Week in review: Bitcoin’s hash rate nears April’s peak as MicroStrategy buys another 1,434 BTC

The daily Bitcoin hashrate approached an all-time high, MicroStrategy bought an additional 1,434 BTC, hearings in the U.S. Congress with top crypto executives took place, and other events marked the week.

Bitcoin price falls below $47,000

On Saturday, December 11, Bitcoin’s price briefly dipped below $47,000.

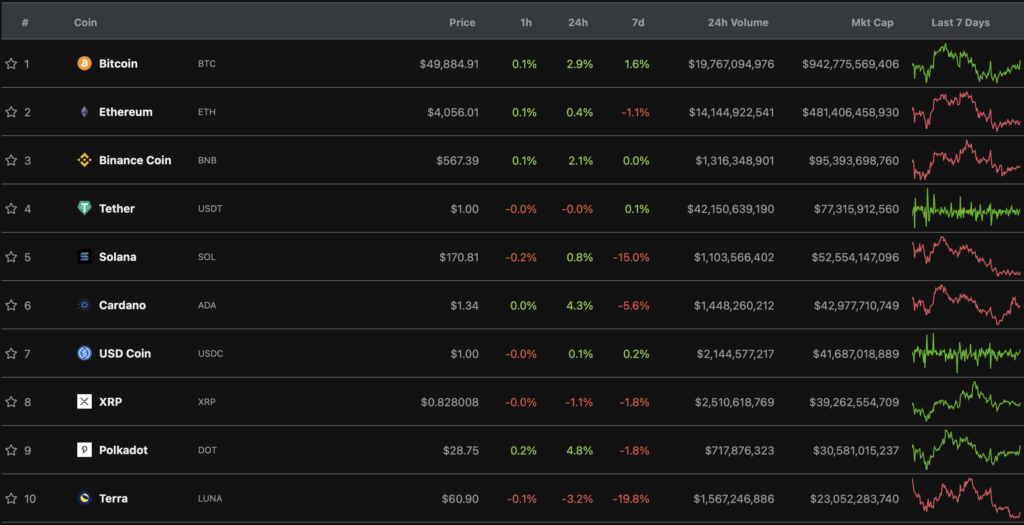

As of writing, Bitcoin is trading at around $50,000. The asset’s market capitalization is $942 billion, according to CoinGecko.

On Tuesday, December 7, the daily hashrate of the first cryptocurrency reached 191 EH/s. This stands as the second-highest figure after the 198 EH/s peak recorded on April 15, 2021.

Most of the top-10 by market capitalization closed the week in the red. Solana (SOL) and Terra (LUNA) fell the most — 15% and 19.8%, respectively.

MicroStrategy buys 1,434 BTC for more than $80 million

The business analytics software provider MicroStrategy additionally purchased 1,434 BTC for about $82.4 million.

According to the report, the average purchase price was approximately $57,477. The transactions took place between November 29 and December 8, 2021.

As of December 9, the firm held 122,478 BTC, having spent about $3.66 billion. At the time of writing, MicroStrategy’s reserves in digital currency were valued at over $6 billion.

Ark Invest founder envisions Bitcoin price at $550,000

The price of the first cryptocurrency could rise by another $500,000 thanks to institutional activity. This view was voiced by Ark Invest founder Cathie Wood.

According to her, such investors are seeking opportunities outside traditional asset classes and are moving to cryptocurrency “right now.”

If institutional investors allocate about 5% of their portfolios to Bitcoin, that could add $500,000 to its current price, Wood conceded.

Bitwise doubts Bitcoin can reach $100,000 by year-end

Bitcoin is unlikely to hit new highs before the end of 2021 and reach the $100,000 level. This view was voiced by Bitwise Asset Management’s Chief Investment Officer Matt Hogan.

He said the level could become a target for 2022, driven by growing institutional support. There are “fundamental tailwinds” behind it, Hogan stressed.

In the British Parliament, lawmakers say Bitcoin is not an investment

Members of the British Parliament told FCA chief Nikhil Rathi that the purchase of Bitcoin and other cryptocurrencies is not an investment, and such phrasing should not be used in relation to them.

“The words ‘your investments’ equate this with a company in the FTSE 100 or a unit trust,” said Harriet Baldwin, a member of the House of Commons, at the committee hearing.

She also noted that the regulator’s published list of unregistered crypto companies may facilitate money laundering.

Bloomberg strategy foresees widespread crypto adoption in the US in 2022

In 2022, the United States is expected to see widespread cryptocurrency adoption with proper regulation and a subsequent bull market, said Bloomberg strategist Mike McGlone.

According to him, the growth of cryptocurrencies in 2021 was linked to monetary policy in developed countries, which sought to ease the economic crisis amid the pandemic.

McGlone is confident that in 2022 the Fed will unwind its emergency stimulus program amid rising inflation and a tight labor market. The move would foster Bitcoin and Ethereum gains, the analyst says.

