Binance backs Elon Musk with $500 million for Twitter takeover

The cryptocurrency exchange Binance has earmarked $500 million to finance the takeover of the social network Twitter, initiated by Elon Musk. The billionaire stated in the filing with the U.S. Securities and Exchange Commission (SEC).

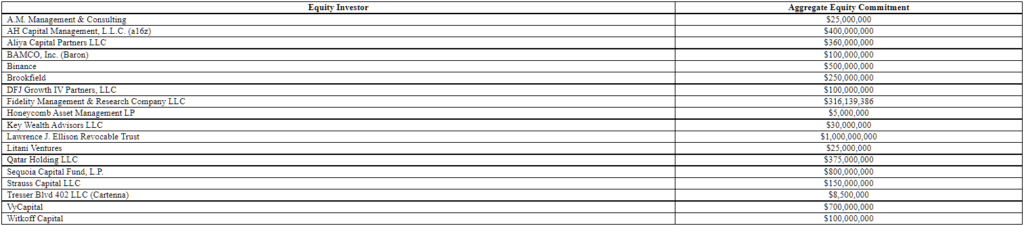

According to the document, Musk raised $7.14 billion from “equity investors.” The largest check ($1 billion) was written by The Lawrence J. Ellison Revocable Trust. In second place is Sequoia Capital, which provided $800 million.

Prince Alwaleed bin Talal Al Saud, who is already a Twitter shareholder, will invest 35 million shares in the company. At Musk’s proposed price ($54.2 per share), his stake is valued at about $1.9 billion.

In early April Musk became the largest shareholder in Twitter after acquiring 9.2% of the shares for $2.89 billion.

On April 14 he offered to buy the social network for more than $43 billion. The entrepreneur explained this as an intention to create an “inclusive arena for free speech”, and not a desire to profit.

Initially Twitter’s management did not value the offer and approved a plan to defend against a takeover. However, later reconsidered its position.

On April 25 the board approved selling the company to Musk for $44 billion.

Coinbase CEO Brian Armstrong called the deal a “victory for free speech”.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!