Glassnode: Most hodlers continue to accumulate Bitcoin positions

Terra collapse pushed some long-term Bitcoin investors to realise losses, but many hodlers took advantage of the price dip below $30,000 to expand their positions. Analysts at Glassnode found these conclusions.

In the aftermath of the recent sell-off, a notable shift in #Bitcoin accumulation trends is underway#Bitcoin HODLers remain the only ones left, however their behaviour signals a doubling down, as prices trade around $30k.

Read more in The Week Onchain👇https://t.co/XTPVi7m8AX

— glassnode (@glassnode) May 30, 2022

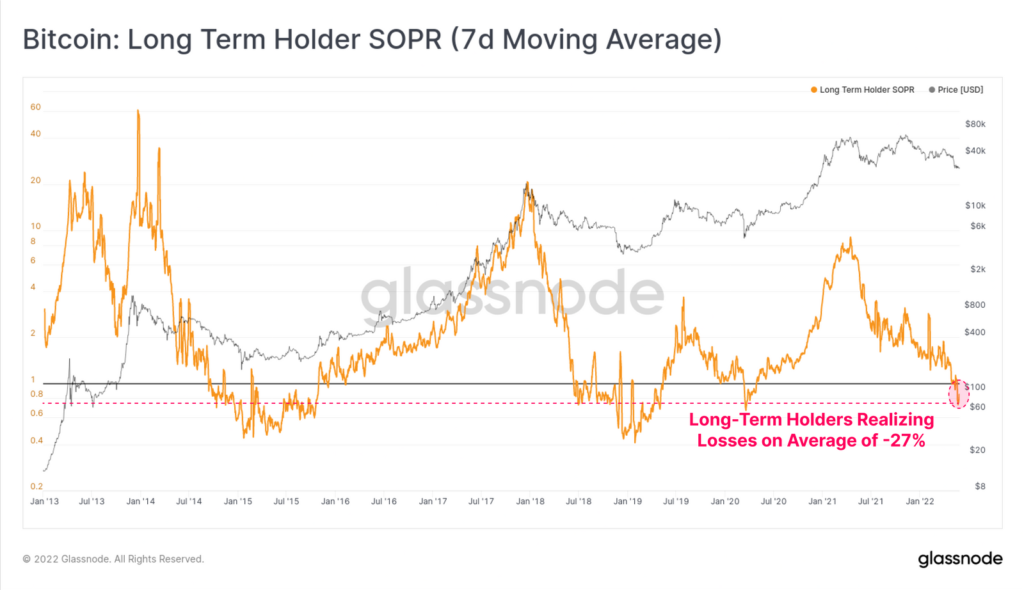

Last week, LTH-SOPR pointed to an average loss of 27%.

Experts recorded signs of hodler capitulation for the first time since the summer of 2020. In bear markets of 2015, 2020 and the 2018 correction, this event signified a turning point in the negative momentum.

