10T Holdings and Akuna Capital acquire stakes in Deribit crypto-derivatives exchange

The 10T Holdings fund of Dan Tapiero and trading firm Akuna Capital have taken stakes in the crypto-derivatives exchange Deribit. The parties did not disclose the financial terms of the deal.

Deribit Announces New Strategic Shareholders

10T Holdings and Akuna Capital become shareholders of crypto derivatives exchange Deribit.

Press release:https://t.co/KplvexRVTf pic.twitter.com/gTvhuLcUY0

— Deribit (@DeribitExchange) August 20, 2021

According to the press release, 10T Holdings and Akuna Capital purchased an unnamed amount of shares in the parent company Deribit — DRB Panama. No additional share issuance was made.

An informed source told CoinDesk that the deal was worth $100 million.

“We are very pleased to make significant investments in Deribit, as no business in the digital asset ecosystem is as dominant in its field,” Tapiero said.

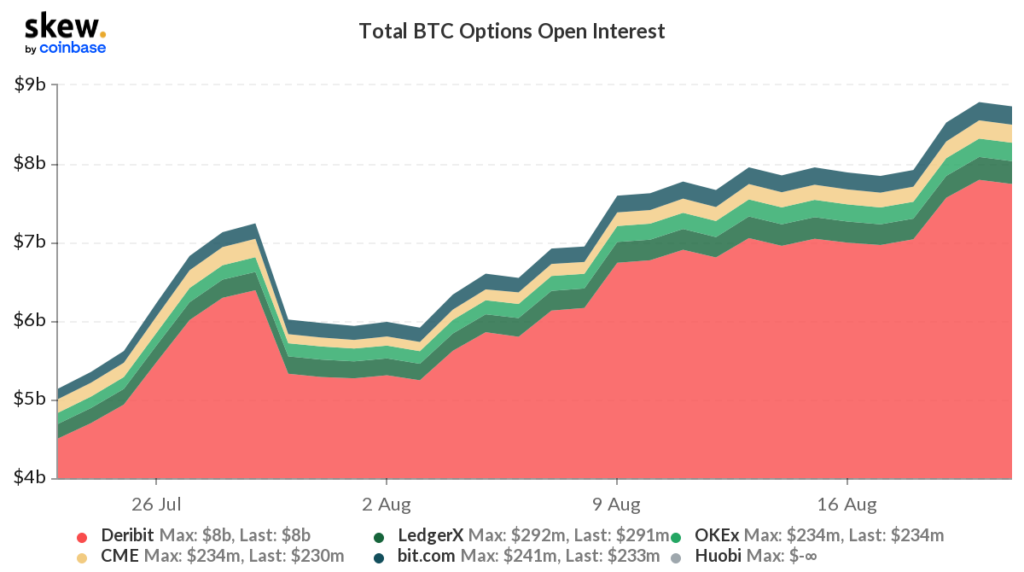

Deribit noted that the platform has grown significantly amid rising institutional demand. In the first half of 2021 its trading turnover reached $528 billion, up 630% from the same period a year earlier. It accounts for more than 90% of the options market (by open interest and trading volume), according to the announcement.

According to Skew, open interest in Deribit’s Bitcoin futures market is estimated at $8 billion.

In February 2021, Dan Tapiero launched a fund with a capital of $200 million for investments in cryptocurrency companies and blockchain startups.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!