Investors’ money funds STEPN: how the Move-to-Earn app monetises running

In 2021, projects in the Play-to-Earn (P2E) sector of the GameFi space became one of the main drivers of growth in the cryptocurrency market. In the new year, a business model gaining traction is changing the perception of blockchain applications — Move-to-Earn (M2E).

According to the World Health Organization, more than a quarter of adults (~1.4 billion people) suffer from insufficient physical activity. Experts say that up to five million deaths a year could be prevented if the population exercised more.

The concept of M2E or FitnessFi gamifies various forms of physical activity. The idea is not new — recall games such as Pokemon Go and Wii Sports. Yet the next generation of apps keeps users engaged not only by social and entertainment factors but also by financial incentives.

One of the most notable representatives of the M2E segment is the STEPN project from Australian studio Find Satoshi Lab. ForkLog has examined how the app works, what pitfalls exist, and whether daily exercise can improve financial well-being.

- STEPN is backed by a little-known development team, but among the project’s advisers is Adidas vice president Scott Dunlap. The product has also attracted funding from Binance, Alameda Research and other investors.

- STEPN has a fairly high entry threshold — to join the project, one must acquire an NFT worth more than $1200.

- The app does enable earning, but there are risks related to the project’s tokenomics, centralisation and the controversial actions of Find Satoshi Lab.

What is STEPN?

STEPN is a fitness application built on the Solana blockchain, which allows users to earn SPL-standard tokens for running and walking. The more a user moves, the greater the reward.

In the latest update, STEPN added support for the BNB Chain. This coincides with the release of a collaborative collection with Asics, which was launched on the Binance platform.

The project is driven by Find Satoshi Lab, a young studio whose other projects include only the digital wallet Solwallet. The latter, however, has not reached release. At the same time, individual team members have mobile development experience.

Co-founder Jerry Huang spent over a decade in the videogames and marketing industries. He is also a co-founder of Falafel Games, which develops mobile applications.

Another Find Satoshi Lab co-founder — Yawn Rong — is a business ambassador for the Algorand project and a representative of industry associations Blockchain Australia and the South Australian Blockchain Association. In 2018 he founded the consulting firm Crypto SA.

Among Find Satoshi Lab’s advisers is Adidas’s digital wing head at Runtastic — Scott Dunlap, who often shares his STEPN-related achievements.

Spring running in the Alps, the AdiZero Pro2‘s just go forever.

215.21 $GST w/20 Energy @Stepnofficial, and a tan line. 🤩#spring #STEPN #adidas #adidasrunning #trailrunning #ötztal #alps pic.twitter.com/rX0ExtObfQ

— Scott Dunlap (@scott_dunlap) April 12, 2022

In April, STEPN’s smart contracts were audited by Verilog Intelligence. The latter also reviewed the codebase of the decentralised exchange WOOFi, as well as a number of other lesser-known projects.

💼 STEPN Audit @Stepnofficial

Verilog team audited the smart contracts of STEPN, a Game-Fi/Social-Fi Web3 application.

Learn more about this audit case at:https://t.co/5aYFQbgNlF pic.twitter.com/XeEK9CWcNp

— Verilog Audit (@verilog_audit) April 5, 2022

Verilog Intelligence specialists found several non-critical issues related to centralisation risks, but overall confirmed the product’s reliability.

Development of STEPN has been ongoing since August 2021, but the app is already profitable. Find Satoshi Lab published a report stating that in Q1 2022 the product generated over 192,635 SOL (~$26.81m) in revenue from NFT marketplace fees and royalties.

The project has received funding from Binance Labs, Sequoia Capital India and Alameda Research, and both of its tokens have risen substantially in price over the last month.

According to the project team, in April the app reached 300,000 daily active users.

