Report: Ethereum DeFi liquidity reaches a record 43 million ETH in January

In January, against the backdrop of a correction in the digital asset market, the total value locked (TVL) in Ethereum DeFi protocols reached a record 43 million ETH, according to ForkLog report.

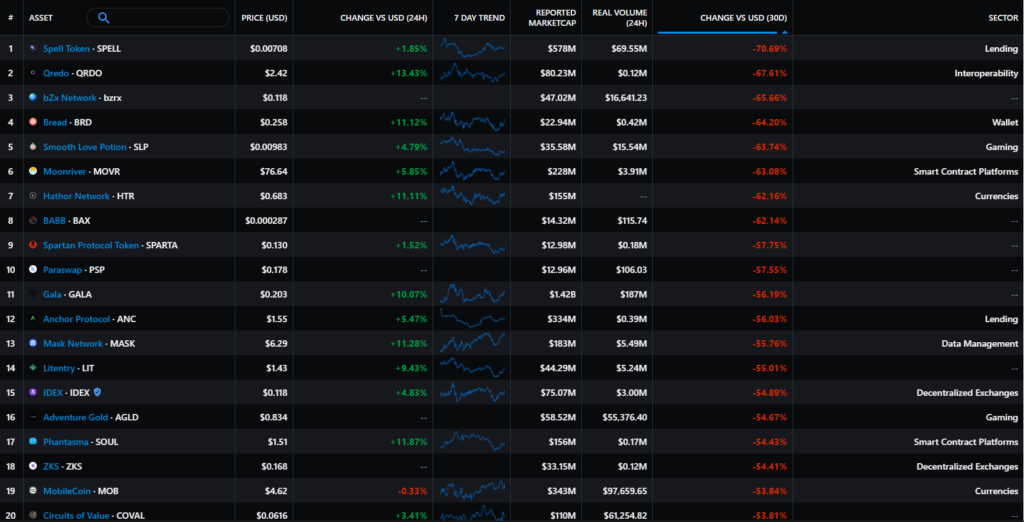

Bitcoin and Ethereum in the past month touched local lows, pulling the rest of the market down. The biggest drop was in the Spell Token (SPELL) governance token of the Abracadabra lending protocol — its price fell 70%.

The decline in SPELL’s price was driven by a scandal surrounding the Wonderland protocol, linked to Abracadabra founder Daniela Sestagalli. The incident also affected LUNA from Terra and SUSHI from SushiSwap. The latter fell nearly 52% over the month — the DEX team is part of the Frog Nation DAO, of which Wonderland is a member.

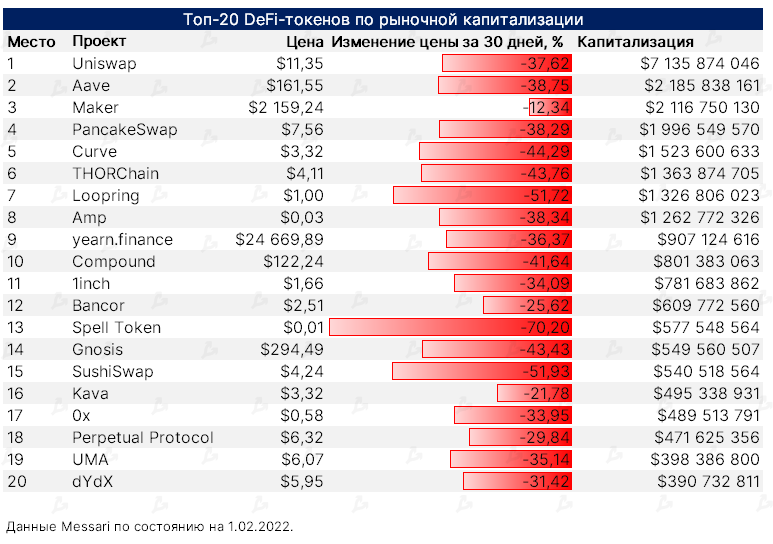

By month-end, all DeFi tokens in the top 20 by market capitalization were in the red.

The total value locked in the DeFi sector declined by 22% to $188.61 billion. The Ethereum ecosystem continues to dominate. On January 27, the ETH-denominated metric reached an all-time high of 43.42 million coins. However, due to the price declines, TVL in dollar terms fell 24%, to $118.51 billion.

The Fantom ecosystem ranked fourth by TVL. During January, its TVL rose 76% to $9.36 billion. There are several reasons for this growth: a 370 million FTM incentive program (~$777 million), numerous integrations, and interest in the Solidly project announced by yEarn.Finance founder Andre Cronje and Daniela Sestagalli.

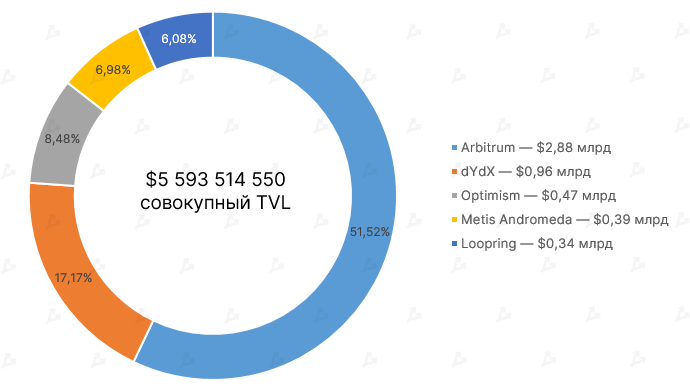

The aggregate TVL of the second-layer (L2) scaling solutions segment surpassed 2 million ETH for the first time — during the month users deposited 514,208 ETH (25% of total liquidity).

Due to the Ethereum correction, the dollar-denominated figure hardly changed — $5.59 billion. The leader Arbitrum accounts for over 51% of the segment’s TVL ($2.88 billion).

Shares of publicly traded crypto-related companies also declined. Bakkt’s stock fell by more than 49%, and MicroStrategy’s shares shed over 32%.

Against the backdrop of a prolonged correction in the digital asset market, interest among Google users in NFTs rose markedly. The number of searches for ‘nft’ surpassed those for ‘crypto’ for the first time.

Interest in the segment is also corroborated by rising trading volumes on marketplaces. The OpenSea metric for January approached $5 billion.

Sponsor of the ‘Bitcoin Industry in Numbers’ column — the global blockchain ecosystem Binance.

In January, NFT trading volume exceeded $6.86 billion, with OpenSea accounting for more than half of the total.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!