August Sees Trading Volumes on CEX and DEX Return to Early-Year Levels

August saw CEX and DEX trading volumes reach early-year levels.

In August, the combined trading volume on centralised cryptocurrency exchanges reached $1.86 trillion, a level last seen in January.

This figure represents a 5% increase compared to the previous month.

Among centralised exchanges, Binance maintained the largest market share, with its spot trading volume rising from $706.1 billion to $737.1 billion.

Bybit secured second place with $126.5 billion, slightly ahead of Bitget, which recorded $126.1 billion.

Meanwhile, decentralised exchange volumes also reached early-year peaks, hitting $368 billion.

Uniswap led the segment with $143 billion, followed by PancakeSwap with $58 billion.

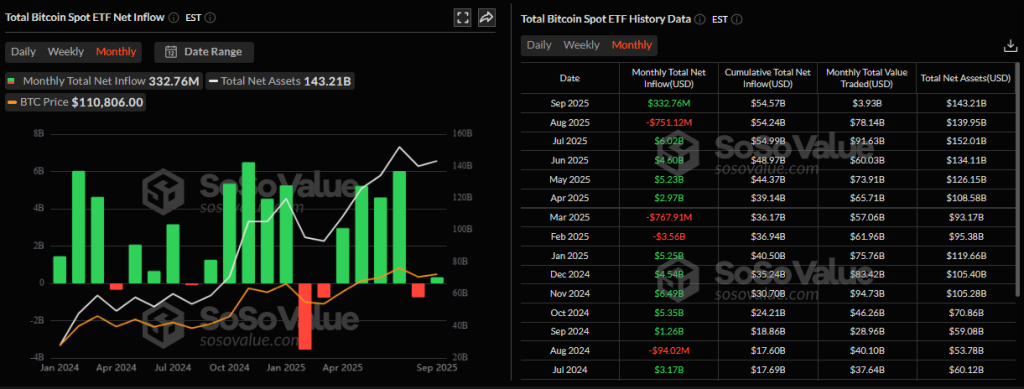

ETF Performance

American spot Bitcoin ETFs showed less positive dynamics, recording a net outflow of $751 million.

BlackRock remains the leading player with IBIT, managing assets worth $82.79 billion at the time of writing. It is followed by Fidelity’s FBTC with $22.2 billion.

In contrast, Ethereum ETFs recorded an inflow of $3.87 billion in August.

Leading the Ethereum ETF sector is BlackRock’s ETHA with $16.16 billion, followed by Grayscale’s ETHE at $4.58 billion.

Back in the US, spot Bitcoin ETFs nearly matched the trading volumes of major exchanges like Binance. On active days, these funds generate between $5 billion and $10 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!