As promised in this week’s Discord AMA, here is the online users for the past 30 mins. We have also achieved 300k DAU this week. pic.twitter.com/I8Pg0Q2Qv1

— STEPN | Public Beta Phase III (@Stepnofficial) April 17, 2022

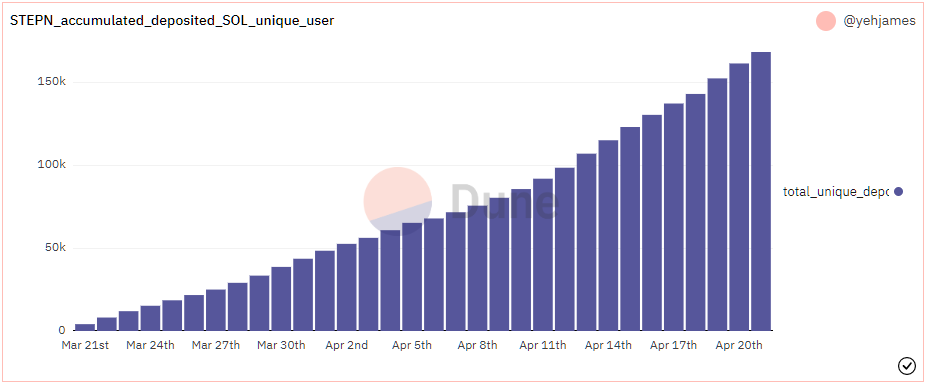

Deposits in SOL to STEPN-linked addresses were made by more than 168,400 unique users.

Running tokenomics

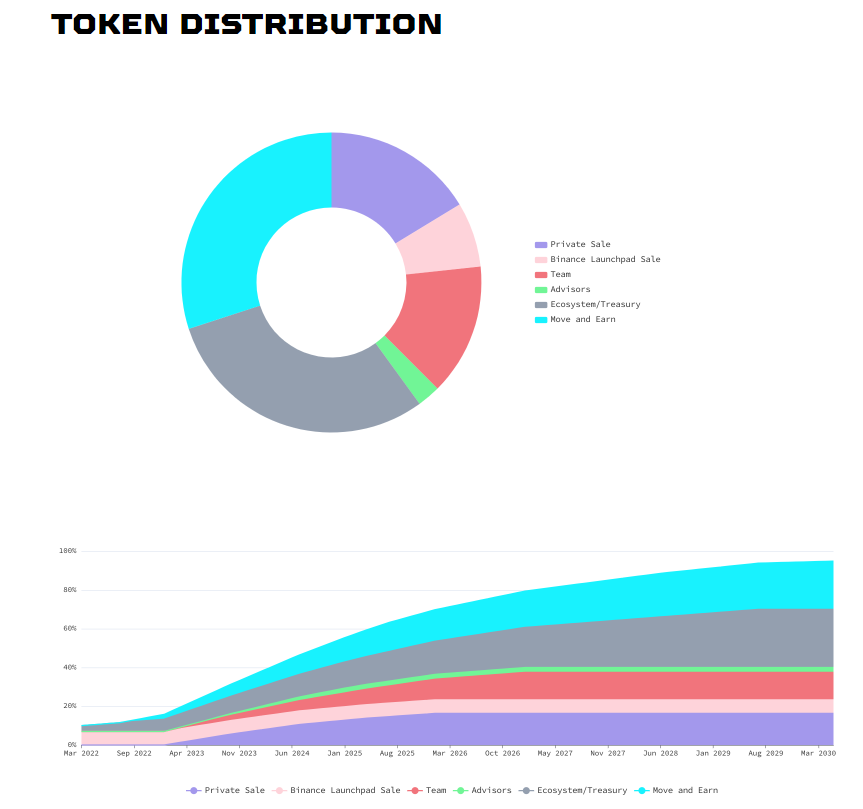

STEPN’s tokenomics are built on two assets — Stepn (GMT) and Green Satoshi Token (GST). The former is the governance token, the latter the in-game currency of the project.

The supply of GST is unlimited. Users earn these tokens for activity tied to the app.

On 20 April, developers updated the technical documentation and released 60 million GST tokens to back decentralised pools for GST:

- 20 million GST on the Solana network and 20 million GST on the BNB Chain were placed in liquidity pools on Orca, Raydium and PancakeSwap;

- 10 million GST (Solana) and 10 million GST (BNB Chain) were locked on Binance for cross-chain bridge smart contracts.

GMT was mined in a premine — its supply is capped at 6 billion tokens. Users can also earn these assets, but access to this feature opens only at NFT level 30.

