crvUSD, GHO and DAI: Is there a future for decentralized stablecoins?

To spite Bitcoin maximalists stablecoins have become an integral part of the crypto industry.

Stablecoins account for a lion’s share of exchange trading volumes; they play a key role in the rapidly developing decentralized finance. As a store of value in a volatile market, stablecoins serve an important link between fiat and digital currencies.

In recent years there has been a trend toward greater dominance of centralized coins like USDT and USDC, backed by traditional financial assets. Given the state of the U.S. banking system, this state of affairs not only undermines trust in the crypto industry but also threatens market development.

- Despite the theoretical advantages of decentralized stablecoins — transparency of collateral and censorship-resistance — the market share of centralized instruments is noticeably higher.

- Historically, most decentralized “stablecoins” have struggled to hold their price at the target level.

- The segment is evolving dynamically — new protocols are replacing the old, offering different mechanisms to sustain price stability. Hopes are raised by projects primed for full launches from major platforms — Aave and Curve Finance.

A Tough Year for Centralised Stablecoins

USDC

In March 2023, the second-largest stablecoin USDC CFTC underlined its peg to the U.S. dollar. It later emerged that its co-emitter Circle held $3.3 billion in reserves at the regulator-shuttered Silicon Valley Bank.

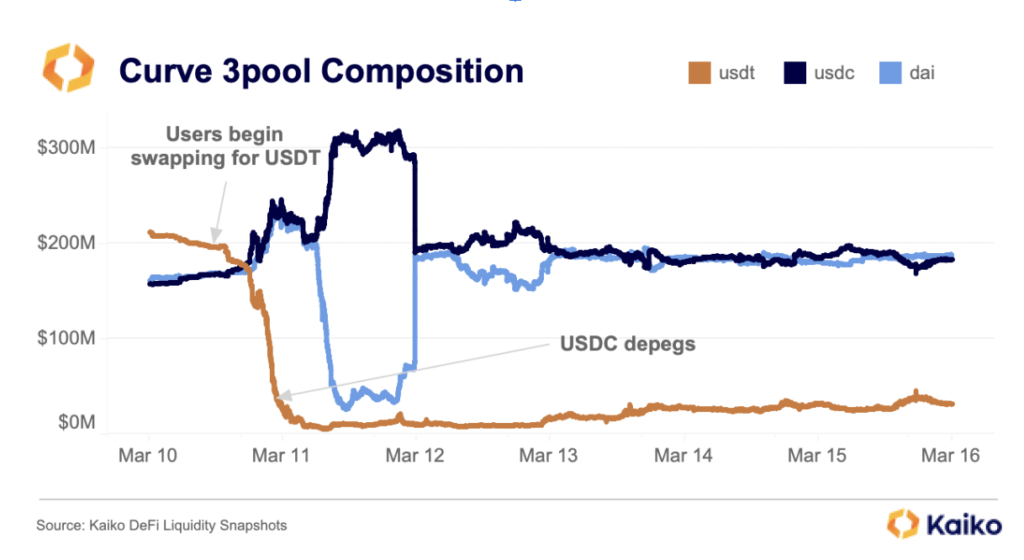

On-chain data vividly illustrate the fall in the stablecoin’s price. The chart below shows the dynamics of the Curve 3pool on Curve against the backdrop of events several months earlier — when users were selling USDC and DAI for USDT.

In other words, there was an exit from relatively transparent stablecoins to USDT, the issuer of which at the time did not report reserves and had even been CFTC lost a significant share of the market.

Although USDC later managed to restore parity with the U.S. dollar, the coin lost a significant share of the market.

BUSD

In February the New York State Department of Financial Services (NYDFS) began an investigation into Paxos, the infrastructure company and issuer of stablecoins. In complying with regulator requirements, Paxos halted the issuance of BUSD tied to Binance.

Shortly after, journalists learned that Circle had filed a complaint with NYDFS, pointing to inadequate backing for BUSD.

Paxos also issues USDP and Pax Gold. The former is backed by U.S. Treasuries and deposits in commercial banks, the latter by physical gold.

