China’s crackdowns spark interest in UNI, but do not boost Uniswap’s on-chain activity

Total Value Locked on Uniswap remains at August’s lows, while user activity has fallen to January levels. A fresh wave of pressure from Chinese authorities on the industry sparked a surge in UNI purchases, but did not improve on-chain metrics.

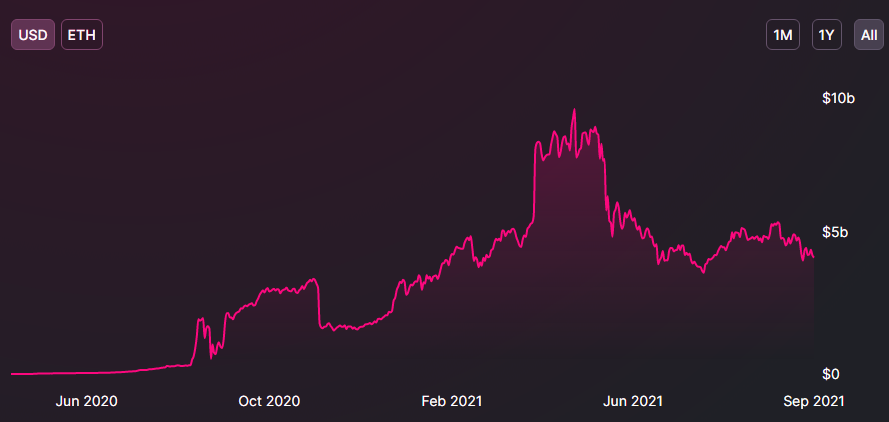

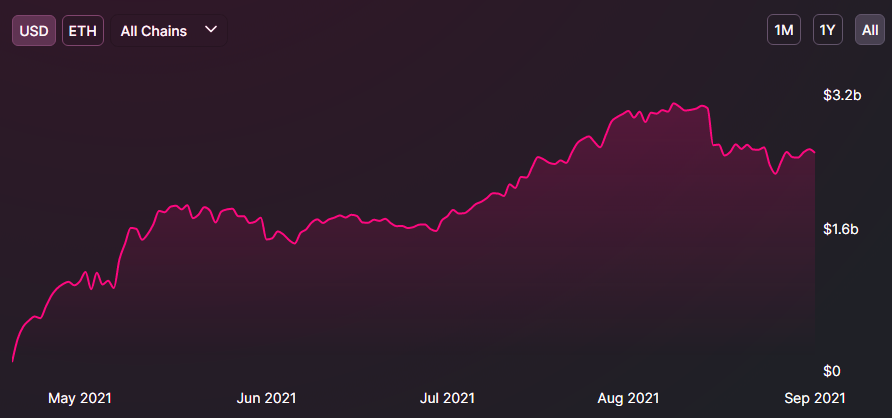

According to DeFi Llama, TVL on the leading Ethereum DEX (combined v2 and v3) stands at $6.65 billion. At its peak in April the figure was $9.33 billion; after the launch of the third protocol in early September it stood at $8.30 billion.

