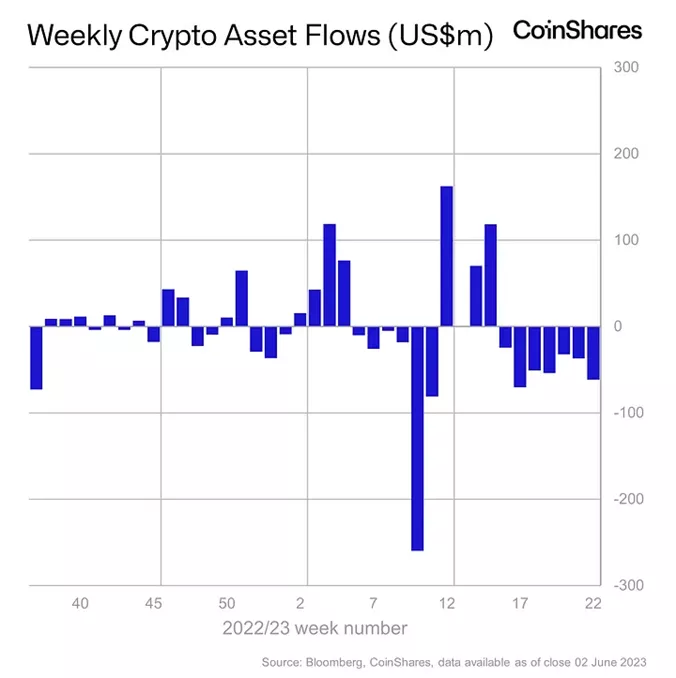

Outflows from crypto funds continued for the seventh week in a row

Outflows from cryptocurrency investment products from 27 May to 2 June totalled $61.5 million, up from $39.3 million a week earlier. This assessment was provided by CoinShares analysts.

Over the last seven weeks, investors reduced holdings by $329 million (~1% of AUM).

“Investors were booking profits and closing short positions. The outflow cannot be interpreted as a structural weakening of interest in digital assets,” the analysts said.

Trading activity in cryptocurrency instruments remained 60% below this year's average. Over the last seven weeks the indicator fell by 55%.

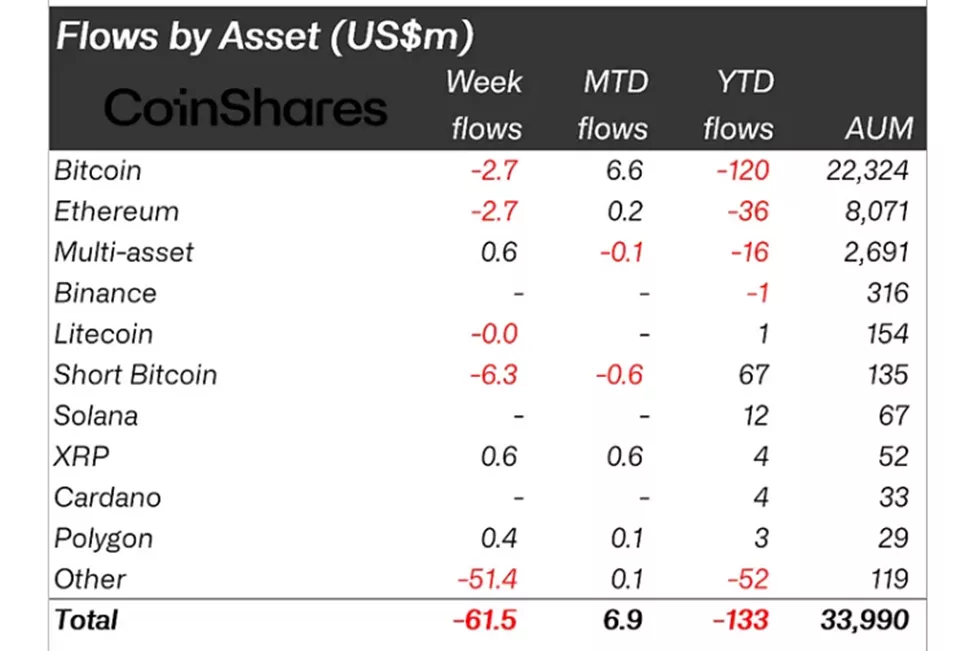

The negative momentum was driven mainly by a substantial outflow from Tron-based products — investors withdrew $51 million, equivalent to 70% of their AUM.

CoinShares attributed the move to the closing of an offering by one of the providers.

From Bitcoin products they withdrew $2.7 million ($11.5 million the previous week). From structures that allow short exposure to the first cryptocurrency, investors pulled $6.3 million versus $10.9 million in the previous reporting period. Over the last six weeks, the AUM of the latter fell by 44%.

Ethereum funds reflected outflows of $2.7 million versus $5.9 million the prior week.

Elsewhere among altcoins there was positive momentum with the exception of Tron.

Earlier, JPMorgan signalled $45,000 as a benchmark for Bitcoin's growth.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!