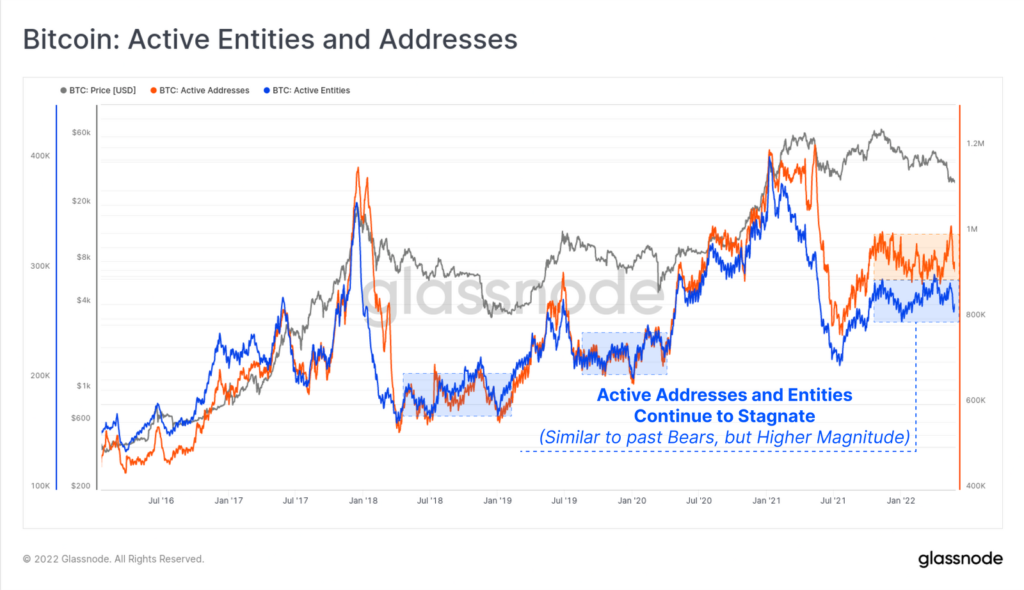

Unlike similar situations in the past, the current wave of declines did not attract new users—the number of active addresses continued to stagnate.

The Accumulation Trend Score indicator reversed the wave of periodic accumulation and distribution of coins observed from January to April, reflecting uncertainty and capital rotation. Over the last 1.5 weeks the metric indicated dominance of purchases by existing investors.

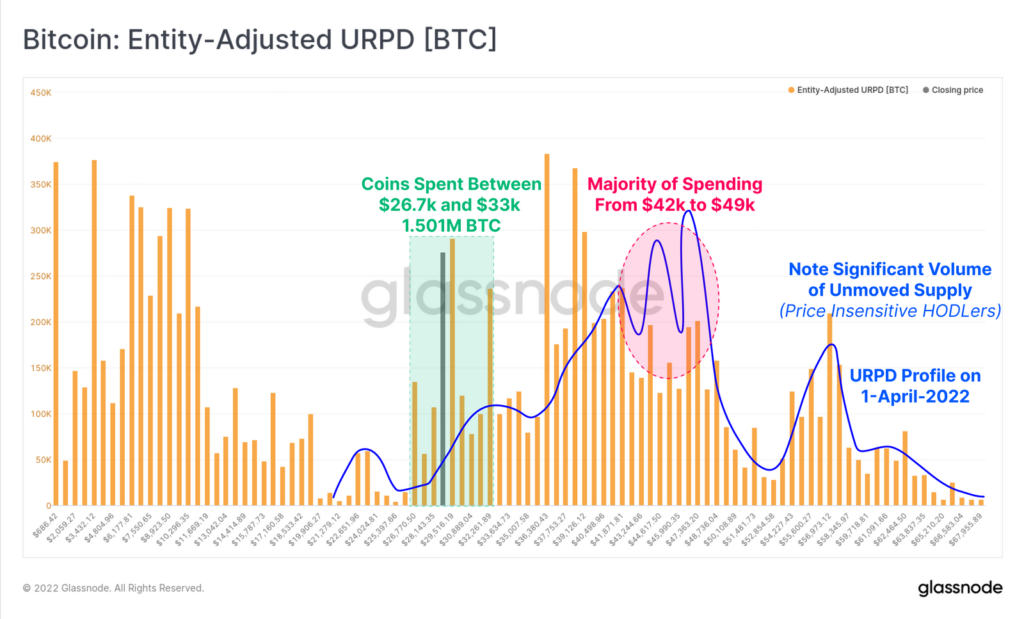

Analysts compared the current market profile as of March 1. They concluded that the majority of “young” coins that moved in the past three months proved insensitive to the latest price swings and may transition to the “mature” category.

As a result, the market’s key driver became the actions of long-term investors.