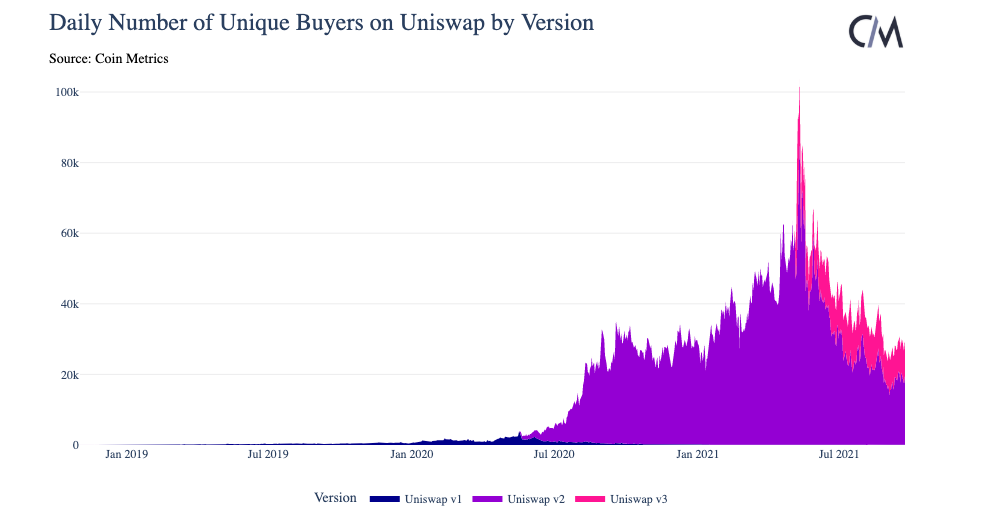

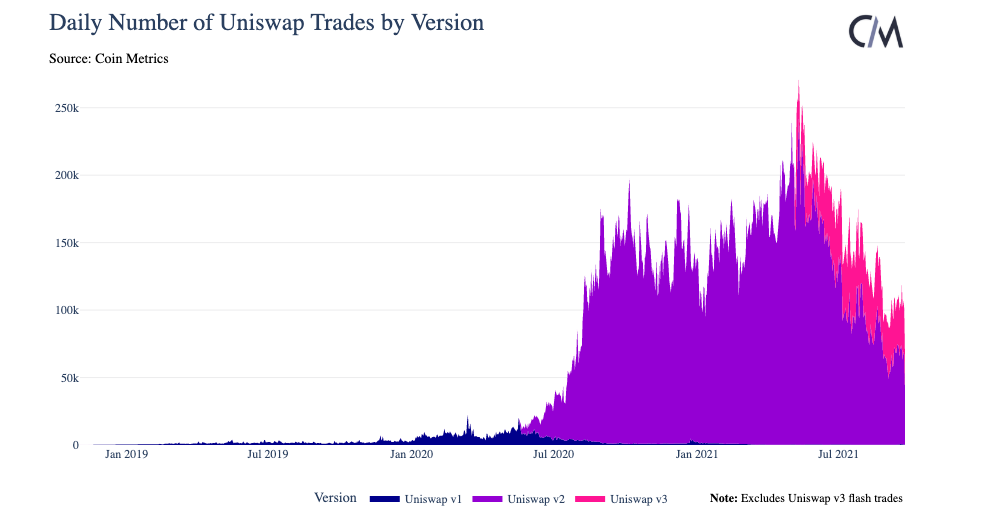

A negative trajectory is evident in metrics such as the number of unique users and the number of transactions.

According to Coin Metrics, the number of unique users in May 2021 reached 100,000. The figure now stands at 30,000.

After May 2021 volatility, the daily transaction volume on the DEX declined from 271,000 to 100,000. Version 2 accounted for 65% of trading activity, and Version 3 for the remaining 35%.

Against the backdrop of warnings from cryptocurrency exchanges Binance and Huobi about halting new account registrations for Chinese citizens and plans to delete existing customer accounts from the country, UNI’s native token rose to a peak of 33.7%, to $26.

At the time of writing, UNI is trading at $23.85, posting a second stretch of growth (16.5%) over a seven-day period and ranking in the top 20 by market cap, according to CoinGecko.

Colin Wu argued that after the ban on centralized exchanges, Chinese traders would pivot to the DeFi sector. He says Chinese citizens are showing interest in the space. Wu expects growth in MetaMask wallet users and the decentralized derivatives platform dYdX.

A large number of Chinese users will flood into the DeFi world, and the number of users of MetaMask and dYdX will greatly increase. All Chinese communities are discussing how to learn defi.

— Wu Blockchain (@WuBlockchain) September 26, 2021

On September 24, it was reported that China had carried out another crackdown on the cryptocurrency industry. In particular, the People’s Bank of China described platforms that facilitate exchanges between digital assets and fiat as illegal.

Previously, the director of the PBoC’s Payments and Settlements Department, Wen Xinxian, called cryptocurrencies and stablecoins a threat to the traditional financial system.

The day before, dYdX surpassed Coinbase’s spot markets by trading volume.

Subscribe to ForkLog News on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!