Hearings in the U.S. Congress feature top crypto industry executives

On December 8, top crypto executives testified before the House Committee on Financial Services. Lawmakers’ views on the sector were divided, but participants noted a “high level of engagement” among congressmen.

The hearing’s agenda on the topic “Digital assets and the future of finance: understanding the challenges and benefits of financial innovation” focused on Bitcoin exchanges, stablecoin issuance, crypto regulation, and interagency policy.

At the hearings testified Circle CEO Jeremy Allaire, FTX CEO Sam Bankman-Fried, Bitfury CEO Brian Brooks, Paxos CEO Charles Cascarilla, Stellar Development Foundation CEO Denelle Dixon, and Coinbase Global CFO Alesia Haas.

If past hearings were mainly about Bitcoin’s use in crime, policymakers at the Wednesday session were interested in the underlying technology and the potential of digital assets.

Visa to facilitate broad Bitcoin adoption

Visa announced the creation of a new consulting division that will help clients navigate cryptocurrencies.

The unit, which will be part of the Consulting and Analytics group, will offer advisory services to financial institutions, retailers, and other firms on topics ranging from deploying crypto features to exploring non-fungible tokens (NFTs).

According to head of crypto business in Europe Nicola Plecas, the move is the next step in expanding into digital assets. Since October 2020 the payments network has processed crypto-related transactions worth $3.5 billion, he noted.

The firm is also developing products focused on stablecoins and central bank digital currencies.

Visa expects its crypto consulting services to drive broad adoption of Bitcoin and other digital assets, as the company seeks to move beyond card payments.

Russia drafts rules for confiscation of cryptocurrency

The Russian Prosecutor General’s Office is working on laws regulating the circulation of cryptocurrencies. The authorities have already prepared rules that would recognise digital assets as property and allow confiscation.

Prosecutor General Igor Krasnov outlined changes in several regulatory acts so that cryptocurrencies in illicit circulation would not only be treated as property, but could also be seized and confiscated.

He noted that criminal-case jurisprudence typically treats digital currencies as property, i.e., as bribe objects, but this is not enough for a uniform and stable application of the law.

Changpeng Zhao says Binance plans to obtain registration in the United Kingdom

Binance plans to file an application with the FCA for registration to become a fully regulated firm within 6–18 months. He did not rule out creating a separate subsidiary modeled on Binance.US in the United States.

To obtain a license, the platform must comply with AML/CFT requirements. This may be helped by “several former FCA staff and a couple of hundred compliance professionals.” Binance has opened an office in the United Kingdom to support this work.

According to Zhao, Binance has fully resumed dialogue with authorities. The platform is in the process of implementing “a number of significant changes in product areas, internal procedures, and regulatory engagement,” he added.

If approved, the FCA license would allow Binance to legally offer futures and other derivatives.

Media: oligarch Kolomoysky has set up a large mining farm at the Zaporizhzhia Ferroalloys Plant

In 2021, at the Zaporizhzhia Ferroalloys Plant, linked to Ukrainian oligarch Ihor Kolomoyskyi, a large batch of mining equipment from Georgia and China was imported. This is reported in the Schemes project investigation.

According to journalists, since February the Georgian company Georgian Manganese supplied 2,600 mining devices from Bitfury. Similarly, nearly 12,500 Bitmain devices were received by the Zaporizhzhia plant from two firms in Hong Kong. The shipments continued in the following months.

The total value of mining equipment imported to the plant in 2021 is estimated at almost 750 million hryvnias (about $27.6 million at the time of writing). Journalists also calculated that if all purchased devices were turned on at full capacity around the clock, it could yield about 80 BTC per month (about $4 million).

Bill Gates envisions shifting from Zoom and Skype to metaverses by 2024

In two to three years, most virtual meetings will take place in the metaverses. Gates wrote in a blog post.

“The idea is that eventually you will use your avatar to meet people in a virtual space that mimics the sense of presence in a real room with them. You will need something like VR goggles and motion-tracking gloves,” Gates wrote.

The billionaire said that people wrongly assume the software behind such simulations will remain unchanged. He noted that the technology behind the metaverse is evolving at a rapid pace, and over time this process will only accelerate.

China calls NFT and metaverses potential Ponzi schemes

Metaverses and NFTs could turn out to be bubbles, Ponzi schemes or other forms of financial fraud. This is stated in an official blog of the Central Political and Legal Affairs Commission of the Communist Party of China.

The authors stressed that many articles and reports point to a bubble in the price of digital collectibles, and NFT themselves are linked with risks such as money laundering and financial fraud.

What else to read

In our traditional digests we have gathered the main events of the week in cybersecurity and artificial intelligence.

The decentralized finance sector continues to attract heightened attention from cryptocurrency investors. ForkLog has gathered the most important events and news of the past weeks in the digest.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!