Analysts record a slowdown in inflows to bearish Bitcoin funds

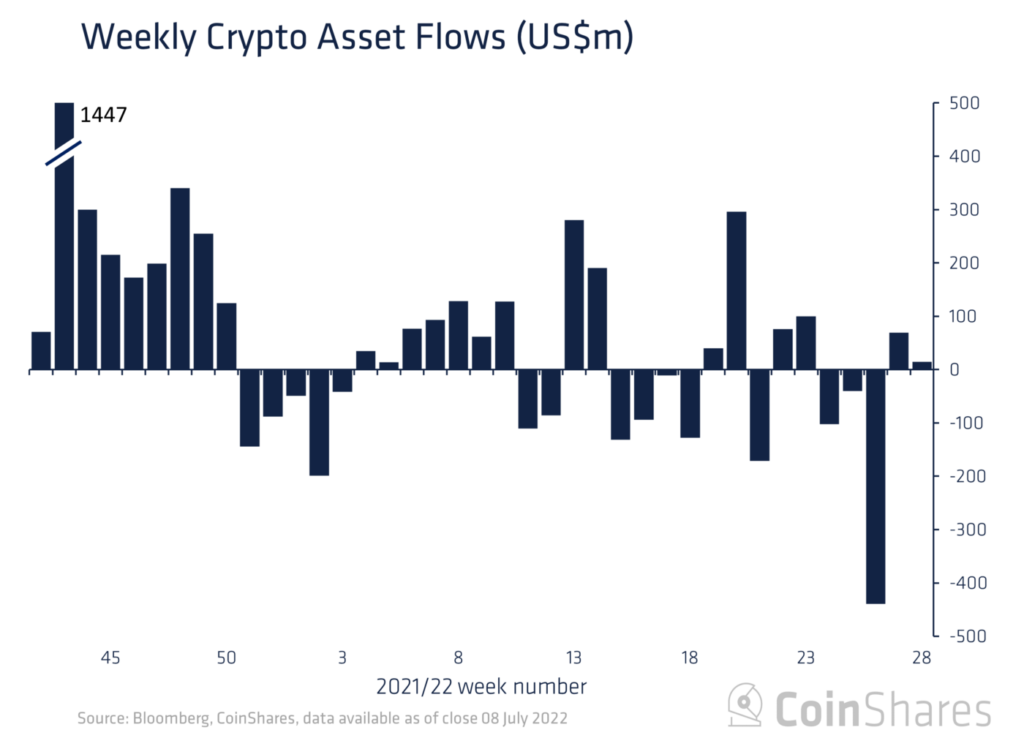

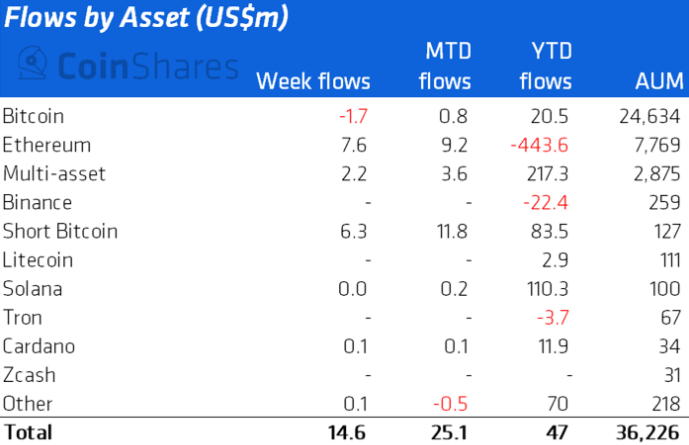

In the period 2-8 July, inflows to crypto investment products totalled $15 million. According to CoinShares, the pace of inflows to funds that allow shorting Bitcoin slowed from $51 million a week earlier to $6.3 million.

According to analysts, AUM of crypto products across the industry rebounded from a yearly low of $35.41 billion to $36.23 billion.

Traditional Bitcoin funds recorded outflows of $1.7 million.

For the third week running, inflows into Ethereum-based products were recorded ($7.6 million). Analysts linked this to the upcoming transition of Ethereum from Proof-of-Work to Proof-of-Stake.

As reported, 60% of Bloomberg investors polled consider a fall in Bitcoin снижение цены биткоина к $10 000 more likely; a rebound to $30,000 is the baseline scenario for the remaining 40%.

Earlier, Ruchir Sharma, head of Rockefeller International, noted that Bitcoin needs to shed excess leverage to regain resilience.

Read ForkLog’s Bitcoin news in our Telegram — news on cryptocurrencies, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!