Celsius unveils plan to reorganise the company; creditors to be paid from mining subsidiary’s profits

The crypto-lending platform Celsius Network unveiled a plan to reorganise the business centred on its mining subsidiary. Profits from mining bitcoin are to be used to compensate users’ losses and to pay creditors.

On July 14, Celsius filed for bankruptcy protection in a New York court under Chapter 11 of the U.S. Bankruptcy Code. Chapter 11 protection does not permit proceedings to be brought against the debtor, allowing it to reorganise its finances.

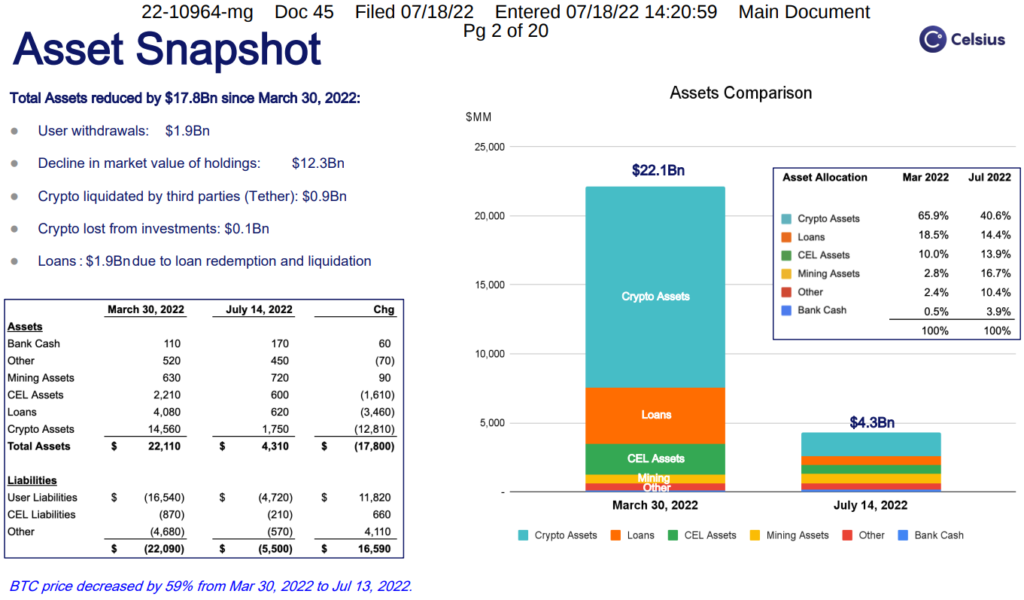

Later, the company’s chief executive Alex Mashinsky said that as of July 13 Celsius owned assets of $4.3 billion. Its liabilities to customers and creditors stood at $5.5 billion.

On July 18, the first hearing in Celsius’s bankruptcy case took place. On the same day, the platform’s interests were represented by the law firm Kirkland & Ellis, which submitted a new filing to the court.

According to the filings, from March 30 to July 14, 2022, the value of assets under the company’s management declined by $17.8 billion. Of this:

- $12.3 billion — decline in cryptocurrency valuations;

- $1.9 billion — withdrawal of funds from deposits;

- $1.9 billion — liquidation and repayment of loans;

- $0.9 billion — liquidation of Tether’s debt position;

- $0.1 billion — losses related to unsuccessful investments.

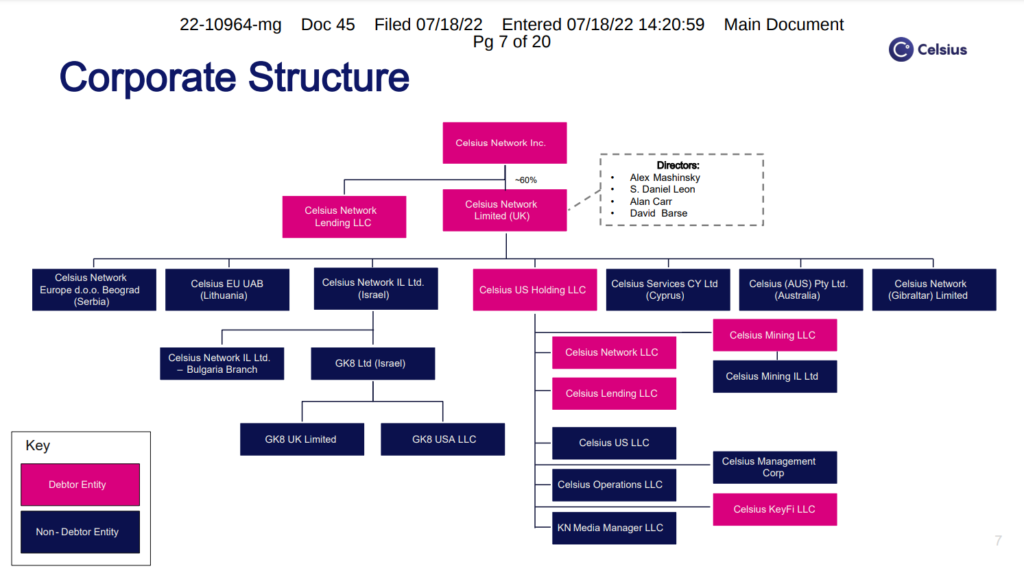

According to the filings, the plan’s compensation of losses largely depends on future profits from Celsius Mining, which sits in the corporate structure as a debtor entity as well.

According to CoinDesk, at the hearings Celsius’s lawyers requested approval for additional spending of more than $5 million to complete the construction of the Texas mining operation. They said it would take about another two months.

The judge approved the request, ruling that during the reorganisation the company’s assets would be under the control of representatives of the U.S. Department of Justice.

In the Justice Department, concerns were voiced about the viability of Celsius’s mining business. At the hearings, state counsel Shara Kornell said:

“There is a mining company that, in my view, is not currently operating but has brought the debtor a substantial amount of money. It is not clear to me whether construction may or may not be the best option for Celsius. Why not simply consider liquidation and move on?”

Representatives of the platform argued that Celsius Mining operates more than 43,000 Bitcoin mining rigs. They plan to raise the number to 112,000 by somewhere in the second quarter of 2023.

The lead counsel Pat Nash said Celsius Mining daily generates roughly 14.2 BTC. For 2022, the enterprise expects to mine 10,100 BTC (about $221 million at the rate at the time of writing).

“If all goes well, in 2023 we plan to generate about 15,000 BTC,” he added.

The Financial Times reported that Celsius owed $439 million to private financial firm EquitiesFirst.

The latter is also listed among the creditors of the collapsed hedge fund Three Arrows Capital.

1174907182280000000048 by ForkLog on Scribd

Follow ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!