Analysts record inflows into bear Bitcoin funds

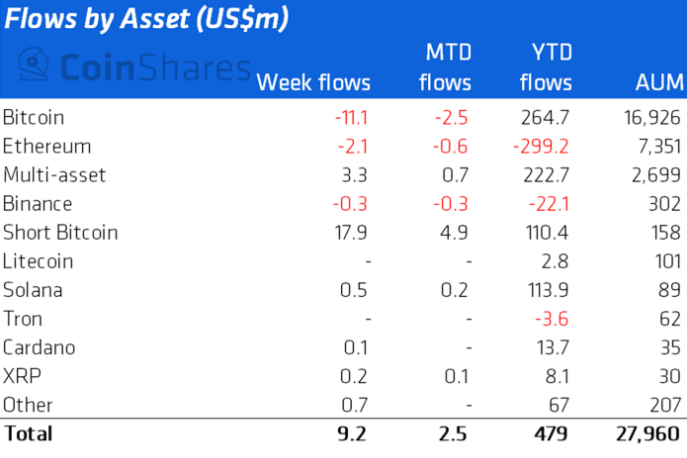

For August 27–September 2, structures that allow shorting the first cryptocurrency recorded a record inflow of $17.9 million, according to CoinShares.

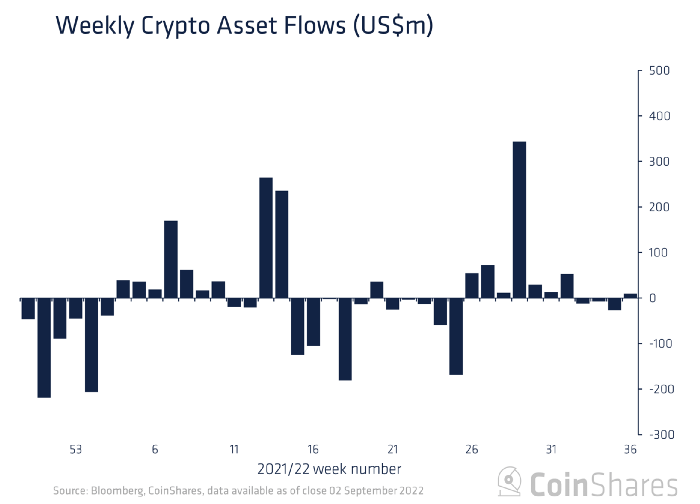

Trading volume of crypto investment products for the week ($915 million) remained close to the October 2020 low ($901 million).

Net inflows across all digital-asset-based products totalled $9.2 million.

In traditional Bitcoin funds, there were outflows of $11 million. The negative trend continued for the fourth consecutive week, totalling $70 million over the period.

AUM in products enabling a diametrically opposite strategy reached a record $158 million.

“This follows the recent speech by the Fed chair in Jackson Hole, where a much more hawkish stance was expressed,” — analysts explained.

Outflows from Ethereum funds continued for the second week in a row (−$2.1 million).

There were no significant changes in products based on other altcoins.

Earlier, Peter Schiff, president of Euro Pacific Capital, predicted Bitcoin to fall to $10,000.

Follow ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!