Week in Review: Russia again debates a crypto ban as Pavel Durov backs the Toncoin project

In Russia, talk of banning cryptocurrencies resurfaced; Pavel Durov publicly supported the Toncoin project, BitMEX announced an airdrop of its own token, and other events of the week.

Bitcoin price clears $51,000 but fails to settle above it

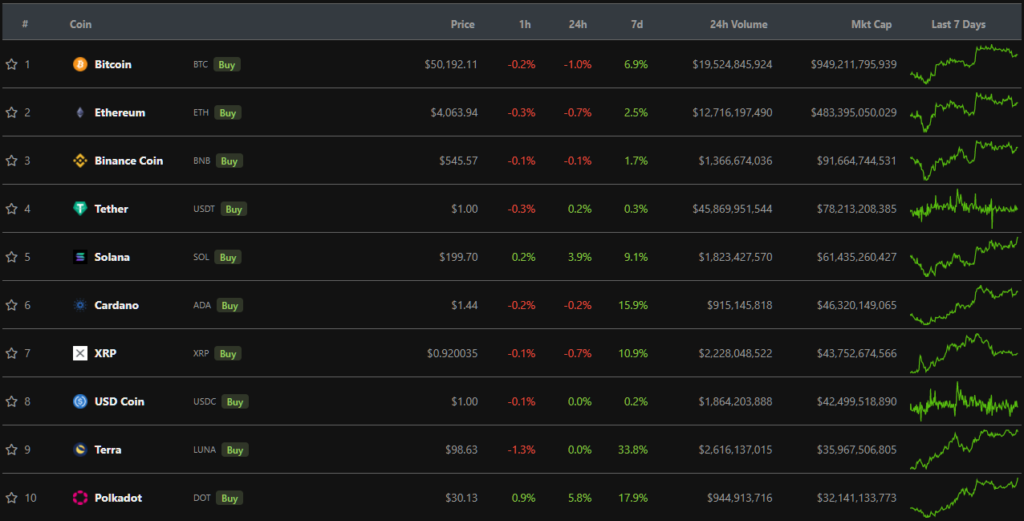

On Thursday, December 23, the price of the leading cryptocurrency rose above the $50,000 level, and the following day surpassed $51,000. The digital gold could not settle above this level. At the time of writing the asset was trading near $50,150.

Bitcoin pulled the rest of the market along. According to CoinGecko, all top-10 assets by market capitalization closed the week in the green. The Terra project token (LUNA) rose by nearly 34%, reached a new all-time high above $100.

Maxima were also updated for the tokens NEAR Protocol (NEAR) and Polygon (MATIC).

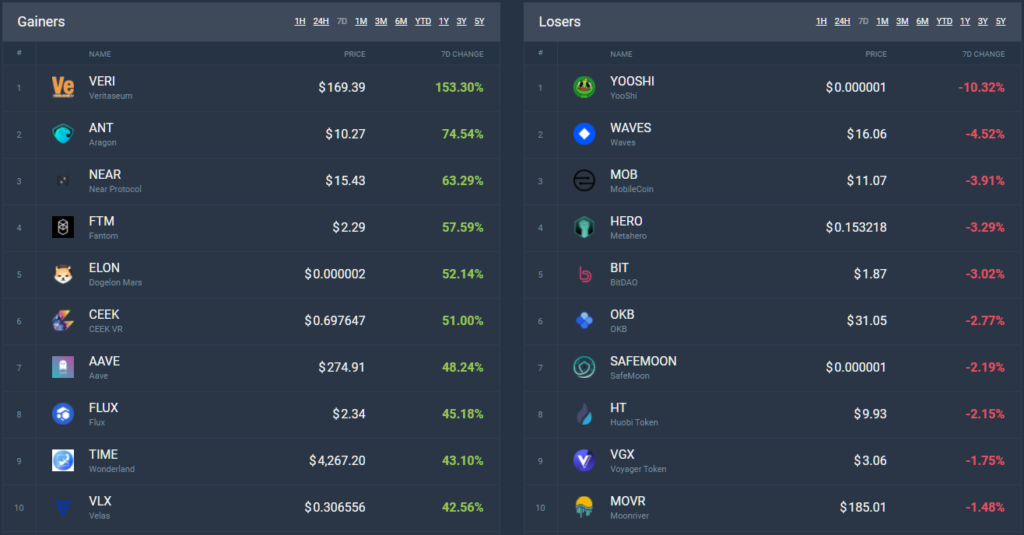

According to CoinCodex, over the week among mid-cap digital assets the biggest gainer was the token of the P2P-finance platform Veritaseum. VERI rose by 153%, and its market capitalization reached $364.28 million.

The metaverse token YooShi (YOOSHI) fell the most, down 10%, with a market capitalization of $374.36 million.

Total cryptocurrency market capitalization stood at $2.5 trillion. The Bitcoin dominance index fell to 38%.

The Bank of Russia sees no place for cryptocurrencies on Russia’s financial market

The Russian central bank intends to regulate the rules governing the circulation of cryptocurrencies by law. This was stated by deputy chairman of the Bank of Russia Vladimir Chistyukhin.