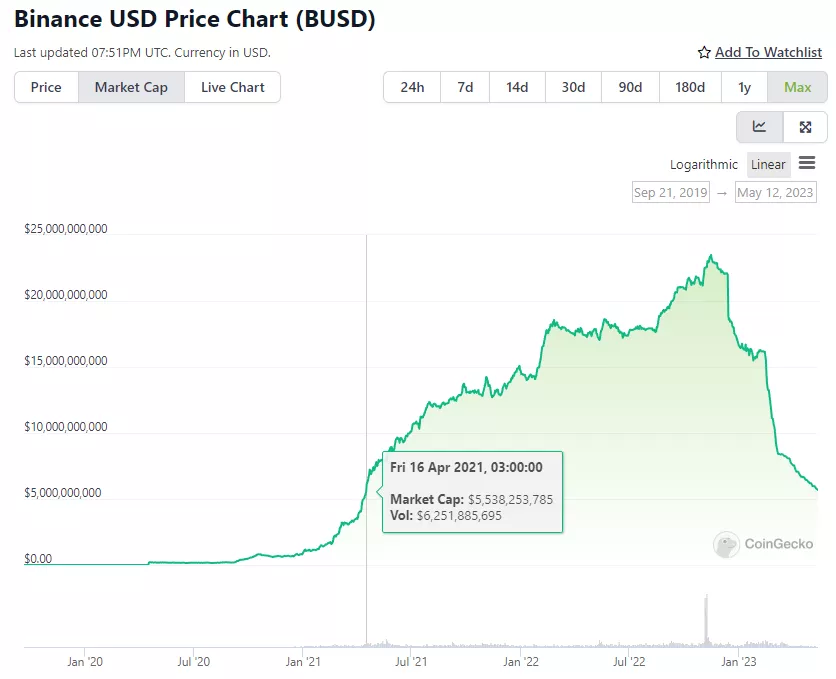

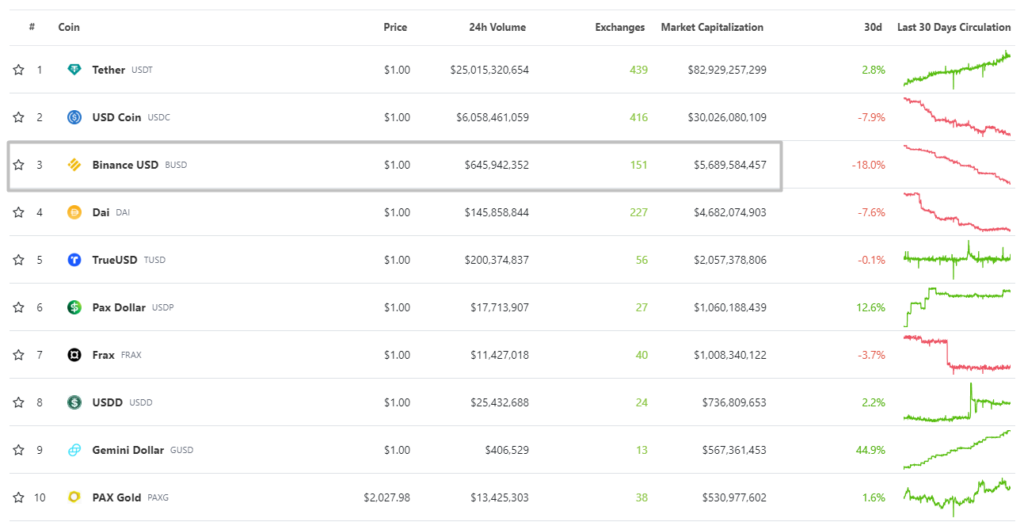

A month after the NYDFS inquiry began, BUSD’s market capitalisation fell below $10 billion. By writing (12.05.2023) the figure stood at $5.68 billion, in line with mid-April 2021 levels.

In CoinGecko’s stablecoin rankings the asset nevertheless sits in third place, behind only USDT and USDC.

