Glassnode: market downturn changes the behaviour of some bitcoin hodlers

A range of indicators suggests the market is entering the ‘deepest phase of the bear market cycle’. This is described in Glassnode’s analytical report.

Researchers note that fundamental metrics have deteriorated. Long-term crypto holders are now bearing substantial losses.

Macro factors are weighing on the market:

- The US Consumer Price Index is at 8.6%, which exceeded market expectations;

- the inversion of the U.S. Treasury yield curves;

- the dollar index rally (DXY).

Against this backdrop, Bitcoin has posted ten red candles over the last eleven weeks.

The chart above shows the price attempting to hold above MA 200.

“Although many macro indicators continue to signal oversold conditions, Bitcoin still correlates with traditional markets. Prices, accordingly, are falling,” note Glassnode analysts.

Below, the MVRV Z-Score indicator has already reached the ‘green zone’, signaling a favourable period for accumulating digital gold in the long term.

The last time the indicator reached comparably low readings was at the end of 2018–2019 and in March 2020. Bitcoin’s price then fell rapidly to extreme lows.

According to Glassnode experts, such hodler-friendly periods last from 8 to 24 months, until Bitcoin’s price hits bottom.

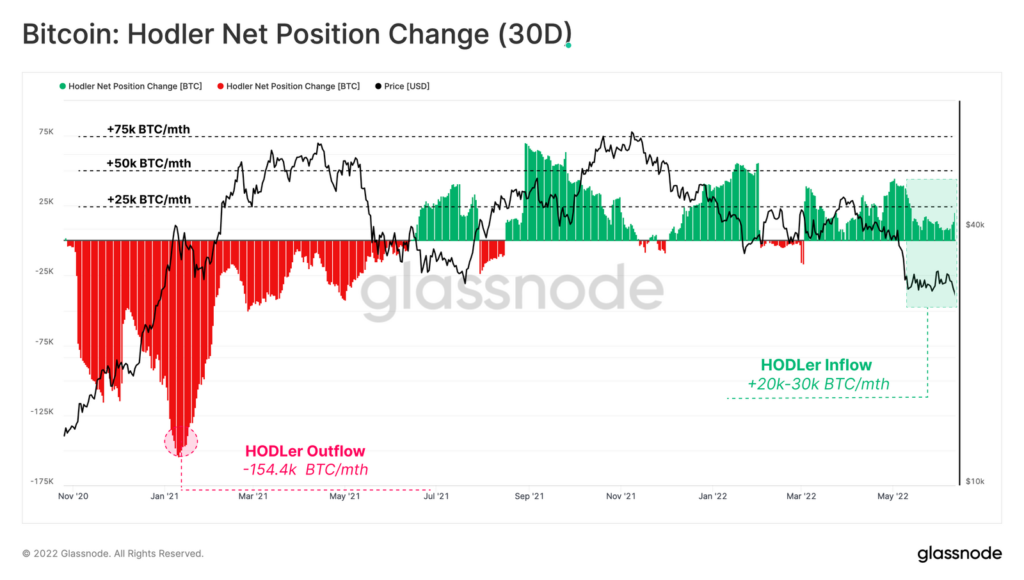

There is a slowdown in the rate of Bitcoin accumulation among long-term investors. Their monthly reserves rise by 15,000–20,000 BTC. In early May, the pace was 64% higher than now.

“The accumulation trend in recent weeks is driven by very large (>10,000 BTC) and relatively small (<1 BTC) players," emphasised Glassnode.

Among ‘crabs’ and ‘sharks’ (1 BTC to 100 BTC), the ongoing decline has coincided with a shift from neutral behaviour toward distribution.

Researchers say the evolution of the situation will largely depend on activity and price support from the whales.

Earlier ForkLog reported a drop in market capitalisation to January 2021 levels.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!