Bank of America casts doubt on Bitcoin as an inflation hedge

Bitcoin has not, for some time now, served as an inflation hedge. Bank of America’s analysts reached that conclusion, Fortune reports.

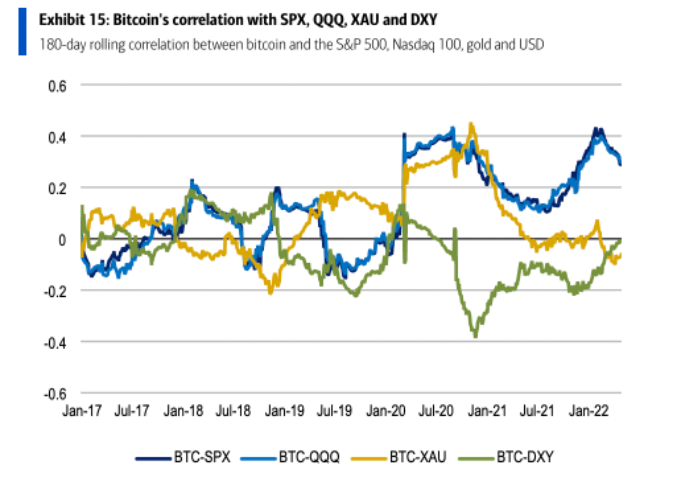

Since July 2021, Bitcoin has moved closely with the stock market in its price movements. On January 31, Bitcoin’s correlation with the S&P 500 reached a record high in the history of observations. A similar peak was also approached in its correlation with the Nasdaq 100.

Experts stressed that this linkage “has become obvious”. They noted the synchronous fall in stocks and Bitcoin the day after решения ФРС повысить ключевую ставку на 0,5%. Analysts expect to see the high correlation persist going forward.

By contrast, the price relationship between Bitcoin and gold has gradually weakened since 2021 and, in the past two months, turned negative. In other words, the movements of the two assets have not been in tandem, the analysts concluded.

Back in May 2022, billionaire Ray Dalio заявил that Bitcoin is not a proper substitute for gold as an inflation hedge.

Earlier, BitMEX co-founder Arthur Hayes назвал a likely drop in Bitcoin to $30,000 by the end of the second quarter due to Nasdaq’s decline.

Follow ForkLog news on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!