A Decentralised Alternative

Decentralised stablecoins are crypto-assets that use blockchain technology to maintain price stability. The latter is usually pegged to a fiat currency such as the U.S. dollar or the euro.

Such protocols rely on mathematical algorithms that adjust the number of coins in circulation in response to market demand.

The assets mentioned — USDT, USDC and BUSD — are controlled by a central organisation. Alternatives such as DAI, and in development, Curve’s crvUSD and Aave’s GHO, use decentralised mechanisms to govern the supply of coins and uphold the peg. Theoretically, this makes them more resilient and secure, as these instruments do not depend on a single point of control and can be created and used without permission from centralised entities.

Experts at CoinGecko classify decentralised stablecoins into four types:

- overcollateralised;

- algorithmic;

- partially collateralised with a native token;

- unbacked by the value of assets or “low-volatility tokens”.

Let us briefly consider each category.

Overcollateralised Stablecoins

To maintain price stability, such coins rely on excessive collateralisation across various crypto assets, for example Ethereum.

DAI from MakerDAO

DAI was the first overcollateralised stablecoin. Unlike centralised projects, it is entirely built on Ethereum smart contracts.

DAI is minted by protocol users themselves. To do this they must lock a certain amount of crypto assets as collateral in a special smart contract known as a Vault.

In return, market participants receive some amount of DAI in a given ratio to the collateral posted. The value of the collateral must be higher than the value of the minted stablecoins.

DAI borrowed can be used like any other crypto asset. The asset is issued at a set interest rate (Stability Fee).

How to Open a Maker Vault from MakerDAO on Vimeo.

When a user repays the issued DAI and accrued interest, the collateral is released, and the stablecoins are burned.

The Maker protocol is governed by a DAO. MKR holders can vote on the governance portal for various proposals from the community.

To safeguard the system’s stability there is a liquidation process — selling collateral to cover funds in the stablecoin that users mint beyond the value of the locked assets.

“DAI coins minted through collateral auctions are used to cover the vault’s outstanding debt, as well as to pay the liquidation penalty set by the MKR token holders for that type of collateral in the vault,” the Maker documentation states.

Liquidation price is the price at which a Vault is liquidated. Users can lower this parameter by adding more collateral or returning DAI to the Vault.

In the first version of MakerDAO, only ETH could be posted as collateral, and the collateral ratio stood at 150%. That meant $150 of ETH could back $100 of DAI.

In November 2019 the project community decided to move to a multi-collateral system — allowing market participants to deposit different cryptocurrencies as collateral for DAI loans.

In July 2022 MakerDAO became the first DeFi protocol to accept U.S. Treasuries and corporate bonds as collateral.

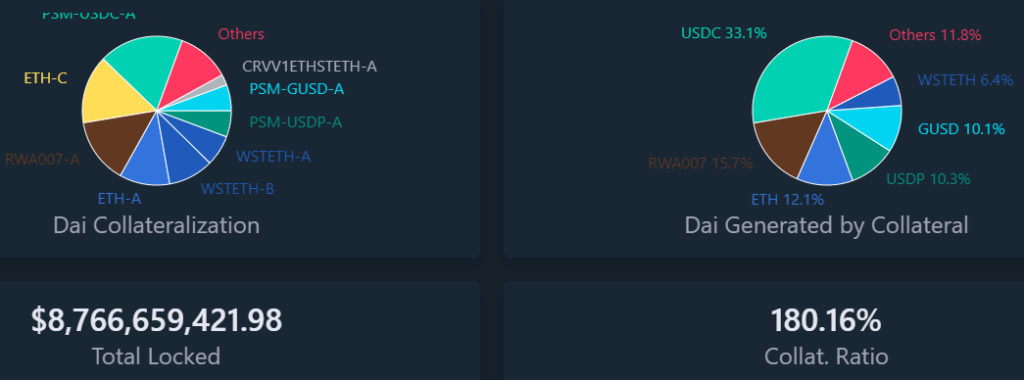

According to Dai Stats, as of 13.05.2023 more than 33% of DAI collateral is USDC centralized, with Ethereum accounting for only 12.1%.

