Week in review: EU bans crypto services for Russian citizens, Hydra servers seized in Germany

The European Union banned deposits to crypto wallets for citizens of Russia and Belarus, German police confiscated Hydra servers, LocalBitcoins handed over data to the tax authorities for more than 100,000 Russian users, and other events of the past week.

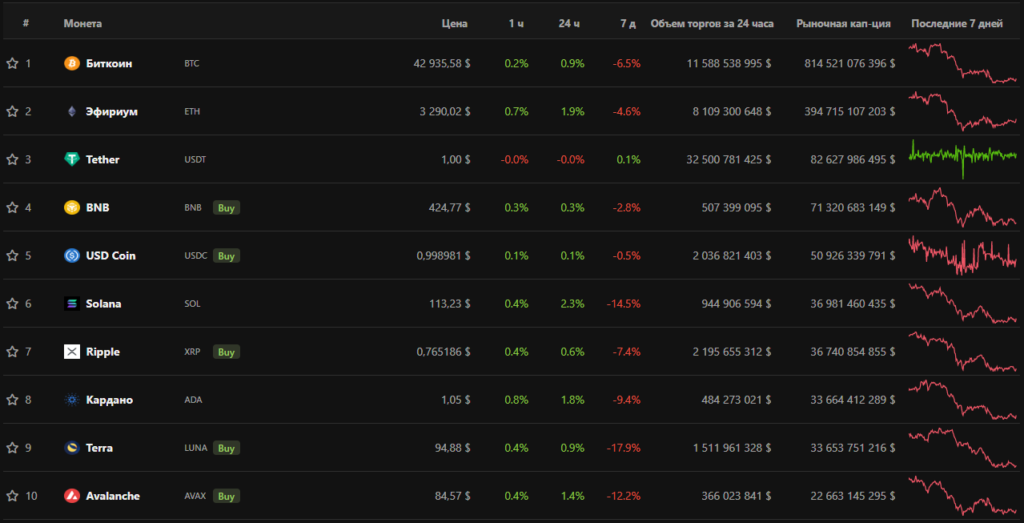

Bitcoin fell 6.5%, Ethereum shed 4.6%

After a local rally in late March, Bitcoin’s price for the week fell by 6.5%. At the time of writing, digital gold was trading around $42,880.

The flagship pulled the rest of the market along. All top-10 assets by market cap closed the week in the red. The worst performers were Terra (-17.9%), Solana (-14.5%) and Avalanche (-12.2%). Ethereum fell 4.6%.

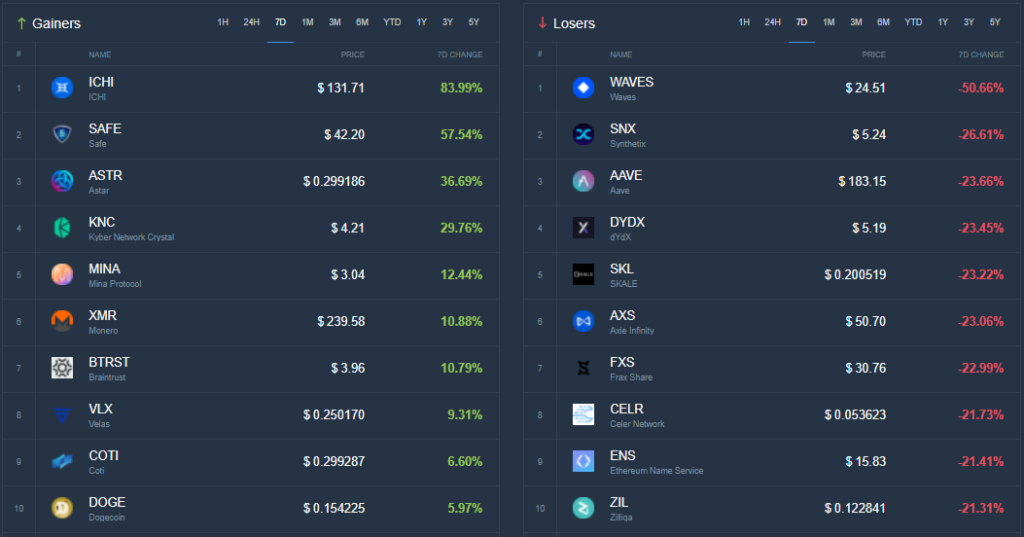

According to CoinCodex, over the week among mid-cap tokens, the governance token of the platform for issuing stablecoins ICHI rose the most, by 83.99%.

The token of the Waves blockchain platform fell the most, by 50.66%.

Combined market capitalization stood at $2.09 trillion. Bitcoin’s dominance index rose to 39%.

EU bans deposits to crypto wallets for Russians and Belarusians as part of a new sanctions package

The European Union approved the fifth package of sanctions against Russia over its invasion of Ukraine. Among the measures adopted is described as an “expanded ban” on deposits to crypto wallets and the sale of banknotes and securities denominated in any currency of the EU member states to individuals and legal entities from Russia and Belarus.

In the same week, the Bank of Russia acknowledged the impossibility of circumventing sanctions with Bitcoin.

German police confiscated Hydra servers and seized 543 BTC

The Federal Criminal Police of Germany confiscated the German servers of the darknet marketplace Hydra. In the framework of the international operation, 543 BTC worth about €23 million were also seized. The investigation into the case was conducted since August 2021 with the involvement of US authorities.

As part of the investigation, the U.S. Treasury imposed sanctions on Hydra and the cryptocurrency exchange Garantex. The Office of Foreign Assets Control identified more than 100 cryptocurrency addresses linked to illicit transactions.

