CEX trading volumes dip as meme-token mania grows

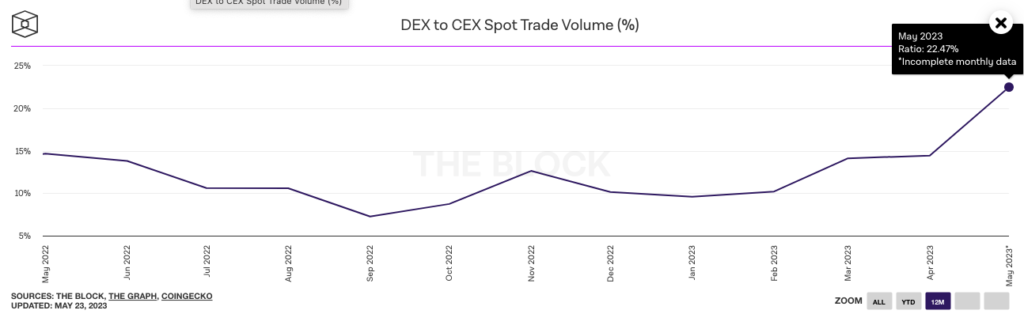

Against the backdrop of meme-crypto popularity, the ratio of trading volumes on decentralized and centralized exchanges reached a record high, surpassing 22% for the first time.

“A limited number of market participants returned to trading on DEX due to meme-token mania,” — заявил the crypto analyst going by the handle BasedKarbon.

Amid the meme-cryptocurrency frenzy, many CEX did not rush to list them. Coinbase, for example, still does not support trading of the popular Pepe (PEPE) token. Binance listing of the asset took several weeks.

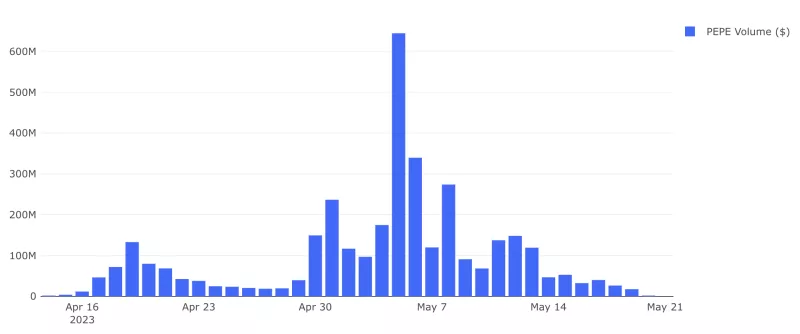

Likely, users did not wait for a CEX listing and began moving to DEX to acquire meme tokens. On May 5, PEPE trading volume on decentralized exchanges on the Ethereum network exceeded $600 million.

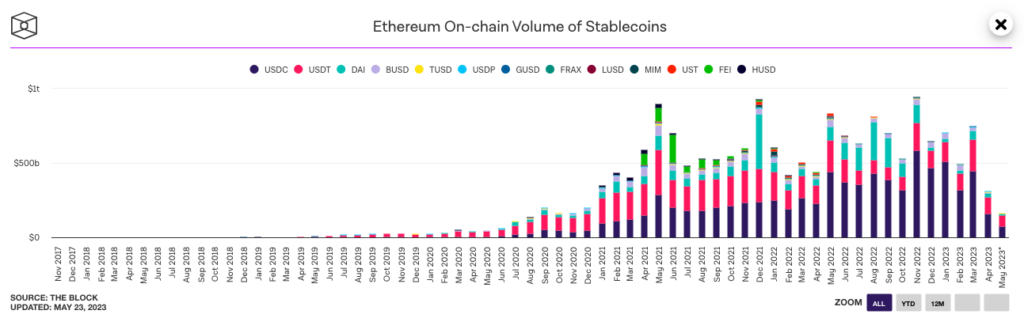

At the same time, the trading volume of stablecoins on the Ethereum network approached 2020 levels. In May the USD Coin (USDC) market cap reached $75.5 billion compared with $158.9 billion the month before.

Trading volume of the stablecoin USDT from Tether also declined—from $110.6 billion to $72.8 billion.

“This is likely caused by high Ethereum fees, which lead to a drop in stablecoin-related activity,” said analysts from The Block.

Experts noted that the USDC-to-USDT ratio also declined, likely due to the March depeg of the first.

As noted by the analysts, according to Scimitar Capital, PEPE holders realized $160m in profits. The bulk of the profits went to users who bought the asset in the first week after launch.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!