By its blocked liquidity metric, MakerDAO ranks second among all DeFi projects in DeFi Llama.

Among decentralised stablecoins, DAI stands out for relatively low price volatility.

Against the backdrop of the problems described above, USDC’s peg to the U.S. dollar slipped; evidently, Circle’s dominance in collateral was to blame. Nevertheless, the system soon rebalanced, and DAI returned to parity with the dollar.

Moves taken in a crisis mode to tighten parameters, aimed at limiting USDC’s influence on DAI, may have aided the protocol.

They envisage reducing the maximum number of stablecoins that can be borrowed against a given collateral. The change also caps daily issuance of the stablecoin at $250 million and raises the issuance fee against USDC collateral from 0% to 1%.

MakerDAO believes the measures will help avert a “dangerous dump” of USD Coin into the PSM and mitigate risks for other DeFi protocols that interact with DAI.

LUSD from Liquity

Liquity is a MakerDAO-like protocol where only ETH can be used as collateral to borrow the stablecoin LUSD.

The project site proclaims that loans are interest-free. It also highlights the platform’s impressive TVL — more than $700 million.

The loan-to-value ratio for borrowers stands at 110%. That means with $100 of collateral you can generate up to 90 LUSD. Such capital efficiency is an undeniable advantage compared with similar services. It opens wide possibilities for executing various DeFi strategies using leverage.

Liquity uses a unique stability mechanism for LUSD based on stability pools. The pools serve as a source of liquidity to liquidate debt during Trove liquidations — the Liquity analogues of Maker’s Vaults.

The algorithm envisions regular LUSD liquidations, during which users are rewarded with ETH and the LQTY governance token pro rata.

If the collateral value falls below the collateral ratio, a stabilization mechanism is triggered. The system automatically liquidates a portion of the user’s locked funds to repay the debt in LUSD.

Collateral is sold at a discount at auctions to those able to repay the loan. This approach helps LUSD stay over-collateralised, and the protocol remains solvent and liquid.

Holders of LQTY can lock tokens in staking to receive a share of protocol fees in Ethereum and LUSD (as of 13.05.2023 the rate is 4.91%).

Liquity’s TVL mirrors that of major lending project Venus on BNB Chain.

Shortly after the protocol launched in 2021, the volume of liquidity locked in it surpassed $4.5 billion. But amid a broader market correction the figure fell sharply. Since early 2023 TVL has been gradually recovering.

Utility token LQTY is traded on the world’s largest exchange, Binance, and ranks 252nd by market cap in CoinGecko’s tally, with a value of $108.7 million (as of 13.05.2023).

The chart below shows that LUSD does not exhibit high stability — by comparison with DAI. Yet the token’s price has hardly ever deviated by more than 10% from parity with the U.S. dollar.

