TradFi woes drive $160m inflow into crypto funds

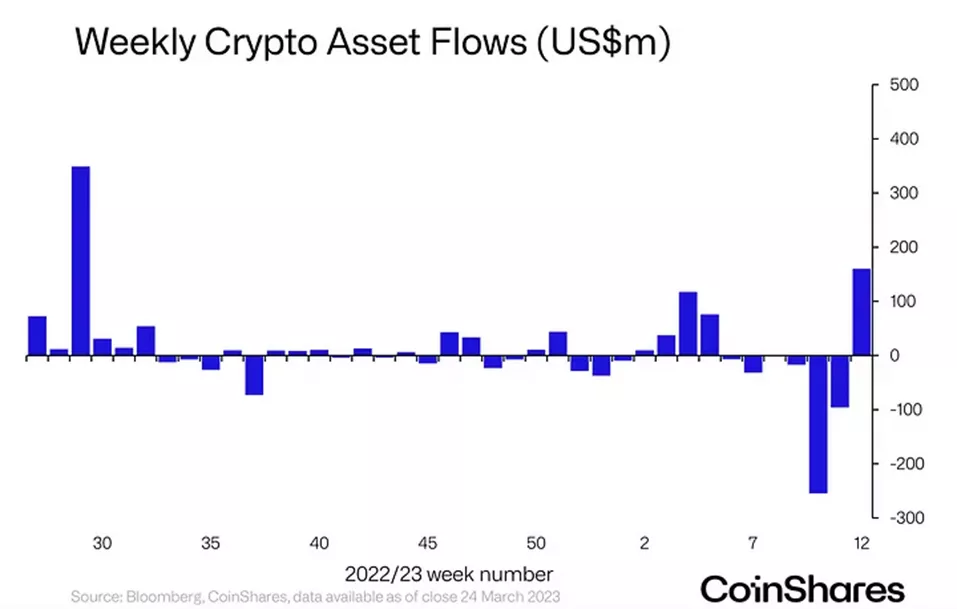

The inflow to cryptocurrency investment products from March 18 to March 24 reached $159.9 million, the highest since July 2022. CoinShares analysts provided these estimates.

“Positive momentum formed belatedly relative to the broader crypto market. We linked it to growing concerns about stability in the traditional financial sector,” the analysts noted.

Over the previous five weeks, investors withdrew $406 million — equivalent to 1.2% of assets under management.

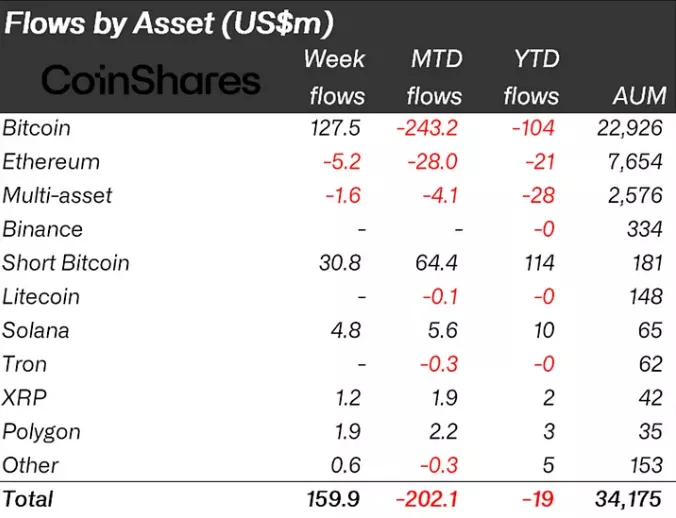

Bitcoin products were the main beneficiaries of the mood shift. The corresponding funds attracted $128 million (a week earlier, an outflow of $113 million was recorded).

In the structures that allow short exposure to the first cryptocurrency, $31 million was invested against $34.7 million in the previous reporting period. Since the start of the year the instrument has attracted $114 million, becoming the most popular among investors.

In altcoins, the dynamics were mixed. Ethereum-based products saw clients withdraw $5.2 million, asset baskets — $1.6 million. Solana-, Polygon- and XRP-based funds attracted $4.8 million, $1.9 million and $1.2 million respectively.

In March 2023, the founder and CEO of Messari, Ryan Selkis, forecasted growth of Bitcoin to $100,000 within 12 months. He described the first cryptocurrency as a reliable investment in light of problems in the US economy.

Similar views voiced by many industry experts, according to CNBC’s poll.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!