Toward the Metaverse: How the GameFi Industry Is Evolving

The rise in gaming tokens has been one of the most notable events this summer in the crypto industry. The growth leader has been the AXS token from the blockchain game Axie Infinity, which rose by more than 1,500% in three months, breaking into the top 50 assets by market capitalization and grabbing the attention of global financial publications. ForkLog examines what is happening in the blockchain-based gaming industry and its prospects.

Blockchain in the service of the gaming industry

Blockchain technologies began to permeate the gaming industry as early as 2014, when the first online casinos started accepting deposits in Bitcoin. But only with the advent of non-fungible tokens (NFTs) did the possibility emerge to create games where players can be full owners of digital characters and items. And where ownership exists, commercial relationships are born.

As early as 2017, the CryptoKitties project with NFT kittens that could be bred and sold for tens of thousands of dollars demonstrated that online games could be not only about spending money, but also about earning.

However, only by 2021 did a critical mass of developers and players accumulate, which led to the formation of an entire market segment – GameFi (short for Game Finance).

Under this term, proposed in 2020 by the well-known developer Andre Cronje, it denotes the full diversity of blockchain-based gaming projects, including those using NFT.

In the GameFi segment, one can conditionally distinguish several categories:

- NFT games across various genres, using Free2Play (“play for free”) and Play2Earn (“play and earn”) models;

- gaming worlds or metaverses (metaverses);

- projects providing tools for developing and distributing NFT games, as well as for bringing existing online games onto the blockchain;

- projects enabling NFT usage in DeFi services.

Games created in 2020 or earlier predominantly ran on the Ethereum blockchain. However, high fees pushed developers to switch to cheaper and faster solutions. A number of games have already been released on the EOS, Tron and Wax blockchains. Since the beginning of 2021, has been growing and the popularity of Binance Smart Chain. In addition, specialized blockchain platforms such as Flow have been launched, adapted for use in the gaming industry and easy NFT issuance.

Axie Infinity: breed, battle, earn!

This summer the game has generated significant buzz, earning mentions in Forbes and other mainstream outlets.

Axie Infinity is developed by the Vietnamese studio Sky Mavis. The creators drew inspiration from the success of CryptoKitties in 2017 and combined its core principles with another popular game — Pokemon Go.

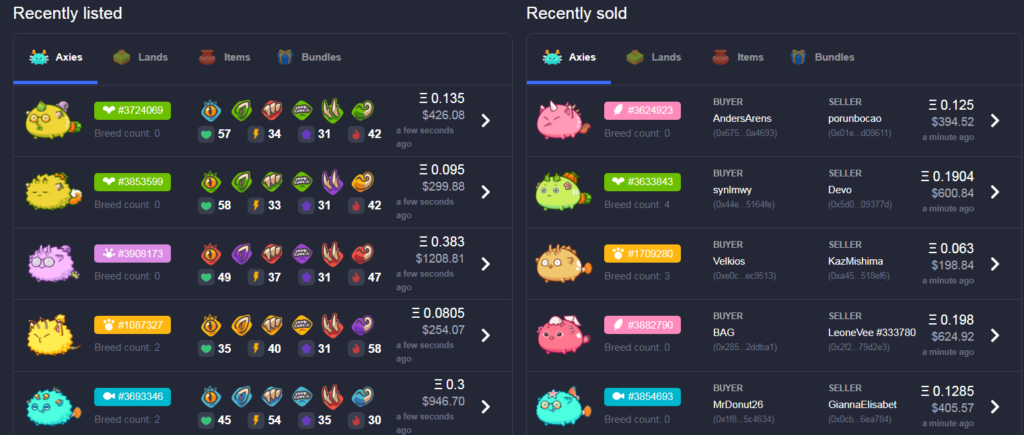

The rise in popularity of Axie Infinity began in June 2021, and by August, more than 1 million people were playing it daily. At the same time, monthly trading volume on Axie Infinity’s marketplace, where in-game NFTs are bought and sold, topped $1 billion. Sky Mavis’s revenue from Axie Infinity from 2018 through July 1, 2021 stood at just $21 million, but by July and August that figure surged to an incredible $485 million.

