Investors in crypto funds return to selling at the start of the year

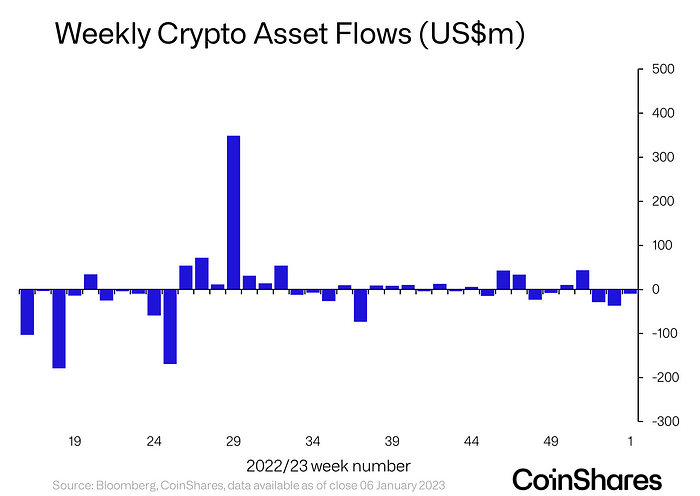

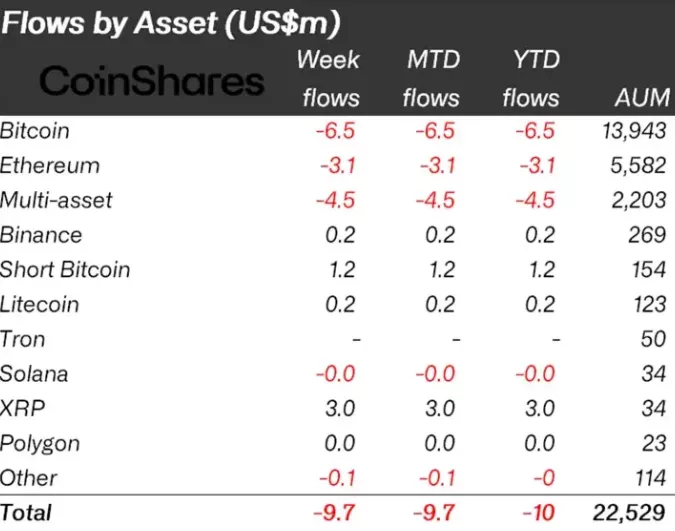

Outflows from crypto investment products from January 1 to 6 totaled $9.7 million. Negative momentum continued for the third week running, according to CoinShares.

During the week, assets under management in crypto products retraced to a low of $20.5 billion after the FTX collapse.

In traditional Bitcoin funds, outflows of $6.5 million were observed. In structures that allow shorting the first cryptocurrency, inflows of $1.2 million.

Outflows from Ethereum funds totaled $3.1 million. The outflow has persisted for the eighth consecutive week.

Among altcoins (excluding Ethereum), investor interest in XRP stood out, with inflows of $3 million, equivalent to 9% of AUM. Experts linked this to greater clarity regarding the outcome of the Ripple case against the SEC.

Earlier, former BitMEX CEO Arthur Hayes expressed the view that Bitcoin has bottomed out, as almost all “irresponsible entities” have run out of BTC to sell.

Earlier in December, Nansen analysts warned of risks of continued bear-market dynamics for cryptocurrencies in 2023.

Read ForkLog’s Bitcoin news in our Telegram — crypto news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!