The STEPN mechanics involve burning tokens: they are taken out of circulation via sneaker repairs and upgrades, opening Mystery Boxes, minting sneakers, and upgrading gems and unlocking slots for them.

A step worth its weight in gold

To join STEPN, a user must register in the app and purchase NFT sneakers.

Registration requires an activation code. The code can be collected at giveaways run daily by the project’s official communities at 13:00 UTC (16:00 Kyiv/Moscow). Existing STEPN users who have reached a certain level of progress in the app may also share them.

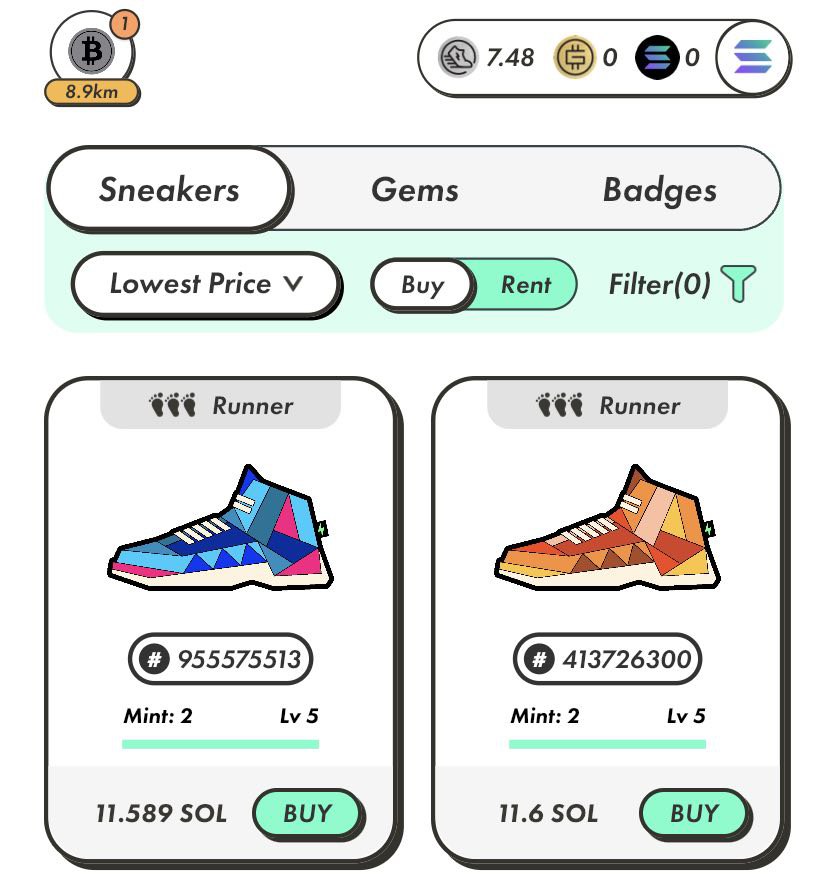

Purchasing an NFT can be done via the in-game marketplace or on Magic Eden and Binance NFT.

The entry threshold is fairly steep: at the time of writing, the cheapest NFT available in the app costs 11.59 SOL (~$1,216). On Magic Eden prices start from 12 SOL. Buying collaborative NFTs on the BNB Chain network will be considerably more expensive.

When creating an account on STEPN, note that this is a highly centralised application.

After registering, a recovery seed phrase is issued and a public address is provided. Private keys, however, are not disclosed to the user.

Depending on the level of desired activity, you can choose sneakers of one of four types:

- Walker (1–6 km/h) — typically yield 4 GST per unit of energy spent;

- Jogger (4–10 km/h) — 5 GST per energy unit;

- Runner (8–20 km/h) — 6 GST per energy unit;

- Trainer (1–20 km/h) — depending on the tempo chosen by the user, yield from 4 GST to 6.25 GST per energy unit.

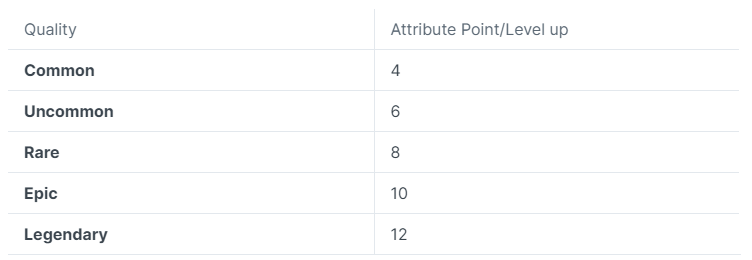

NFTs are also divided into five quality classes — Common, Uncommon, Rare, Epic and Legendary. Quality determines their minimum and maximum starting stats, as well as the number of attribute points sneakers gain with each level-up.