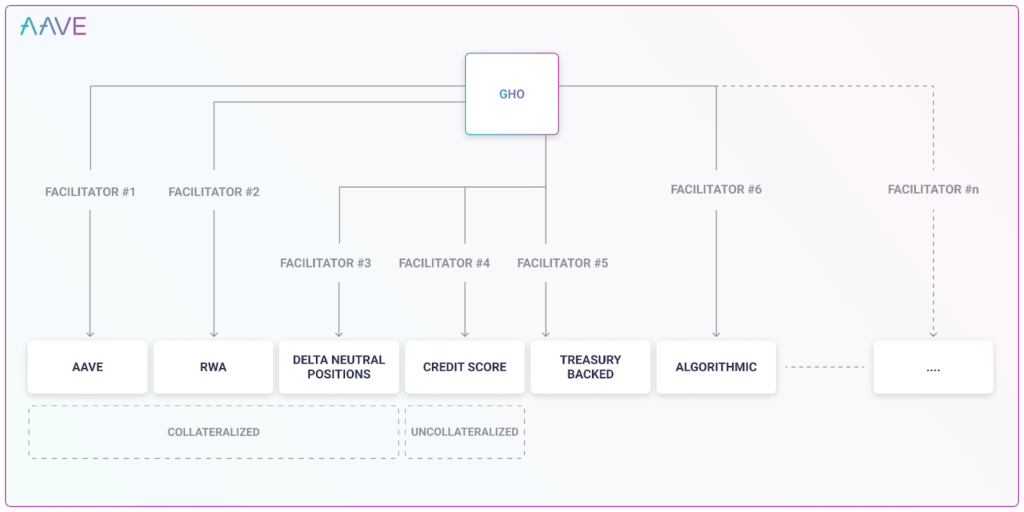

GHO from Aave

Aave — a decentralised lending protocol. It enables earning interest on deposited funds and borrowing crypto assets. The project sits in third place on the DeFi Llama TVL ranking with a figure of $5.1 billion (as of 13.05.2023).

In July 2022 the developers proposed to launch a native multi-collateral stablecoin for the ecosystem, GHO, pegged to the dollar.

“As a decentralised stablecoin on the Ethereum network, GHO will be minted by users. As with all borrowings in the Aave protocol, collateral (in a defined ratio) must be provided to be able to issue GHO,” the team explained.

As collateral, a diversified set of crypto assets is supported by the protocol. Users will continue to earn interest on the collateralized tokens.

All decisions concerning the stablecoin, including rates, collateral level and more, will be made by the DAO, the team noted.

“The introduction of GHO will make borrowing in stablecoins on the Aave protocol more competitive, provide more opportunities for users, and give additional income to the Aave DAO, directing all interest payments from GHO loans to the DAO treasury,” the developers added.

They also proposed offering a discount on issuing the stablecoin to AAVE stakers, arguing that this would spur stkAAVE growth and bolster protocol security.

It is envisaged that community-approved facilitators will control the issuance and burning of GHO, within an emission cap.

In February the Aave Companies launched GHO on the Goerli Ethereum testnet.

The mechanism of GHO mirrors that of other decentralised products. To issue GHO, a user must post collateral. When the debt position is repaid (or liquidated), the stablecoin is returned to the Aave pool and burned. However, accrued interest flows straight to the DAO treasury.

“With current market conditions, the adoption of decentralised stablecoins remains constrained, and the segment nevertheless holds growth potential,” the developers noted.

crvUSD from Curve

At the end of 2022, the team behind the popular non-custodial AMM-exchange Curve published a white paper for the decentralised stablecoin crvUSD. News of the project had appeared several months earlier.

In May of the following year the developers deployed on the Sepolia test network the smart contracts for the new stablecoin, which also features an overcollateralisation model like DAI.

Soon followed a mainnet launch on Ethereum. Not all went smoothly — the developers redeployed the contracts after “some expert review.”

The discovered bug prevented Curve (veCRV) holders from earning rewards from liquidity pools containing the stablecoin.

crvUSD is built on an LLAMMA algorithm — Lending-Liquidating AMM — which continuously liquidates and automatically deposits collateral to manage risk and uphold parity with the dollar.

Curve Finance specialises in trading between stablecoins and other tokens of equal value with minimal slippage and fees.

The protocol occupies fourth place by TVL in the DeFi Llama ranking, with about $4.19 billion (as of 14.05.2023). The platform, however, leads among DEX.

Algorithmic Stablecoins

Such protocols are programmed to respond to shifts in supply-and-demand to maintain the pegged price and stability of the coins.

Most of these products operate in two-token systems: the stablecoin itself and a volatile crypto asset that helps sustain parity with the target asset.

Examples of popular algorithmic stablecoins:

The issuance of such stablecoins involves burning the corresponding value of the volatile assets backing them. For example, when issuing 10 USDD the system burns $10 worth of TRON (TRX).

Price fluctuations attract arbitrageurs. When a stablecoin trades below its peg, many market participants may want to buy the stablecoin at a discount and then redeem it for the volatile asset, such as TRX or LUNC (formerly LUNA), at around $1.

For example, if USDD trades at $0.95, a trader could buy it at that price and then burn the “stablecoins” in exchange for TRX, earning about $0.05 per coin. Another example: a stablecoin at $1.01 enables users to swap $1 of TRX for 1 USDD and earn about $0.01 per coin.

