Analysts record largest outflow from crypto funds since June

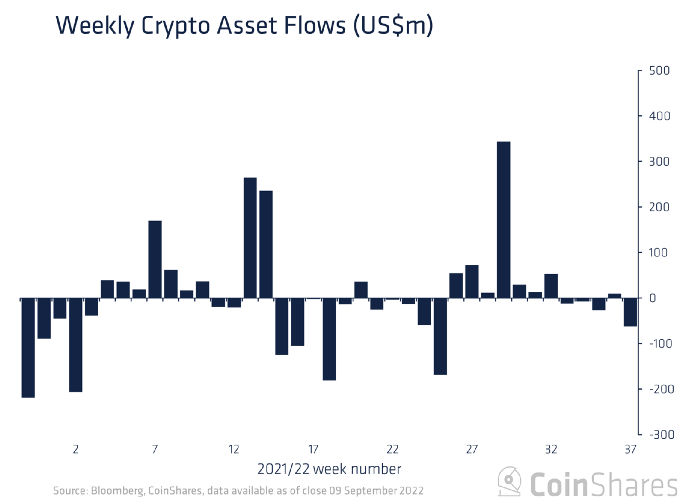

The outflow from crypto investment products for 3–9 September totalled $63 million, versus $8.7 million a week earlier (adjusted for a $17.9 million inflow into bearish Bitcoin funds). Analysts at CoinShares said.

Over the last five weeks, total withdrawals from crypto investment products amounted to $99 million.

Turnover, around $1 billion, was 46% below this year’s average.

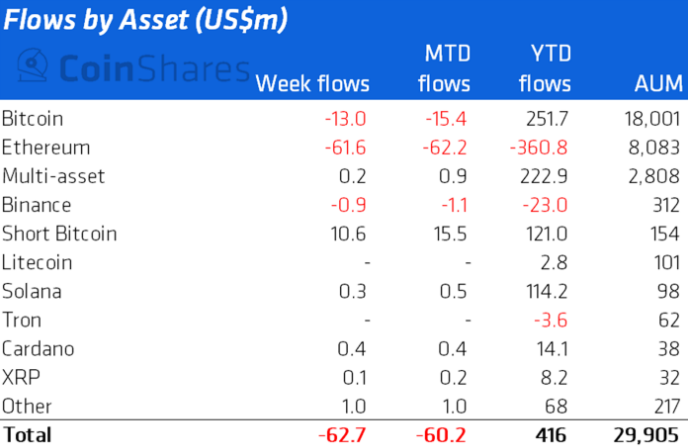

In traditional Bitcoin funds, outflows reached $13 million (negative momentum has been recorded for a fifth week running). In products that allow short exposure to the first cryptocurrency, inflows were recorded ($10.6 million).

Ethereum funds continued to see outflows for a third consecutive week, at markedly higher pace ($61.6 million vs $2.1 million a week earlier). Analysts linked this to investor concerns about potential issues scheduled for September 15 The Merge.

No notable changes were observed in products based on other altcoins.

Chainalysis noted a divergence in the prices of the two largest cryptocurrencies after The Merge. Analysts say that staking will make Ethereum resemble bonds or exchange-traded products, and, accordingly, could attract institutional capital.

Earlier, a trader using the pseudonym filbfilb predicted a drop in Bitcoin from current levels to $10,000–$11,000.

Read ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!