STEPN features four attributes, each affecting the gameplay in a particular way.

Efficiency affects the amount of GST earned. The higher this stat, the more tokens a user earns per unit of energy spent. This attribute is among the most important factors in calculating earnings.

Luck determines the frequency of Mystery Box drops and their quality.

Comfort is not currently used. The metric is described in the technical documentation as having been redesigned and is under development.

Resilience determines the NFT’s durability. As the user moves, sneaker durability decreases — they must be repaired for GST. Higher resilience reduces wear and related costs.

With high wear, NFTs incur a penalty to earnings: if durability falls to 50%, efficiency drops to 90%; if it falls to 20%, efficiency drops to 10%.

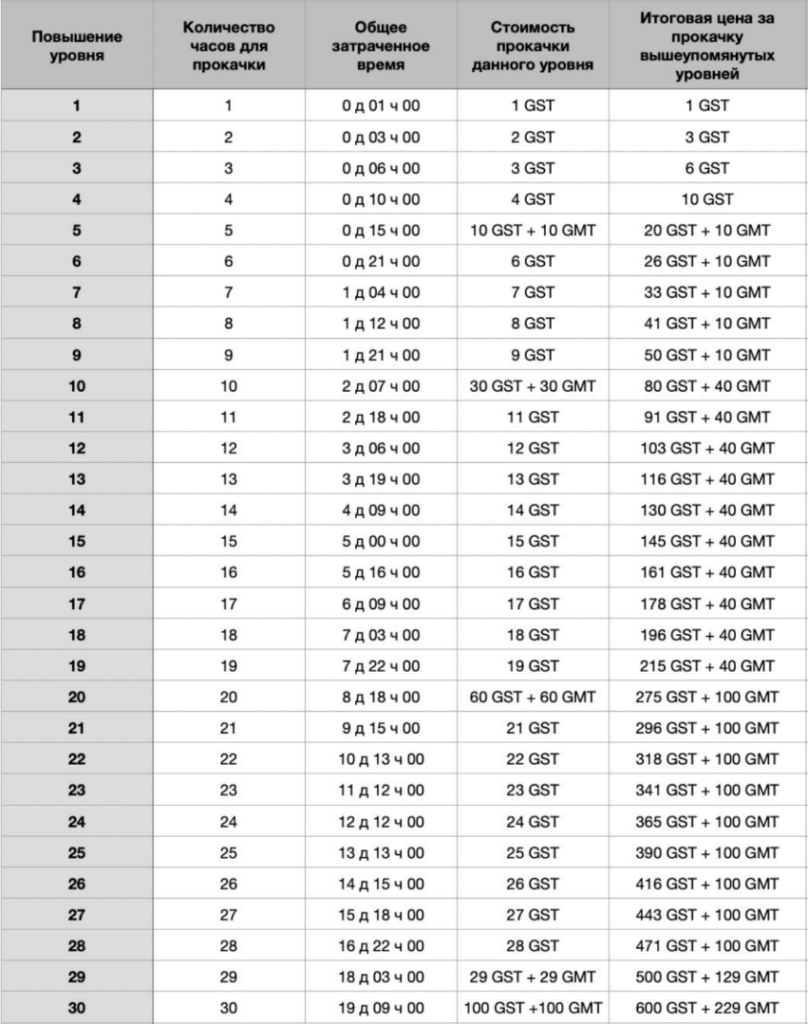

Since the latest update, the cost of upgrading sneakers in STEPN has risen significantly. To reach level 30, you need to spend 600 GST and 229 GMT (over $3,500 at the current rate).

Can you earn with STEPN?

The STEPN gameplay is straightforward: when going for a walk or jog, the user starts the tracker and tries to keep the pace within the green band. For this, they are awarded GST tokens (or GMT at level 30 upgrades).

