CoinShares: Inflows into crypto funds slow

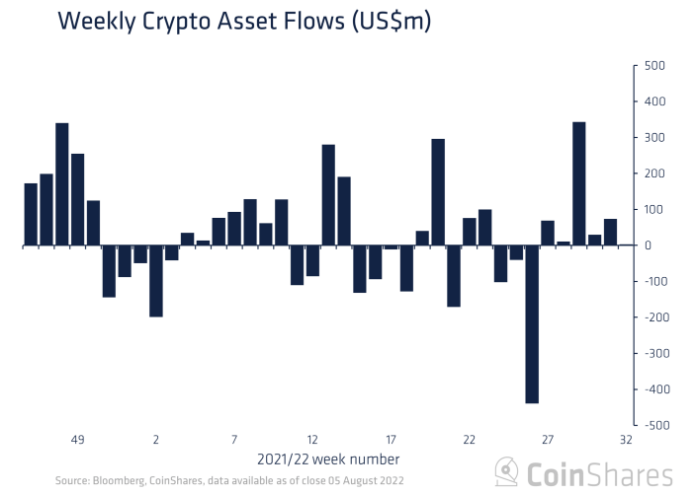

Inflows into cryptocurrency investment products for the period July 30 to August 5 amounted to $3 million. Over the last six weeks, total inflows reached $529 million, according to CoinShares.

[1/5] This week’s Digital Asset Fund Flows Report is now available. Written by @jbutterfill, the headline for this week is: Year-to-date inflows recovered to US$0.49bn, the second week of outflows in short-bitcoin Read on for the highlights ->

— CoinShares 👩🚀 (@CoinSharesCo) August 8, 2022

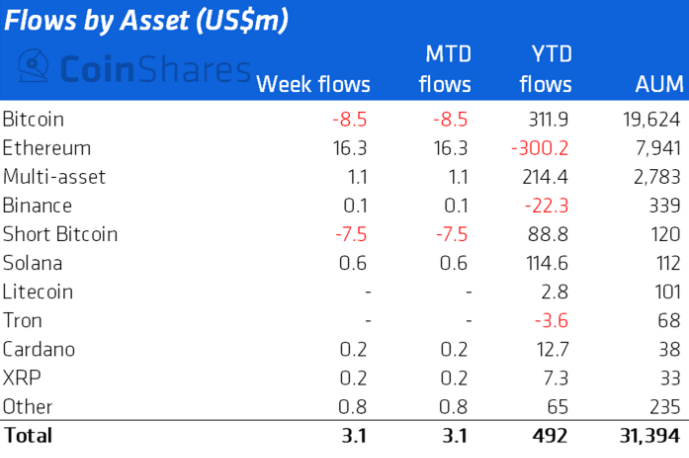

Since the start of the year, crypto funds have attracted $492 million.

По расчетам аналитиков, AUM для криптопродуктов по индустрии в целом stood at $31.4 billion.

Despite deteriorating market conditions, во втором квартале управляющие компании запустили 32 новых инструмента. Это второй показатель после октября-декабря 2021 года (33).

В традиционных биткоин-фондах наблюдался отток в размере $8,5 млн. Из структур, которые позволяют открывать шорты по первой криптовалюте, зафиксирован второй по итогам недели вывод клиентских средств ($7,5 млн).

Inflows into Ethereum-based products ($16 млн) продолжаются седьмую неделю подряд. Инвесторы в ожидании The Merge увеличили свои позиции на $159 млн.

According to experts, trading activity remains subdued. The volume of crypto-product trades in the latest reporting week stood at $1.1 billion. This figure is more than half the year-to-date average of $2.4 billion.

Analysts at Grayscale had forecast the end of the crypto-winter by March 2023.

Earlier, CoinShares chief strategist Meltem Demirors forecast Bitcoin reaching a new all-time high within the next 24 months.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!