VanEck files to launch ETF tracking gold-mining stocks and crypto miners

Asset manager VanEck has filed with the U.S. Securities and Exchange Commission an application to launch ETF aimed at gold-mining companies and miners.

According to the filing, VanEck Gold and Digital Assets Mining will track an index whose basket will include shares of gold mining and crypto-mining companies. The fund will forgo direct investment in digital assets. The filing does not specify a ticker or a management fee.

In conversation with Blockworks, ETF.com portal analyst Sumit Roy noted that investments in the shares of a fund like this represent quasi-investments in cryptocurrencies and precious metals.

“Although I do not write off this ETF, I do not think it will gain the same popularity as specialized funds. Investors who buy bitcoin are too different from those who buy gold,” he added.

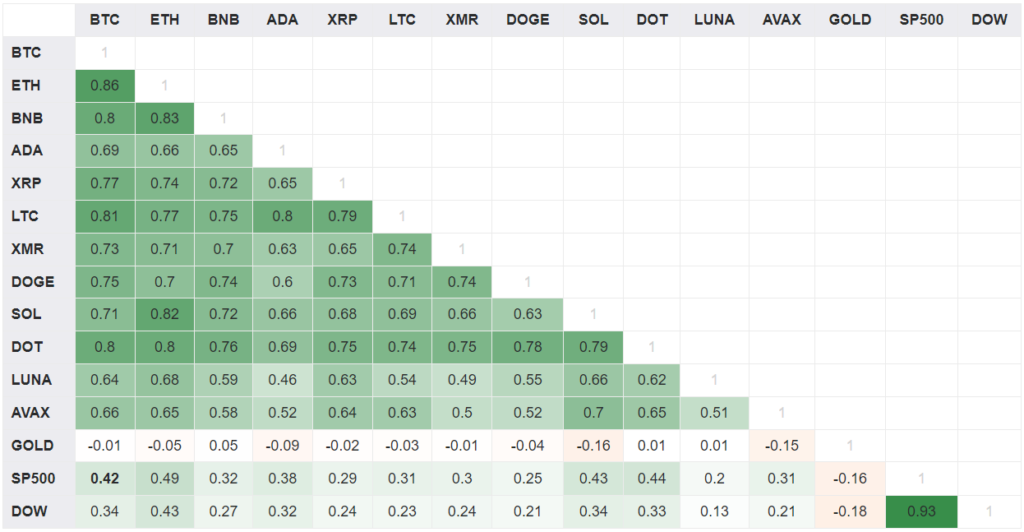

Bitcoin has a negative statistical correlation with gold (-0.01). The cryptocurrency correlates far more strongly with the stock indices S&P 500 (0.42) and Dow Jones (0.34).

In November 2021, VanEck’s bitcoin futures ETF began trading on the Chicago Board Options Exchange. According to Yahoo Finance, the fund’s average daily trading volume is 32,576 shares, and the price per share is around $37.

Earlier, in December, VanEck filed to launch ETF based on mining companies’ shares.

Follow ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!