CoinShares: Institutional interest shifts from altcoins to Bitcoin

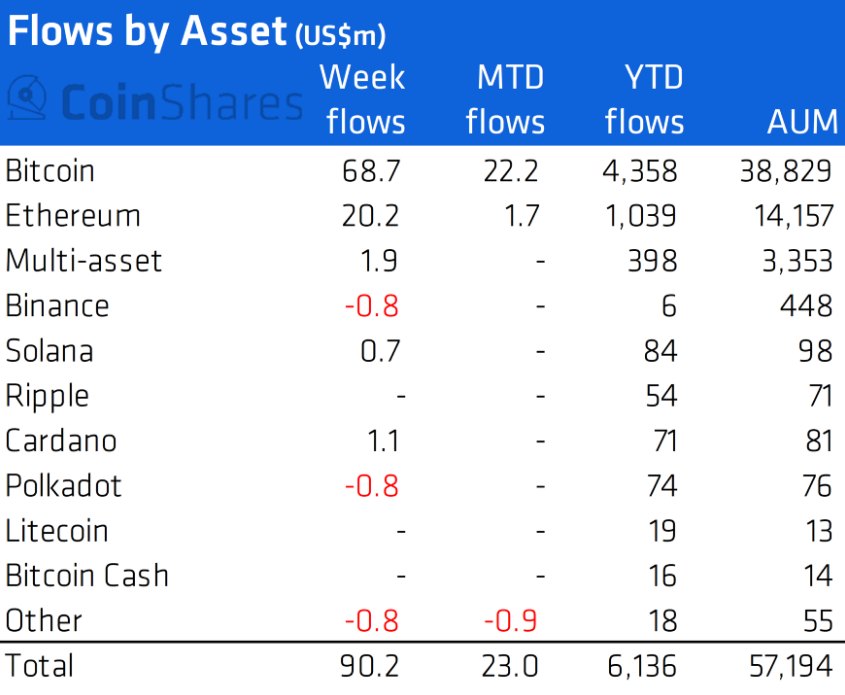

Net inflows into Bitcoin-based funds for 27 September through 1 October totalled $69 million, with overall inflows into digital-asset products at $90 million. The data come from CoinShares’ report.

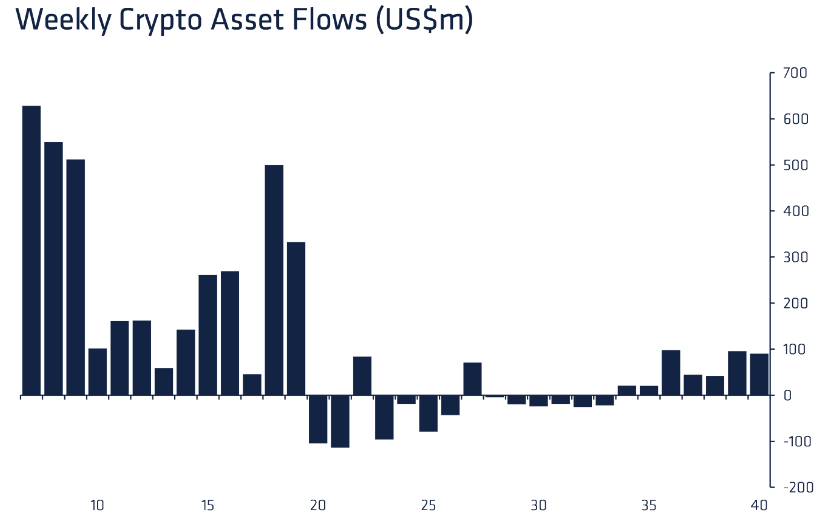

Positive momentum has continued for the seventh week running, with total inflows amounting to $411 million. Trading volume remained subdued at $2.4 billion, versus $8.4 billion at the peak in May.

«We believe the decisive shift in sentiment [in Bitcoin fund dynamics] is driven by growing trust in this asset class and more constructive comments from the SEC and the Fed», — the analysts noted.

Ethereum-based funds attracted $20 million. The share of such instruments declined to 25% from a peak of 28%.

For other altcoins, the week was mixed. Products based on Polkadot, Tezos and Binance Coin posted outflows of $0.8 million each, while Cardano and Solana saw inflows of $1.1 million and $0.7 million, respectively.

Earlier, JPMorgan analysts concluded that institutional investors shifted to Ethereum futures.

Follow ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!