Unlike UST (USTC), which never fully regained trust, USDD has remained near its peg at around $1, though it has experienced some deep drops, notably amid the USDC turmoil in March.

The Terra debacle underscored a key lesson for algorithmic stablecoins: trust is central. When trust erodes, stability mechanisms fail and reviving the system through multi-million-reserve burning is not guaranteed.

Partially Collateralised Stablecoins

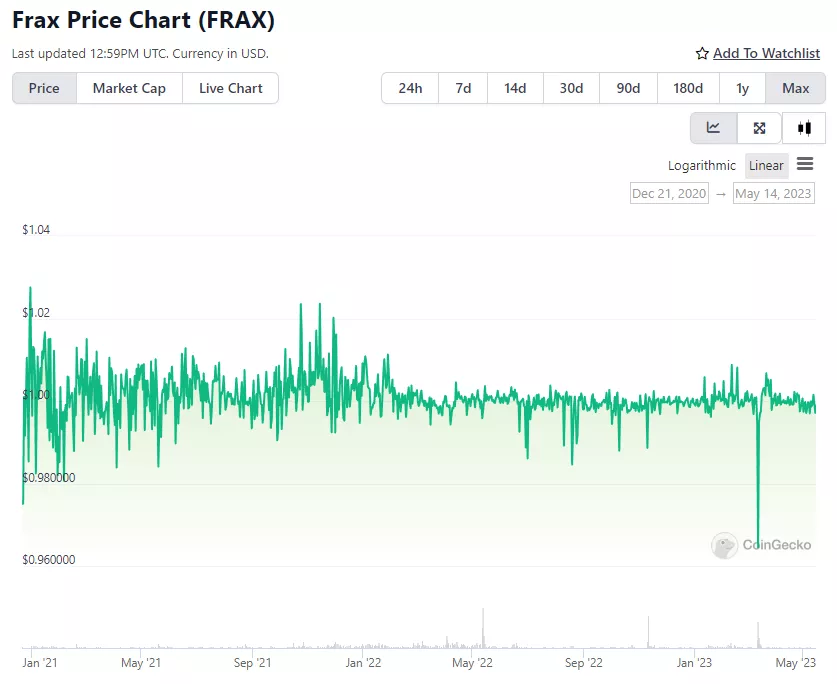

One example of such protocols is Frax Finance. Partially collateralised stablecoins rely on a mix of algorithms and partial reserve backing.

The stablecoin FRAX is backed by two types of collateral:

- a centralised stablecoin USDC;

- the project’s native token — Frax Share (FXS).

Collateral parameters are governed by the Proportional Integral Derivative (PID) mechanism and depend on the ratio of FXS liquidity to the total FRAX supply.

When FRAX trades above $1, the PID lowers collateral; when the price is below $1, it raises it.

Arbitrageurs can buy or mint FRAX, preserving its peg at $1.

For FRAX issuance a user provides collateral in USDC and FXS. The collateral ratio determines the mix of these two tokens used in its creation. A higher ratio means more FXS is locked up during the issuance process. veFXS is used to allocate a portion of the protocol’s revenue to FXS stakers.

There is also Frax’s other asset — FPI, indexed to the US consumer price index and governed by a separate DAO with its own token — Frax Price Index Share (FPIS).

In February Frax Finance community decided to gradually move FRAX from algorithmic backings toward full reserve backing. A corresponding proposal was approved by 42 million FXS (98.08%).

The move away from a hybrid model would entail:

- the abandonment of FXS issuance and the decollateralise function;

- a pause in FXS buybacks;

- using protocol revenue to raise the collateral ratio (CR).

The community also approved purchases of Frax Ether (frxETH) up to $3 million monthly to bolster reserve sufficiency. The asset is tied to ETH liquidity in the ecosystem.

“Costs arising from incomplete backing currently far outweigh the benefits, as this could undermine the perceived safety of FRAX. A gradual move to 100% CR is the best path for the protocol’s long-term functioning and growth,” the proposal states.

