Citi Identifies AI and Stablecoins as Key Drivers of the RWA Market

Tokenized assets will capture 10% of market volume by 2030.

By 2030, tokenized assets are expected to account for 10% of the global market turnover, according to the annual report by American bank Citi, as reported by CoinDesk.

The study involved 537 financial organizations, including custodians, broker-dealers, and asset managers.

The primary drivers of the growth in the RWA share will be bank-issued stablecoins and artificial intelligence. Analysts suggest that stablecoins will enable efficient collateral management and fund tokenization, while AI will automate settlement processes.

According to Citi, 86% of the surveyed companies are already testing neural networks for client onboarding. Of these, 57% use artificial intelligence for post-trade automation, including data reconciliation and liquidity management.

“From accelerating settlements to automating asset servicing, enhancing shareholder engagement, and improving corporate governance, companies worldwide are united in key priorities. The industry stands on the brink of significant transformation,” noted Citi representative Chris Cox.

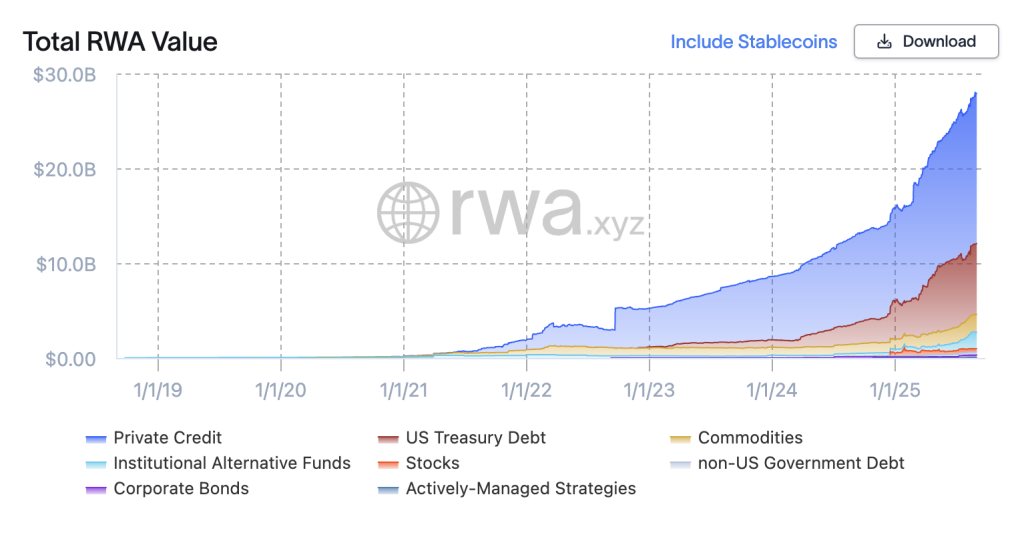

The trend towards tokenization continues to grow. At the time of writing, the current capitalization of the RWA sector, excluding stablecoins, stands at $27.95 billion.

Stablecoins as an Additional Tool

Mastercard views stablecoins as a payment technology that complements existing financial infrastructure rather than competing with it. This perspective was shared by the head of the company’s European division, Christian Rau.

🔵 Interview avec Christian Rau, responsable crypto Europe de @Mastercard

Mastercard s’intéresse de près aux crypto-actifs, mais sans rupture de cap

Dans un entretien avec @TheBigWhale_ détaille comment le groupe américain intègre progressivement cette technologie dans son… pic.twitter.com/VhZyB0kNhm

— Grégory Raymond 🐳 (@gregory_raymond) September 2, 2025

According to him, stablecoins improve cross-border payments and reduce currency risks. The integration of such assets into Mastercard’s infrastructure aligns with the company’s strategy to create secure and regulatory-compliant payment solutions, he added.

The firm implemented stablecoin payments in April. To achieve this, Mastercard partnered with Circle, Paxos, and Nuvei. Previously, the company also teamed up with the crypto exchange Kraken to launch physical and digital debit cards.

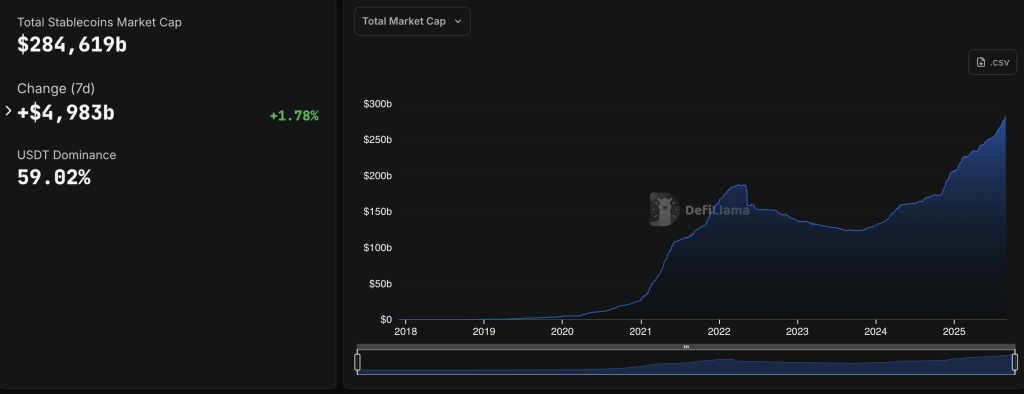

On September 2, the market capitalization of stablecoins reached a new all-time high of $284.6 billion.

In late August, Citi analysts warned of the threat posed to banks by stablecoins.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!