Analysts identify $21,100–$23,500 as resistance for Bitcoin

Early signs of demand coincided with a record high in the number of bitcoins held by hodlers. For Bitcoin to continue its rally, digital gold must break through resistance at the levels indicated by several on-chain metrics, according to Glassnode analysts.

Bitcoin faces strong resistance as it approaches several key on-chain cost basis.

With early signs pointing to a shift in demand, the #Bitcoin holder-base is slowly but surely becoming saturated by those with the strongest resolve.

Read more here 👇https://t.co/kdBVDmjapV

— glassnode (@glassnode) November 7, 2022

Near $21,100 lie the realized price and the ‘cost basis’ of coins purchased by speculators. $23,500 is the latest figure for hodlers.

Ahead of these levels, selling may come from market participants who have endured volatility and remain uncertain about Bitcoin’s prospects.

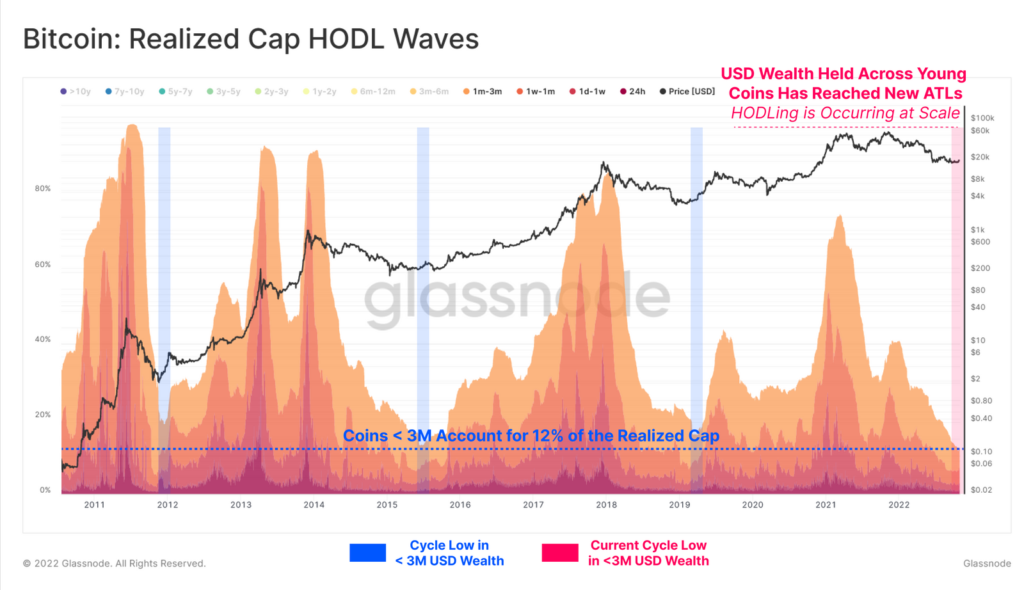

По метрике HODL Waves на базе реализованной капитализации эксперты зафиксировали рекордно низкий уровень монет в распоряжении спекулянтов (с горизонтом менее трех месяцев).

The hodler category has become the most dominant in historical retrospect. This signals a decisive refusal to spend and sell, despite ongoing problems in global capital markets, — the analysts stressed.

Используя индикатор Realized HODL Ratio, эксперты зафиксировали стабилизацию динамики показателя после волны снижения с сентября 2021 года.

Движение к равновесию темпов изменения благосостояний владельцев «старых» и «молодых» монет зачастую наблюдается вокруг экстремумов рынка вроде дна 2018-2019 годов, пояснили специалисты.

