Paradigm buys Coinbase shares for $49.4 million

Paradigm purchased 810,000 shares of Coinbase, a cryptocurrency exchange, at an average price of $61, spending $49.4 million. The venture firm said this in a filing with the SEC.

The deal was effected by Paradigm One LP, a subsidiary. Together with Paradigm Fund LP, the structures own about 4.5 million Coinbase securities.

The firm’s co-founder Fred Ehrsam is a co-founder of the cryptocurrency exchange and retains a seat on its board.

The top executive directly owns 1.1 million Coinbase shares through the Frederick Ernest Ehrsam III Living Trust.

On May 10, 2023, Paradigm sent a letter to the court as amicus curiae in support of Coinbase against the SEC.

The platform filed it after receiving notice from the Commission of an investigation into the listing process on the platform and its products — Coinbase Prime, Coinbase Wallet and staking service Coinbase Earn.

“Paradigm and the entrepreneurs it backs are keen to hold the SEC to account for delays in responding to the exchange’s petition for rulemaking,” the statement said.

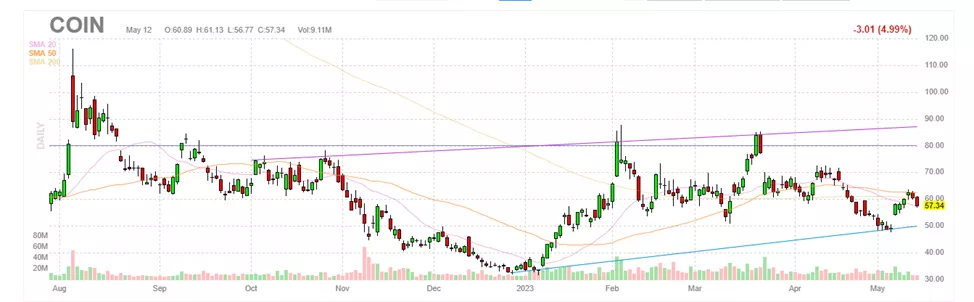

Since the start of the year Coinbase shares have risen 62%. The losses since the IPO stand at 85%.

Coinbase’s net loss in the first quarter of 2023 amounted to $78.9 million, or $0.34 per share, well ahead of analysts’ expectations ($0.87).

ARK Invest has been an active buyer of Coinbase securities in recent months.

In April, Paradigm criticised the SEC’s approach to regulating cryptocurrencies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!