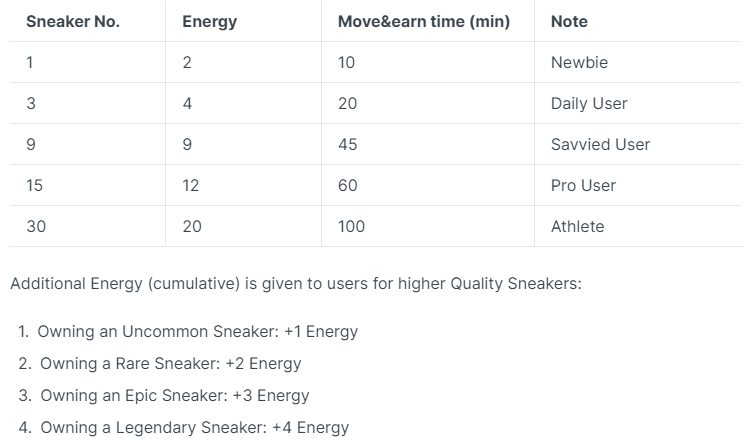

Player actions are limited by energy. The base is 2 units, but it can be increased by buying additional NFTs or sneakers of higher quality than Common.

Every six hours, 25% of the maximum energy reserve is restored.

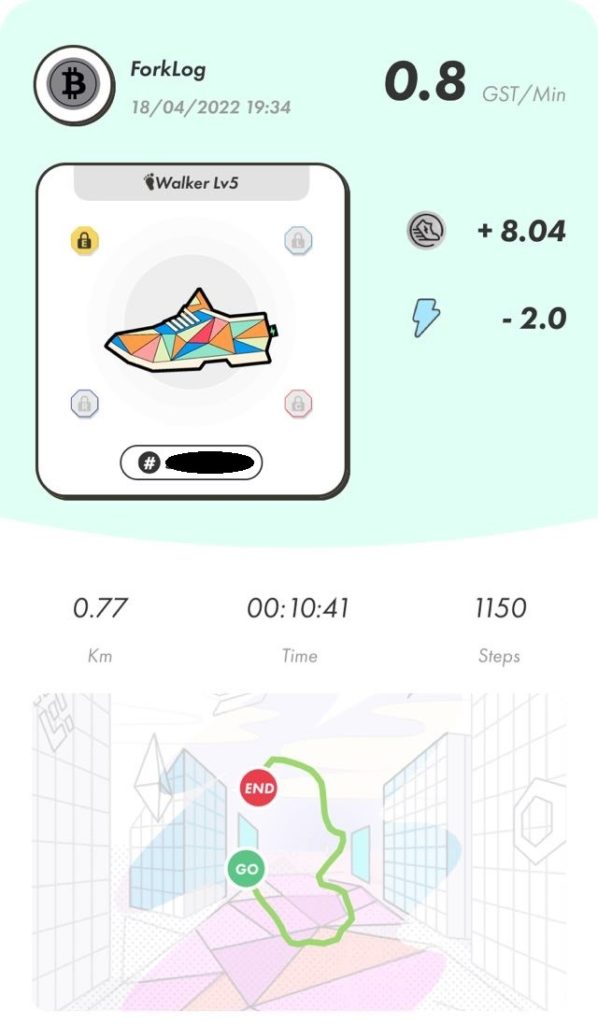

We bought NFTs and tested STEPN for a week. At level 5 of upgrades, Walker-class sneakers (Common quality) earned around 8 GST per 2 energy units spent (~$37 at the rate at the time of writing).

Higher-quality NFTs would yield more, but they would also cost more.

Theoretically, the initial outlay of $1,389 (11.42 SOL to buy sneakers + 20 GST for upgrades) could be recouped in about 50 days. This assumes costs for sneaker repairs (~1.6 GST — 1.8 GST per walk) but does not account for GST price volatility — since late March the token has traded in a range from $5.50 to $3.88, according to CoinGecko.

Aside from that, thanks to upgrades and growing popularity, the NFT itself appreciated in value, opening up the possibility of additional profit.

After accumulating a sufficient amount of cryptocurrency, you can buy another pair of sneakers and release a third. This increases the maximum energy reserve, and thus earnings. In addition, the NFT can simply be sold.

