CoinShares: institutional investors focus on bitcoin ahead of ETF launch

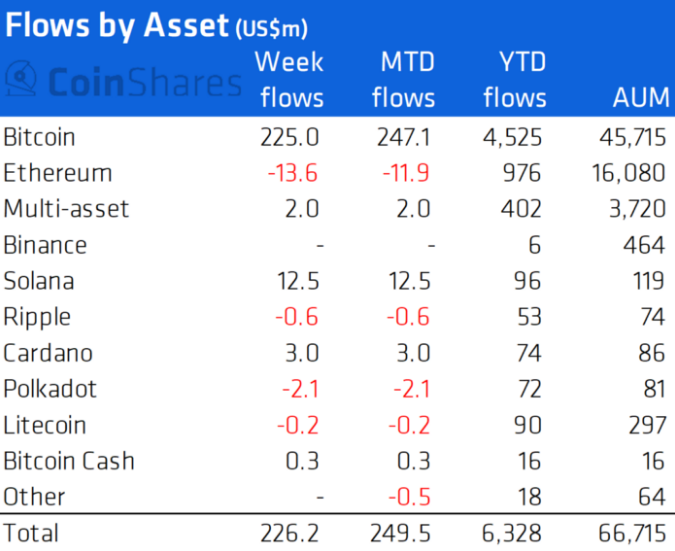

Net inflows into bitcoin-based funds for the week of October 2 to 8 amounted to $225 million, with digital asset products overall at $226 million. The figures are in CoinShares’ report.

A week earlier these figures stood at $69 million and $90 million respectively.

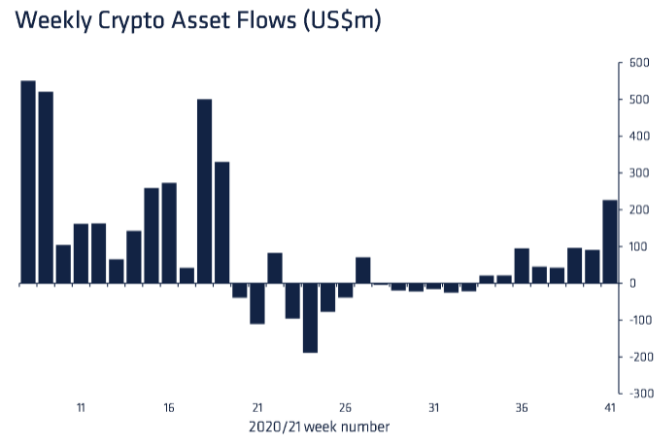

Positive momentum continued for the eighth week in a row — during that period total inflows amounted to $638 million.

Total assets in digital-asset-based products reached $67 billion, down 5% from the all-time high.

“We believe that the turning point in sentiment toward bitcoin is linked to constructive statements by the SEC Chairman Gary Gensler regarding the potential launch of a bitcoin-ETF. Our survey also showed rising participation by institutional investors in this asset class,”, the analysts commented.

Ethereum-based funds recorded outflows of $14 million. The share of such instruments declined to 24% from a peak of 28%.

For other altcoins, the week was mixed. Products based on Ripple, Polkadot and Litecoin recorded outflows, while Cardano and Solana saw inflows of $3 million and $12.5 million respectively ($1.1 million and $0.7 million in the previous week).

Earlier, JPMorgan analysts as reasons for the rally cited institutional interest, the growing popularity of the Lightning Network, and assurances from US authorities that there are no plans to ban cryptocurrencies.

Follow ForkLog’s news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!