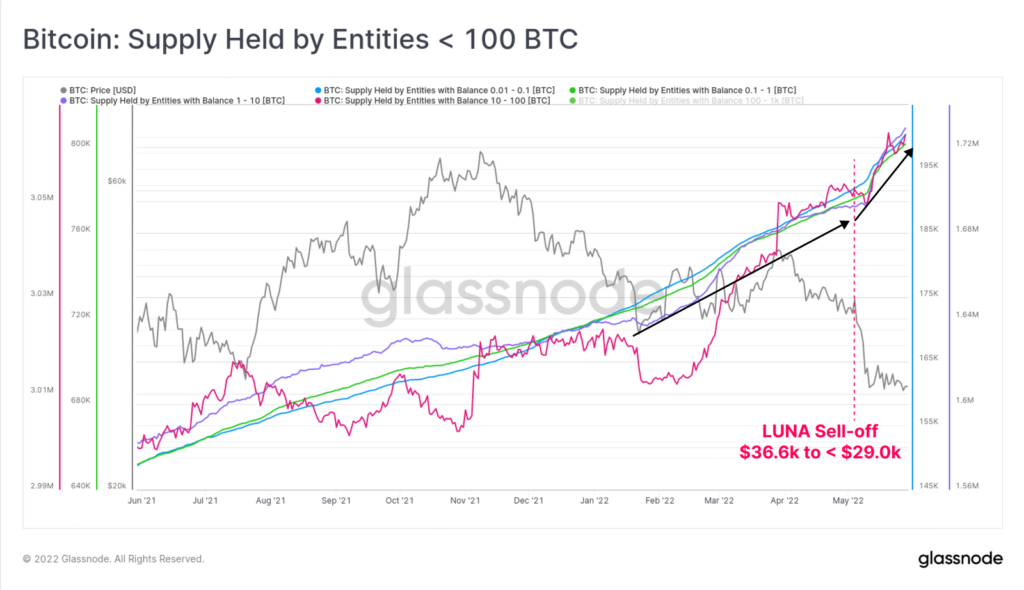

Glassnode forecast an uptick in the coming months toward an all-time high in the number of coins held by hodlers.

The chart below illustrates a significant unloading of 1.5 million BTC in the $42,000–$49,000 range and a shift of coins to buyers in the $26,000–$33,000 corridor.

The sold LFG 80 081 BTC moved to private investors and institutions, among which notable are wallet holders with balances below 100 BTC. Their aggregate position rose by 80 724 BTC, absorbing the increased supply from the non-profit behind UST.

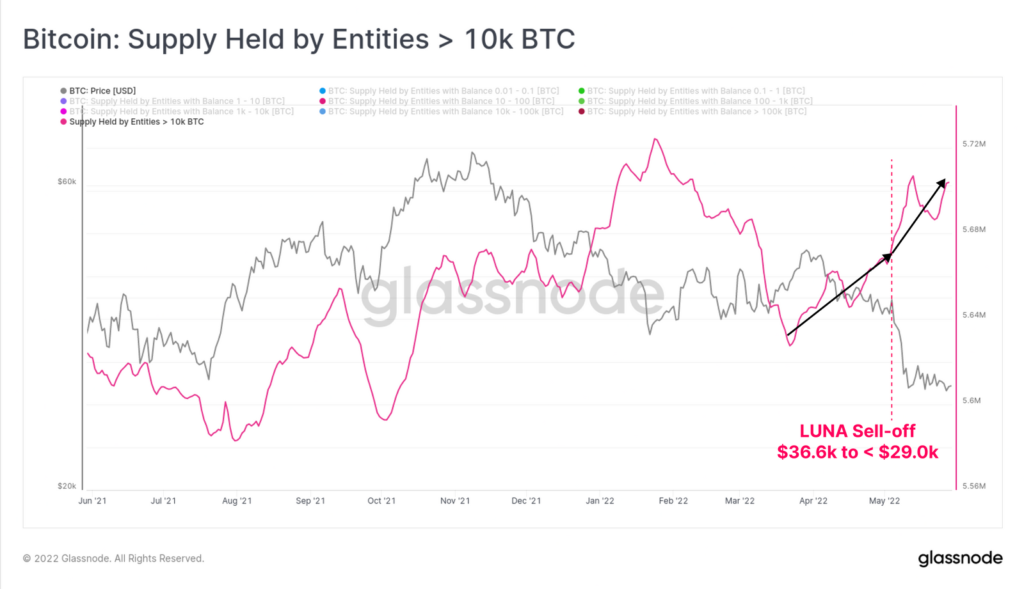

Significant accumulation activity was also shown by whales with balances above 10,000 BTC. In May they bought 46 269 BTC. This figure includes the 80 081 BTC sold by LFG.

“We are closely watching the macroeconomic environment and signals of a weakening link between digital assets and equities. Will the correlation strengthen, and how will the market react to tighter monetary policy? Nevertheless, the growth in hodlers is impressive,” the analysts concluded.

Analysts at JPMorgan named Bitcoin’s fair value at $38,000.

Guggenheim Partners Investment Director Scott Minerd and noted Bitcoin critic Peter Schiff have allowed for Bitcoin prices to fall to $8,000.

Subscribe to ForkLog news on Telegram: ForkLog Feed — full feed of news, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!