In the future, developers promise to add an NFT rental feature. This means sneaker owners can earn passive income.

At first glance, investing in STEPN looks attractive — there is potential to earn substantial profits from daily runs or walks. However, before making an investment decision one should understand the pitfalls that exist within the project.

The bitter pill

It is worth starting with the fact that STEPN is in beta testing — this brings with it corresponding issues.

Occasionally the app misreads movement speed and refuses to award tokens. The tracker returns an error Moonwalking, even when all required conditions are met, or users simply cannot log in due to “network congestion.”

After a recent update, the community reported token losses on transfers. The developers explained the situation as a bug and have since resolved the issue. But there is no guarantee this will not recur.

As noted above, STEPN is a centralised application. A user cannot store NFTs on a non-custodial wallet, so in the event of blocks or other incidents they risk losing access to funds. Non-custodial wallet

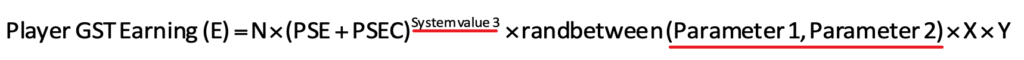

Despite its simplicity, STEPN has a complex and opaque reward system. User earnings in GST are calculated by the following formula:

Where:

- N — energy expended;

- PSE and PSEC — sneaker efficiency and user efficiency coefficient (taking into account gems and other boosters) respectively;

- X — average speed;

- Y — NFT resilience;

- randbetween (Parameter1, Parameter2) — a function that selects a random value within the system-defined range;

- System value — the value set by the game developers.

In this formula, two variables merit attention — randbetween (Parameter1, Parameter2) and System value. The value of the first is unknown and not specified anywhere. The value of the second, according to the technical documentation, developers may adjust at their discretion.

From this, it follows that the project team can materially influence users’ earnings, not through transparent actions like increasing internal stock of tokens, but by behind-the-scenes adjustment of system parameters.

We have previously written about the fragility of tokenomics in P2E platforms. Successful projects rely on complex economic models that determine resource distribution.

Developers continually seek a balance between an engaging experience and a system of incentives that compels users to invest time and money in the product.

In blockchain games a potential solution to this problem is to include a larger pool of in-game stockpiles and tokenised resources. These systems allow the project team to perform the functions of a monetary regulator.

In a P2E product, users are prepared to spend the earned money within the app’s ecosystem simply because it offers an engaging gaming experience. However in M2E projects, that approach may not work.

The only internal token stockpiles in STEPN are the sneaker upgrade and repair systems, as well as fees charged for opening Mystery Boxes and other in-app operations.

The team has announced a multiplayer-like feature that, it seems, will resemble a leaderboard, and promised periodic events. Yet the project’s tokenomics do not look sustainable, and the measures listed above are unlikely to suffice in making it so.

The practice of editing the technical documentation during testing also seems dubious. In fact, developers increased GST in circulation by 40 million tokens, arguing the move was necessary to ensure liquidity. Yet such measures were not foreseen in the original version of the document.

Thus a separate risk is the possibility of GST and GMT price declines. At the time of writing, the tokens have shown positive momentum. Over the last month, the first rose by 37% and the second by 293%.

But things may change — just look at Axie Infinity. At the time of writing, AXS price had fallen more than 70% from its November 2021 peak.

Conclusion

As Vitalik Buterin, founder of Ethereum, has said, the main aim of cryptocurrency is to “do things that have a meaningful impact in the real world.”

The M2E model aligns with this ideology and sits within the Web 3.0 concept. Projects like STEPN could prove a breakthrough for people leading sedentary lives, encouraging them to move more.

The financial incentives proposed in M2E do work. People have spent money on doctors for centuries, but now they are paid for leading a healthy lifestyle.

There is little doubt the segment will develop in tandem with the concept itself. We will undoubtedly see projects offering an even more engaging user experience.

STEPN itself could be a game-changer, but first the developers must build a sustainable economic system.

You might consider the product if you have spare funds and a desire to take up a sport you’ve long postponed. Yet the Axie Infinity experience above shows that in the long run the majority of users should not expect stable earnings from the app.

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!