Since launch, the game has operated on the Ethereum network, so all in-game actions were expensive for players. In April 2021, Axie Infinity migrated to a closed, self-developed sidechain, Ronin, with far cheaper transactions.

The Axie Infinity gameplay centers on Axies, each of which is an NFT token. They come in nine different classes with their own combat traits. Axies can grow, reproduce, and fight in two battle modes: PvP (team vs team) or PvE (team vs monsters).

Because Axies are not given to new players for free, the game requires initial investment. As of the end of August, prices for the simplest Axies on the Axie Infinity marketplace started at around $200, while creatures with enhanced combat traits cost more than $600-$700. Thus, simply starting to play requires spending about $600, and assembling a capable team costs at least $2,000.

The most complex and costly part of the game is Axie breeding. These creatures have six body parts, traits coded by a set of genes. When two Axies breed, the offspring inherits parental genes with a certain probability, according to dominance or recessiveness, and this determines its combat traits and market price on the Axie Infinity marketplace.

Breeding has several caveats: breeding cannot occur between siblings, nor between parents and their offspring. Axies also cannot breed more than seven times in their lifetime. All these rules curb mass breeding of Axies and uncontrolled population growth.

The game’s base currency is the Axie Infinity Shards (AXS) token. It is required to level up and breed Axies. A single breeding consumes 4 AXS and between 150 and 3150 Smooth Love Potion (SLP) tokens, depending on how many times the Axie has bred.

The main earnings for players come from SLP tokens, earned in PvP and PvE battles. SLP tokens are traded on Binance, FTX, and a number of other crypto exchanges, enabling players to convert earnings into fiat without problem.

With active daily play, players’ earnings can reach $500-$1,000 per month. The internet is full of stories of people in developing countries escaping unemployment, solving financial problems, and quitting their regular jobs thanks to earnings from the game. It is especially popular in the Philippines, where more than 40% of Axie Infinity players come from.

NFT games: remakes, imitations, half-baked titles

Since early 2021 the number of NFT games has grown many times over. In the Playtoearn.net ranking there are more than 360 online games in Free2Play and Play2Earn formats, where one can interact with NFT items and earn crypto. They span all known genres—from card games to economic simulators, strategy, arcade and racing.

Let us mention a few notable projects. For example, the RPG game CryptoBlades, developed by Riveted Games. It has gained notable popularity (up to 90,000 players per day on BSC), and its SKILL token surged from $1.05 to $184 in July 2021. Even after a deep correction, the token trades around $40.

In GameFi, as in the wider crypto industry, solutions proven successful are widely borrowed. For example, NFT game My DeFi Pet, running on the BSC blockchain, is very similar to Axie Infinity: you breed and raise pets. The inheritance mechanics are simpler. In July, the DPET token surged tenfold. In those days the game attracted more than 30,000 players per day, but by the end of summer attendance had fallen tenfold.

Some NFT games have not yet reached release, but their tokens already trade on leading exchanges and even sit in the top 200 by market cap.

Examples include My Neighbor Alice, a multiplayer blockchain game blending sandbox and social simulation, being developed by Antler Interactive. Release is planned for spring 2022, but the ALICE token, launched on Binance Launchpool in March 2021, already has a market capitalization of over $300m.

A similar situation surrounds Illuvium. This is a decentralized RPG with NFT collection that will run on the Ethereum network. Launch was planned for late 2021, but the ILV token already has a market capitalization of more than $250m, rising more than eightfold over the summer. This was helped by staking with an annual yield of over 85%. While awaiting the release, ILV holders could earn from staking and price appreciation. The staking rewards, paid in ILV tokens, are locked for 12 months, helping shield the token from selling pressure.