Later, a district court in the Northern District of California unsealed an indictment against one of Hydra’s administrators — 30-year-old Dmitry Pavlov (for administering the platform, providing hosting services, and conspiring to launder money and distribute drugs).

Also this week, a district court in Saint Petersburg allowed investigators to seize stolen Ethereum coins from the suspect’s wallets. The ruling is a precedent in Russian jurisprudence.

LocalBitcoins handed data to the tax authorities of over 100,000 Russian users

The Russian tax service received information on more than 100,000 LocalBitcoins P2P platform users for 2021. This was reported by GMT Legal managing partner Andrey Tugarin, citing the agency’s data. He noted that LocalBitcoins forwards data to the Finnish Tax Administration, which in turn provides it upon request by the Russian FTS.

CEO of Binance tops Forbes’ crypto-billionaires list

The founder and CEO of Binance, Changpeng Zhao, topped Forbes’ ranking of the wealthiest in the blockchain and crypto industry. With a fortune of $65 billion, he ranked 19th on the world’s list of the richest people.

In second place was last year’s leader — the co-founder and head of FTX Sam Bankman-Fried ($24 billion). The top three was completed by Coinbase founder and CEO Brian Armstrong with $6.6 billion. The publication counted a record 19 billionaires in the sector.

Intel unveils new Bitcoin mining chip. The company paused operations in Russia

The Intel company announced the launch of the second generation of its own Bitcoin mining ASIC chip called Blockscale.

It delivers a hash rate of up to 0.58 TH/s with an energy efficiency of about 26 J/TH. A single chain can group 256 chips (~148.5 TH/s).

This week Intel announced it would suspend operations in Russia in response to the invasion of Ukraine.

Unknown launched fake “Sbercoin” on PancakeSwap

The SberCoin.Finance project launched trading of the SBER token, posing as the bank’s official stablecoin. The developers claimed ties to the financial institution and promised a fixed annual yield of 383 025%.

In a ForkLog comment, representatives of Sberbank denied involvement in this project and clarified that the official Sbercoin has not yet been issued.

MicroStrategy bought more than 4100 BTC for $190 million

The MicroStrategy unit, MacroStrategy, purchased 4,167 BTC for $190.5 million. In total, the company holds 129,218 BTC in reserves.

NEAR up 23% in 24 hours on rumors of stablecoin launch

On April 8, the Near Protocol token rose by 22.7%. NEAR’s market capitalization surpassed $12 billion.

The drivers were news of a $350 million funding round and rumors of the launch of the algorithmic stablecoin USN. The latter was spotted by a user in the test interface of the Ref Finance protocol.

Ledger unveils updated hardware wallet

The hardware-wallet maker Ledger unveiled a new version — Nano S Plus, targeted at NFT collectors and DeFi users.

According to the developers, the new device has a larger screen, and the increased memory capacity “allows installing over 100 applications and managing more than 5,500 digital assets”.

Lightning Labs launches protocol for issuing stablecoins on the Lightning Network. Integration with Shopify and Robinhood expected

The Lightning Labs team closed a Series B funding round of $70 million. The funds will go toward developing the Taro protocol, which also enables issuing stablecoins on the Bitcoin network and using them in Lightning Network apps.

The CEO of Strike, Jack Mallers, presented several partnerships for the Lightning Network-based payments operator, the key one signed with Shopify. The integration will remove banks from settlements. This will reduce fees for sellers and provide privacy for buyers.

The online broker Robinhood expanded access to beta testing of its crypto wallet and said it plans to integrate the Lightning Network “in the coming months”.

BitMEX co-founder forecast Ethereum above $10,000 by end-2022

According to Arthur Hayes, the main driver of price to new highs will be the transition to Proof-of-Stake, after which Ethereum will function as a commodity-backed bond.

TON investor lost court against Telegram over return of investments in the project

Zotobi Management Limited founder Igor Chuprin demanded Telegram return investments in the Telegram Open Network (TON) project totaling $1 million in full.

However, the court dismissed the suit, finding that Chuprin either became acquainted with the documents since they were circulated online and discussed in the blockchain community, or “understood all the risks, and did not care”. This is evidenced by the signed agreement.

Financial Times learned of Meta’s plans to issue its own digital tokens

According to the publication, Meta is considering the creation of several centralized tokens—”social” or “reputational” (for its own metaverse), as well as incentive tokens (for content creators, influencers and Instagram users). The tokens are unlikely to use blockchain technology in their operation.

Jordan Peterson warns against ‘unbridled enthusiasm’ for Bitcoin

The philosopher and University of Toronto psychology professor Jordan Peterson at the Bitcoin 2022 conference in Miami called the first cryptocurrency revolutionary, but worrisome.

In his words, a decentralized monetary system that deprives the state of monetary control, while positive in some respects, carries unforeseen risks.

Also on ForkLog:

- Binance will support the hard fork of the BNB Beacon Chain.

- In Miami, a cryptocurrency analogue of the “Charging Bull” on Wall Street was installed.

- Luna Foundation Guard and Terraform Labs will invest $200 million in AVAX.

- For the CEO of the Turkish crypto exchange Thodex, more than 40,000 years in prison were requested.

What else to read and watch

In a step-by-step guide, they explained how to use the non-custodial Trust Wallet from the Binance ecosystem.

In the March analytical report we discuss the main events and key trends in the crypto market.

Sponsored by the Bitcoin Industry in numbers — the Binance global blockchain ecosystem

ForkLog AI has gathered the most important AI news of the week.

The crypto industry is drawing more institutional players. This is evident from new investments in infrastructure and the growing attention companies give Bitcoin as an asset class. The most important events of the past weeks are in ForkLog’s overview.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!