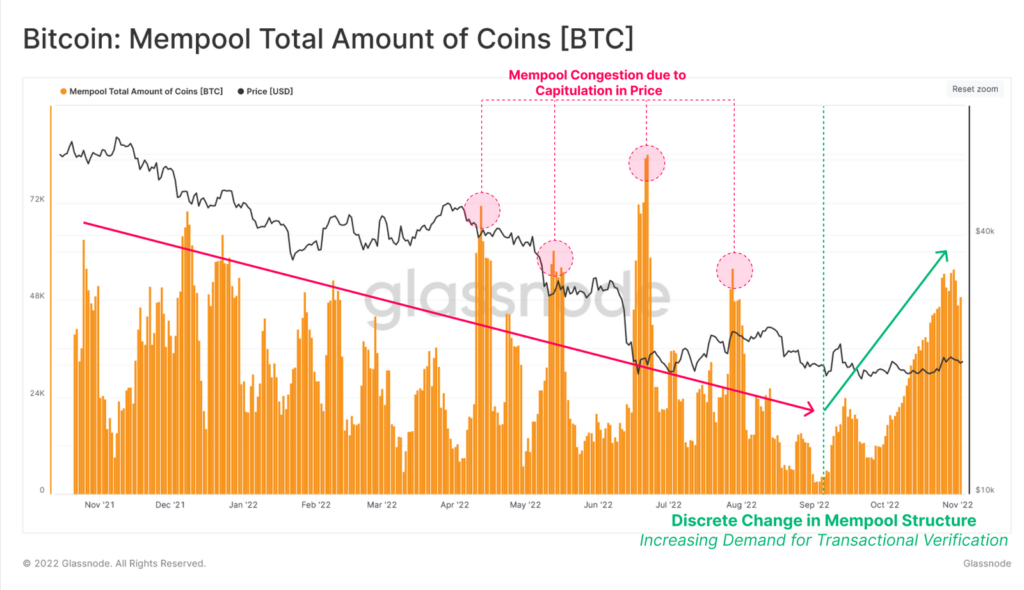

Ранние признаки спроса проявились в виде увеличения размера мемпула. Тенденция лишь зарождается и требует дальнейшего наблюдения.

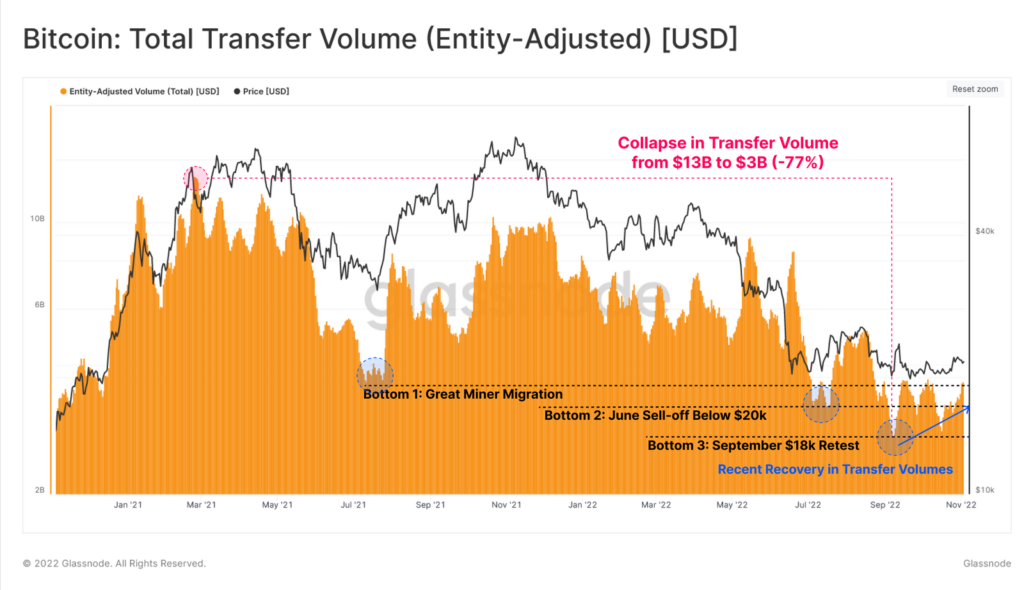

Similar encouraging signals formed on the metric of daily on-chain transfer value in dollars. After peaking at $13 billion in May 2021, the indicator fell 77% by September 2022 and is currently in the $3–4 billion range.

In October, Galaxy Digital founder Mike Novogratz suggested that the bear market would continue for another two to six months.

Earlier, Glassnode analysts forecast a consolidation of Bitcoin in the range $16,500–21,100.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!