He said that the central bank believes that residents and businesses may own and store cryptocurrency, but not through domestic infrastructure or intermediaries.

The official added that a more detailed position on crypto assets will be presented in a separate document in the near future:

«In this document, our approaches will outline what role for cryptocurrency we see in the Russian financial market. Hint: we do not see a place for cryptocurrency in the Russian financial market».

Earlier, the deputy speaker of the State Duma and head of the group Alexey Gordeev spoke about the first meeting of the working group on cryptocurrencies, without specifying the direction of discussion. According to Sergey Mendелеev, CEO of Indefibank, the meeting reached a final decision to ban these assets.

Forbes, citing a source close to the Bank of Russia, reported that the regulator and market participants are weighing several options to curb investments in the crypto market, including blocking card transfers by certain MCC-codes.

Meldeleev also published a screenshot of a letter in which the bank “Tinkoff” asked a client for documents relating to “crypto-exchange operations” conducted using accounts.

In a ForkLog interview, GMT Legal managing partner Andrey Tugaryan noted that Russian banks may restrict client access to their services if they engage in cryptocurrency operations and fail to prove the source of funds.

Pavel Durov backs Toncoin developers. The token’s price rose 46%

Pavel Durov publicly commented for the first time on the Toncoin project. He said the Telegram-based technology is alive and evolving. He stressed that Toncoin is independent of the messenger team, and wished the developers success.

BitMEX will launch its own token

On February 1, 2022, the BitMEX cryptocurrency derivatives exchange will issue the BMEX token and conduct an airdrop. Users on the platform can already earn the asset for registering with KYC or through the referral system. In the future BMEX will offer discounts on fees.

The ability to trade and withdraw BMEX is expected to appear around early Q2 2022, when BitMEX’s spot platform launches.

Dogecoin Foundation and Vitalik Buterin develop a DOGE staking mechanism

The Dogecoin Foundation unveiled an updated project roadmap. Among other things, it includes a transition from Proof-of-Work to Proof-of-Stake, implying staking of the cryptocurrency and a move away from mining. Work in this direction is being carried out in collaboration with Ethereum co‑founder Vitalik Buterin.

Binance abandons quarterly BNB burn in favour of Auto-Burn

The cryptocurrency exchange Binance has abandoned the concept of quarterly burning of Binance Coin (BNB) in favour of a mechanism for automatic withdrawal from circulation: Auto-Burn.

The mechanism is designed to provide greater transparency. It does not take into account revenues generated by the trading platform, but is based solely on the price of BNB and the number of blocks mined during the quarter.

During the week, there were media reports of a $750,000 penalty imposed on Binance by the Turkish Financial Crimes Investigation Board.

Airdrops of the week

The Terra Name Service, Terra’s domain-name service, unveiled the TNS token and on December 24 distributed 17% of its issuance, or 8.33 million coins, to users.

The snapshot for the first distribution was taken on December 17 at 12:32 MSK.

The service is analogous to Ethereum Name Service, which previously distributed tokens to early users — hence TNS drew on ENS experience.

The developers stressed that they want to avoid tokens landing in “weak hands” and therefore excluded bounty hunters from the distribution.

Also on December 24, the OpenDAO project conducted an airdrop of SOS tokens to OpenSea users. The network snapshot was taken on December 23.

Despite the hype around the airdrop, little is known about the project itself. OpenSea’s developers stressed that they have no affiliation with SOS and advised users to “study the contract before demanding tokens”.

Kraken buys Staked and announces an NFT marketplace with lending

The American cryptocurrency exchange Kraken acquired the staking platform Staked. The deal was described as “one of the biggest acquisitions in the industry”, though financial details were not disclosed.

Kraken CEO Jesse Powell confirmed that the company is working on a NFT marketplace. He said the platform could feature a system in which clients could use non-fungible tokens as collateral for loans.

Larry Cermak gives a 2022 forecast for the bitcoin industry

In 2022, investor interest in existing crypto projects will persist, with exchanges and data providers likely to benefit the most. This is the forecast from The Block’s vice-president of research Larry Cermak.

He believes the focus in the coming year will be on layer-2 protocols delivering faster and cheaper transactions atop blockchains. The underpinning will be the continued existence of decentralised applications built specifically for L2 solutions.

Also on ForkLog:

- Media reported cases of funds disappearing from bitcoin wallets belonging to Salvadorans.

- Aksakov: Russians invested 5 trillion rubles in cryptocurrencies.

- Justin Sun paid $28 million for a spaceflight.

- Some of the bitcoins from a wallet calling itself a WEX “miner” moved to Binance.

What else to read

In traditional digests we gather the week’s main events in the areas of cybersecurity and artificial intelligence.

Blockchain technology remains one of the hottest trends among financial, governmental and corporate organisations worldwide. ForkLog offers an overview of the most interesting latest initiatives.

In ForkLog’s educational cards we explain the GameFi project Axie Infinity.

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!