Evergrande pays up on September 22, but authorities warn of a potential ‘storm’

The Chinese developer Evergrande Group, on the brink of collapse, whose on-balance-sheet debt is estimated at about 2% of China’s GDP, paid interest on bonds to local investors. Beijing has urged local authorities to prepare for a potential ‘storm’, according to Wall Street Journal.

On September 22, the company agreed to pay 232 million yuan ($35.9 million) on four-billion-yuan bonds maturing in September 2025.

The situation with the $2 billion issue maturing in March 2022, for which the company is due to transfer $83.5 million to investors on September 23, remains unclear as of this writing. Earlier the company promised to do so.

Next week the company faces another interest payment on bonds totaling $47.5 million.

The issuer has 30 days to repay the debt to investors to avoid a technical default.

Sources for the publication said local authorities were instructed to prepare to prevent any unrest and to mitigate problems for home buyers and Evergrande employees.

They should assemble working groups of lawyers and auditors to obtain a full picture of the developer’s financial position, transfer unfinished properties to competitors, and strengthen monitoring of public sentiment.

According to Bloomberg, by the end of 2021 Evergrande will need to pay $669 million in coupons and will have to meet $7.4 billion in obligations in 2022. The company’s equity stands at about $3.9 billion with debt near $300 billion.

Earlier the company breached three red lines set by the authorities for developers:

- Debt-to-asset ratio, excluding advances, at 70%;

- Net debt to equity ratio at 100%;

- Liquidity to short-term debt at 1:1.

On September 23, Bloomberg reported that Evergrande Group’s EV unit failed to pay salaries to some workers and did not pay some suppliers for factory equipment on time.

Sources from Asia Markets said the CCP is developing a plan to restructure the company into three separate legal entities within the coming days.

On September 23, it emerged that Chinese Estates (Holdings), Evergrande’s largest shareholder, plans to fully sell its 5.7% stake in the company. The investor is prepared to book a loss of about $1 billion.

The day before, Federal Reserve Chair Jerome Powell, during a press conference following the meeting, said that American corporations do not face a significant risk from Evergrande. But the situation could affect investor confidence in certain sectors, he added.

Financial Times recorded a rising perception of risk among investors in Asia’s junk-rated bonds. Economists have begun lowering forecasts for China’s GDP growth in Q4. The central bank of the country, for a second consecutive day, is pumping billions of yuan into the financial system via reverse-repo operations.

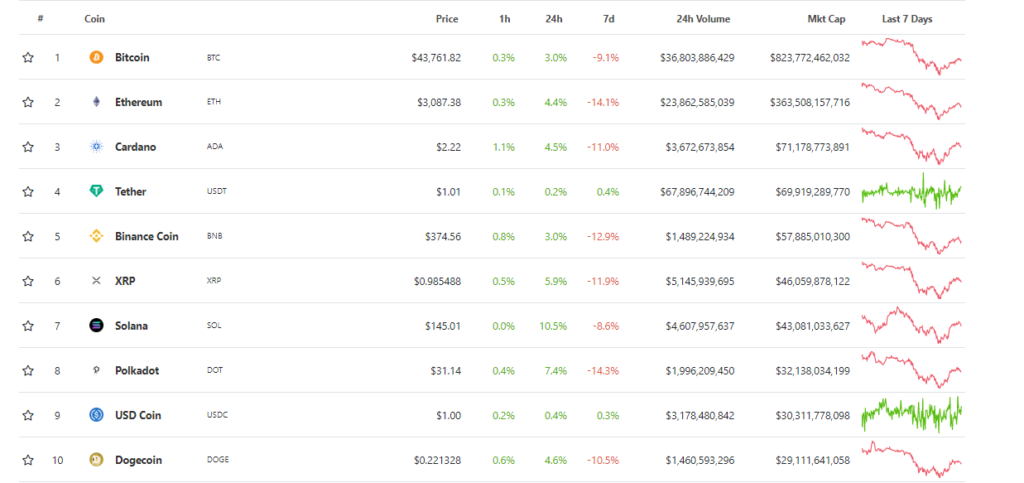

Against the backdrop of news around Evergrande and the recent Fed meeting, bitcoin and Ethereum prices are consolidating near the highs reached yesterday, maintaining yesterday’s resilience. Polkadot has extended its positive momentum.

The founder of Galaxy Digital, Mike Novogratz expressed confidence about the near-term prospects of the digital-asset market, as long as bitcoin does not fall below $40,000 and Ethereum below $2,800.

On Tuesday, bitcoin prices briefly breached the level he flagged. Ethereum also slipped below $2,800. After the Fed meeting they remained above those levels.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!