What is the price of a hectare of virtual land?

A special category of NFT games is virtual worlds where players can own digital items and land parcels as NFTs and use them within the game’s economy.

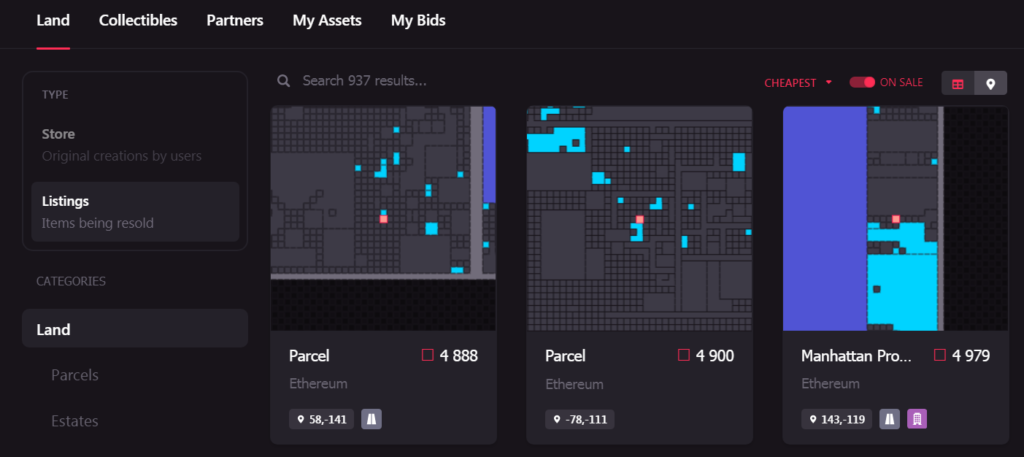

The most famous tokenized virtual world is Decentraland. This project began developing by a group of enthusiasts in 2015, but public release occurred in early 2020.

At auctions in 2017–2018, more than 45,000 digital parcels were sold, each corresponding to an ERC-721 LAND token confirming ownership of the land. Parcels can now be bought only on the secondary market. In June 2021, the largest digital real estate deal in Decentraland occurred when Republic Realm purchased a block of 259 virtual parcels for $913,000. The cheapest LAND today can be bought on the built-in marketplace for $4,000-$5,000.

Parcels in Decentraland are purchased for various purposes. They are rented out, virtual buildings are erected on them, mini-games, casinos, NFT shops, advertising spaces are opened.

Decentraland is governed by a DAO: voting rights lie with LAND owners and MANA token holders. Interestingly, the value of the MANA token extends beyond Decentraland: it can be used as collateral for loans on the DeFi platform MakerDAO.

Tokenized land markets exist in other well-known virtual worlds such as SANDBox (MineCraft-like on blockchain with the in-game token SAND) and Somnium Space (with 3D glasses support and the CUBE token).

In Axie Infinity, at the start of 2021 there was also an opportunity to own plots in a virtual world called Lunacia. Its territory is divided into 90,601 land parcels, each corresponding to an NFT. The parcels are valuable because they will allow gathering game resources and hosting PvE battles.

In February 2021, the largest NFT parcel purchase to date was recorded for $1.5m. The cheapest Lunacia plots today are sold on the Axie Infinity marketplace for $12,000.

Currently the most visited virtual world with a digital real estate market is Alien Worlds, operating on the WAX blockchain. According to DappRadar, at the end of August this metaverse saw daily participation of more than 400,000 players. The appeal lies in the fact that, unlike Axie Infinity and other Play2Earn games, it does not require initial investments. A newcomer starts with a basic toolkit to mine game tokens Trilium (TLM), which can be withdrawn and sold on crypto exchanges.

Players can buy land plots on planets of the Alien Worlds metaverse, earning their share of tokens generated by the planet daily, as well as a fee from all players mining TLM on their plot.

