doronin.

According to the Estonian Ministry of Economic Affairs and Communications, the service obtained a license to exchange virtual currencies and the right to hold them. However, the license is currently suspended.

In Finiko’s user agreement, the legal entity Cyfron FNK LTD is listed, registered in Saint Lucia. A search in Saint Lucia’s company registry for the company name yielded no results.

In the Cyfron FNK LTD document, it disclaims responsibility for any client losses when using the system.

“The service does not guarantee the accuracy of information on the site or the safety of the service. The company is not a broker and does not provide investment services.”

In early December 2020, at the request of the Tatars prosecutor’s office, a criminal case was opened against Finiko on suspicion of organizing a financial pyramid.

Malefactors operated in other Russian regions as well. The total number of victims stands at no fewer than 84,000 people.

Data: Etherscan.

Preliminary calculations by law enforcement indicate that in Tatarstan alone the real damage from Finiko’s activities amounted to 7 billion roubles (over $95 million). The criminal case itself lists a far smaller figure — 80 million roubles (just over $1 million).

During January 2021, unknown individuals began actively withdrawing cryptocurrency from Finiko’s wallets. According to Etherscan, withdrawals amounted to tens of millions of dollars per day.

From February 2021, Finiko has been listed on the Bank of Russia’s blacklist as having signs of a financial pyramid.

The outlook for criminal proceedings will depend on the findings of a financial forensics examination, according to Sergei Mendeleev, CEO of Indefibank.

“Formally Finiko is still operating and even paying. The problem lies in the payout scheme using its own token, which devalues severalfold in a day. As a result, for every thousand invested you will get back, at best, a couple of hundred dollars, but for now you will get it,” he told ForkLog.

According to Mendeleev, Finiko managed to stay on the market for quite a long time for a number of reasons:

- they stored funds in Bitcoin, and “as long as it rose, the math largely added up”;

- the management was adept at introducing new “features” that attracted ever more adherents;

- they persuaded people not to withdraw, but to reinvest all profits back into the pyramid.

“The combination of these three factors and the founders’ personal charisma did the rest, which is why it did not collapse at the beginning of the year after the criminal case was opened,” says an independent expert.

The larger the scheme, the harder it is for investors to assert their rights in court. None of the organizers of the large Cashbery pyramid has been arrested to date. This allows dozens of other malefactors to continue their activity unimpeded.

“Hope remains only in a show trial; after all, Finiko harmed hundreds of thousands of investors, and I personally estimate the fraudsters’ losses at around a billion dollars,” added Mendeleev.

To illustrate the scale of the fraud, Sergei Mendeleev pointed to a January transaction of 1,000 BTC, which over a couple of weeks went to paying interest. Balances on two well-known wallets total about $20 million each.

“I am absolutely convinced that in scale this is second only to MMM among pyramids, and we have yet to realise the consequences,” the expert concluded.

The Telegram channel Ghost In the Block identified a further set of Finiko wallets through which more than $300 million was withdrawn in total. Some of the funds moved via the Huobi, Uniswap and Binance exchanges.

ForkLog sought comment from Finiko’s representatives but did not receive a prompt response.

As ForkLog previously reported, in our were offered to delete it “for a reward”, ForkLog CEO Ekaterina Erosheskaya said on behalf of individuals linked to the pyramid that they had launched a new project, which the publicity around it was “untimely.” Erosheskaya’s attempt to have the request granted, of course, was denied.

Follow ForkLog news on Telegram: ForkLog Feed — all the latest, ForkLog — the most important news, infographics and opinions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!