Grayscale does not rule out classifying Zcash, Stellar and Horizen as securities

Analysts at Grayscale Investments have acknowledged that the cryptocurrencies Zcash (ZEC), Stellar (XLM) and Horizen (ZEN) may be classified as securities. CoinDesk reports, citing the organisation’s documents.

According to the report, Grayscale was contacted by staff from the corporate finance and enforcement divisions of the SEC. Their inquiry concerned an analysis of the company’s investment products based on ZEC, XLM and ZEN within the framework of securities law.

According to CoinDesk’s documents, Grayscale acknowledged that each of these assets “may currently be a security” or “may in the future be deemed a security by the SEC or a federal court”.

The papers disclosed by the publication cover May–August 2022. In earlier documents, the company stressed that the regulator had not provided guidance on the classification of the assets in question.

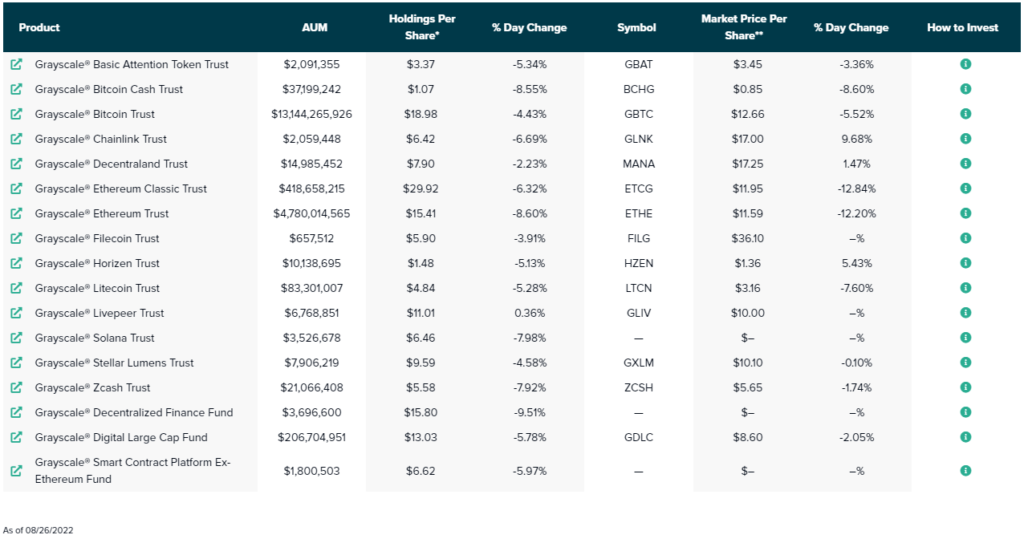

As of 26 August 2022, the combined assets under management of the Zcash Trust, Stellar Lumens Trust and Horizen Trust were valued at $39.11 million. For comparison, the largest of the group’s trusts — Bitcoin Trust — $13.14 billion.

Grayscale Investments and CoinDesk are part of Barry Silbert’s Digital Currency Group.

In July, U.S. authorities arrested former Coinbase product manager Ishan Wahi. He was charged with insider trading.

The SEC also filed against the suspect a lawsuit with similar arguments, but stressed that it concerns securities fraud.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!