To assist developers and players

As NFT games and virtual worlds grow in popularity, an infrastructure tailored to developers, players, and investors in gaming assets is taking shape. Here are some of the most interesting projects in this space.

Enjin has been building a platform since 2017 to help developers migrate existing and new online games to the blockchain, and to issue in-game items as NFT.

In 2020 the Enjin Adopter program launched, drawing dozens of game developers and helping them create, fund, monetize, and sell their projects on the blockchain. Today several online games run on the Enjin platform: Lost Relics, 9lives Arena, Space Misfits, The Six Dragons and others.

To bypass Ethereum’s network limits, in spring 2021 the company launched its own blockchain, Efinity, with a native coin EFI. The new network delivers up to 1,000 transactions per second and features its own NFT standard. It is envisaged that all gaming projects on the Enjin platform will operate on this blockchain in the future.

Another project in this space is Ultra Games. It began as a decentralised and cheaper alternative to platforms like Steam or Google Play Store that take 30% of developers’ revenues. To date Ultra Games has evolved into a full ecosystem, including a platform for developing and distributing blockchain-based games, tools for monetising gameplay and creating decentralised marketplaces for virtual goods, a developer backend, and much more.

In June 2021 Ultra launched its own network (an EOS fork) with a native coin, UOS, enabling free and fast transactions. This network has its own Ultra NFT standard and the Ultra Wallet, with cross-chain asset transfers.

An interesting approach is used by Gala Games, a developer and publisher of NFT games. At present only one game, Town Star (a city-sim), is available to players, but more games across different genres are expected, using the same NFT items. There is also a single store for NFT items across all Gala Games titles, with prices denominated in GALA. In this way, games across genres form a single ecosystem with one economy.

GALA tokens also double as a governance tool: holders vote on the inclusion of NFT games from other developers into the Gala Games ecosystem, which should interest smaller teams seeking distribution and player recruitment.

A special place in the evolving GameFi industry is occupied by Yield Guild Games. This DAO-governed guild invests in in-game NFT assets and virtual worlds.

The project has attracted funding from venture firms Delphi Digital and Andreessen Horowitz. An IDO occurred in July 2021 and by the end of August yielded returns of more than 3,500% for participants in the token sale, while the governance token YGG’s market cap surpassed $900m.

YGG holders have the right not only to participate in project governance but also to receive a share of income from NFT-asset operations, e.g., resales or leasing of game items, virtual land, and so on. At launch, the project focused on managing digital assets in three popular games: Axie Infinity, Sandbox and League of Kingdoms. In Axie Infinity, the project already owns thousands of Axies and rents them to Filipino players, taking 30% of their earned SLP tokens.

Perspectives and risks for GameFi

Many experts believe the GameFi segment has a bright future. Developers gain new tools for distributing and monetizing games, and millions of players worldwide have the opportunity to combine gameplay with earnings.

Axie Infinity’s financial success is pushing hundreds of teams around the world to release NFT games across genres, so 2022 could see many interesting new releases.

Yet there are risks. Most existing NFT games are graphically primitive (often on the level of early 2000s Flash games) and offer repetitive gameplay. In terms of player engagement, they still lag behind top massively multiplayer online games like World of Tanks, Fortnite or World of Warcraft, where millions of players live inside the game for years, spending time and money.

A repetitive gameplay loop and low engagement lead to waning interest in new titles, and after the hype comes oblivion.

Moreover, the current Play2Earn economic models are sustainable only with a constant inflow of new players with money and hopes for quick returns. It is likely that as popularity wanes, NFT items and game tokens will devalue rapidly.

This suggests game tokens are well suited to speculative play during the rise of new NFT games but are unlikely to be suitable for long-term investments.

The fate of infrastructure projects such as Enjin and Ultra, which supply blockchain tools for developers, causes far less concern. As the saying goes, during a gold rush the biggest profits belong to the sellers of shovels.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news, ForkLog — the most important news, infographics and opinions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!