In fact, the idea of moving to full backing may have arisen in light of the NYDFS’s earlier complaints about BUSD’s issuer.

As of 14.05.2023 Frax’s market capitalisation stood at around $1 billion. The chart below shows the stablecoin’s price rarely deviated by more than $0.02 from the $1 peg, indicating the effectiveness of the project’s partial reserve model.

Low-Volatility Tokens

RAI from Reflexer Labs is an overcollateralised Ethereum-backed experimental “stablecoin” not pegged to any token or fiat. To mint it, you lock a quantity of ETH and pay a 2% fee.

The currency does not rely on Vaults or a fixed peg. The exchange rate of the token is entirely determined by supply and demand. The two sides are the users of SAFE (who mint the coins from their ETH) and the token holders who use RAI in other protocols and applications.

Depending on market conditions, the two sides gain incentives to mint or repay RAI. That approach stabilises the system.

Because of its design, the market price of RAI is volatile. The asset’s all-time high reached $4.19, with a low around $2.47. Yet the token has shown far less volatility than ETH, used as collateral.

Ethereum co-founder Vitalik Buterin managed to earn money on RAI price changes. He held a short position on the “low-volatility token” for seven months, then closed it, earning $92,000 in profit.

Buterin began trading in May 2022. He borrowed 400,000 RAI, then sold them for DAI worth $1.2 million, creating a kind of short position on RAI.

The co-founder closed the short on 22 January 2023, selling DAI and ETH for $1.13 million against RAI. On-chain researcher kyoronut notes that the open was at 3.053 RAI/DAI and the close at 2.786 DAI/RAI (-8.7%). The expert added that since mid‑May the price of the “low‑volatility token” has fallen another 7.6%. And Yet, Buterin sold the token at local price peaks.

Since the position opening (2022-05-15), RAI’s redemption price decreased by 7.6% (dune: https://t.co/wnC6higSYO ).

He sold RAI at some spikes of the market price ( https://t.co/AvYdywXU51) . pic.twitter.com/Z0VQ0CAz5H

— kyoronut?️ | きょろナッツ (@kyoronut) January 22, 2023

Co‑founder of Reflexer Labs Amin Solaimani, now leading SpankChain, cited Buterin’s trades in support of the argument that the design of a “low‑volatility token” is imperfect.

ETH-only RAI was a mistake

the ETH staking yield means that borrowing RAI against pure ETH will always have some % opportunity cost

the RAI redemption rate should almost always be negative to reflect this opportunity cost

decentralization is expensive, people don’t want to pay pic.twitter.com/rMCs1tCFlN

— Ameen Soleimani (@ameensol) January 23, 2023

Co‑founder of Ethereum, Vitalik Buterin’s contribution to RAI’s short was cited by Solaimani as evidence of flaws in the low‑volatility design.

“RAI, based solely on ETH, was a mistake,”

The main drawback to the asset is that users do not receive staking rewards on ETH used as collateral. Thus, RAI issuance comes with an opportunity cost, helping explain the token’s downward trajectory.

According to Solaimani, solving the problem may require restarting the protocol with stETH from Lido as collateral.

Conclusions

Decentralised stablecoins are censorship‑resistant and far more transparent than centralised alternatives — on‑chain tools and services allow users to verify the collateral structure themselves, without third‑party auditors.

These assets are still at the outset of their development and many projects in the segment have faded. Yet promising new projects are emerging with somewhat different stability mechanisms.

Most algorithmic stablecoins have not demonstrated themselves as reliable stores of value. Terra’s collapse proved this; another example is the depegging of Neutrino USD (USDN) from the dollar amid WAVES’ price declines.

Tron founder Justin Sun was forced to raise USDD’s collateral to 200% to sustain the peg.

Regulatory obstacles also hinder the segment — not surprisingly, the Frax Finance community decided to gradually move FRAX from algorithmic backing toward full reserve backing.

There is considerable hope in stablecoins from giants like Aave and Curve Finance. The launch of new products is not far off, but how these assets will perform on the market remains to be seen.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!