Societe Generale proposes MakerDAO the first ‘security token refinancing’

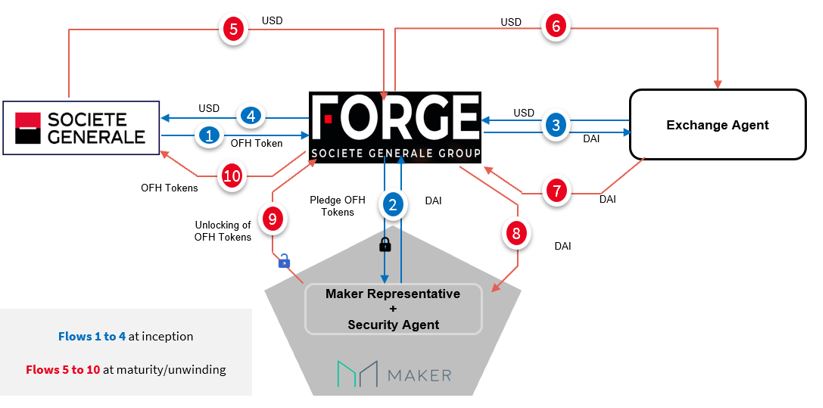

The financial conglomerate Societe Generale has proposed to the DeFi project MakerDAO to use digital bonds issued by its subsidiary Forge as collateral to obtain a loan of $20 million in the stablecoin DAI.

Société Générale, the third largest bank in France, just made a collateral onboarding application to Maker for 20 million USD.

Backed by EUR bonds, proposed by their blockchain subsidiary.https://t.co/hxGEMOIWjy

— Rune Christensen (@RuneKek) September 30, 2021

The bank called the proposal ‘the first experiment at the intersection of regulated institutions and open-source protocols’.

Societe Generale submitted the corresponding application on October 1 on MakerDAO’s DeFi project forum.

The proposal involves using OFH security tokens (obligations de financement de l’habitat) – mortgage-backed bonds, under French law.

The instruments were issued in May 2020 as zero-coupon bonds with a notional €40 million ($46.4 million) and maturing in May 2025. They carry AAA ratings from Moody’s and Fitch.

Forge issued the OFH on Ethereum using the CAST (Compliant Architecture for Security Tokens) framework with open-source code.

The loan would run for six to nine months and would be provided by several corporate entities.

For the group, the deal will be a ‘pilot use case’ for developing the regulatory framework and ‘increasing liquidity of digital bonds and the service’s profitability’.

In the ‘refinancing of security tokens’, six organisations are expected to participate. Among them are the DeFi project’s legal representative, the securities agent DIIS Group, and an external transfer agent.

MakerDAO founder Rune Christensen admitted that he had no idea about the proposal.

This is one of the many examples of how the MakerDAO governance system can become more scalable,

Turns out it was the future of France all along! 😀

Amazed that I had no clue about this at all the whole time. This is one of multiple recent examples in Maker Governance of how the post-foundation model of organization is proving to be more scalable

— Rune Christensen (@RuneKek) September 30, 2021

The user @iamDCinvestor noted that the Societe Generale initiative demonstrates Ethereum’s emergence as a global settlement network.

in 24 hours, two of the biggest financial institutions made big announcements

Visa with their L2 plan

Societe Generale with their attempt to get their on-chain assets usable in Maker

and you’re wondering if Ethereum will become a global settlement layer

it’s happening, now

— DCinvΞstor (@iamDCinvestor) September 30, 2021

The Societe Generale proposal will be put to a vote in the coming weeks.

Earlier in April ForkLog reported that the European Investment Bank planned to issue two-year bonds worth €100 million on the Ethereum platform.

In the same month, Societe Generale issued the first structured product in the form of security tokens on the Tezos public blockchain.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!