India’s Crypto Regulation Stalls Amid Government Concerns

Despite delays, an Indian minister reported crypto assets in his portfolio for the second year running.

The Reserve Bank of India (RBI) is uncertain about the need for legislation for the crypto market, as managing risks through regulation may prove challenging. This is reported by Reuters, citing a government document.

Instead of permanent regulations, authorities plan to maintain partial oversight. They believe that integrating digital assets into the country’s main financial model could increase systemic risks.

While the RBI acknowledges that regulation would lend “legitimacy” to cryptocurrencies, their “troubling nature” might lead to increased speculation. Furthermore, the agency would be unable to control P2P transfers and operations on decentralized exchanges.

According to the bank’s estimates, Indians have invested $4.5 billion in various cryptocurrencies, so the use of such assets does not yet pose a “significant or systemic risk” to financial stability. However, the RBI noted that the current limited regulatory clarity, including tax rules, has contributed to restraint.

“Charting a clear path forward or defining a unified policy approach is not easy,” the document states.

As explained by journalists, international cryptocurrency exchanges can currently operate in India after registering with a local government body responsible for comprehensive anti-money laundering risk checks. Income from digital assets is subject to punitive taxes.

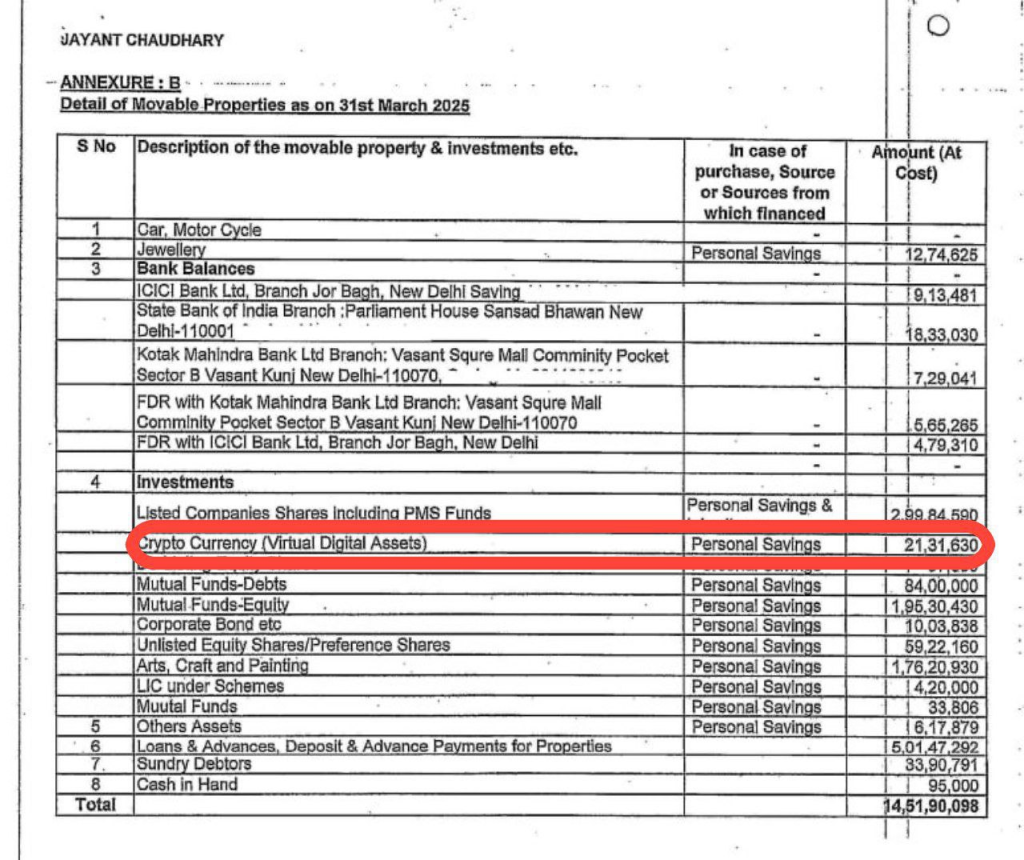

Crypto Assets of an Indian Official

Despite the absence of comprehensive regulation, the Minister of Skill Development and Entrepreneurship, Jayant Chaudhary, has reported crypto assets in his portfolio for the second consecutive year.

The official’s investments have grown by 19% since the last declaration in 2024, reaching 2.131 million rupees (~$25,500). His spouse’s investments also increased by 18% to $26,800.

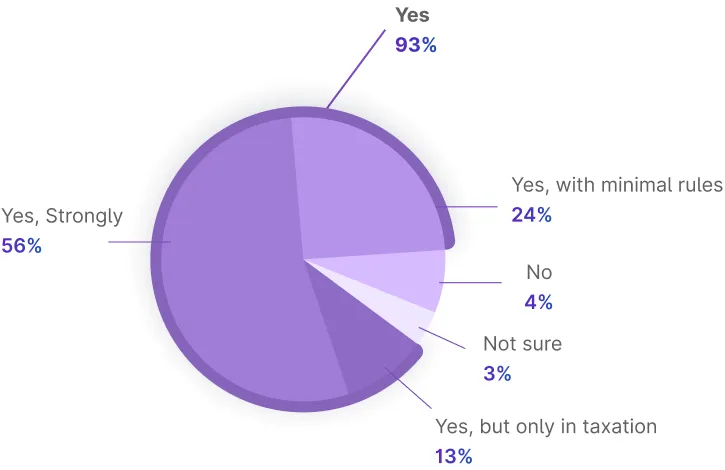

According to a survey by the Indian exchange Mudrex among more than 9,000 people, 93% of respondents support cryptocurrency regulation in the country.

“If India wants to expand its participation in the cryptocurrency world, regulatory clarity is the most important factor. The survey showed that 90% of respondents would invest more if government policy became clearer and taxes more balanced,” the study states.

Earlier, India ranked first in Chainalysis’s cryptocurrency adoption index for 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!