Analysts record a decline in risk appetite in the crypto market

Low exchange volumes, the dominance of algorithmic activity in the DeFi space, and rising demand for USDT and major coins point to a growing investor preference for “capital parking.” Analysts at Glassnode concluded as much.

As an increasingly hostile regulatory environment is established in the US, capital appears to be flowing out, and eastward in the digital asset sector.

Much of this hints to a generally risk-off environment, with the remaining capital concentrating in the more liquid majors,… pic.twitter.com/5IeQKOuaAV

— glassnode (@glassnode) June 5, 2023

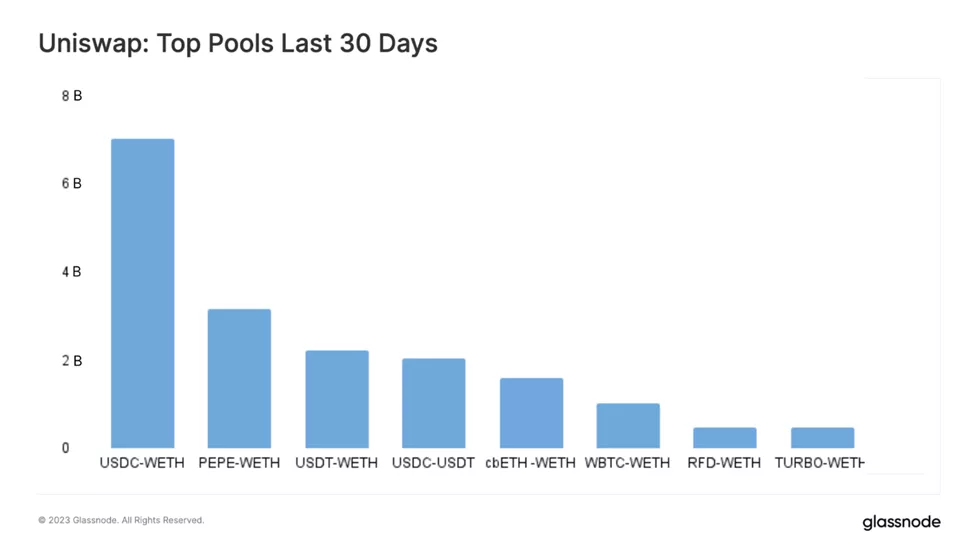

Spike in transaction fees in the Ethereum network in May to levels seen during the 2021-2022 bull market, specialists attributed to activity of pools holding ETH, WBTC, stablecoins and cbETH on Uniswap, rejecting the narrative of hype around meme tokens.

On the popular DEX over the last month, gas consumption accounted for 7.7–14.4% of total gas usage (+388% on average versus the previous 30 days).

“Notably, only a portion of these operations [on Uniswap] were organic — arbitrage, MEV and algorithmic trading,” — the analysts noted.

Nine of the ten most active addresses were MEV bots. The largest of them executed trades worth about $3 billion.

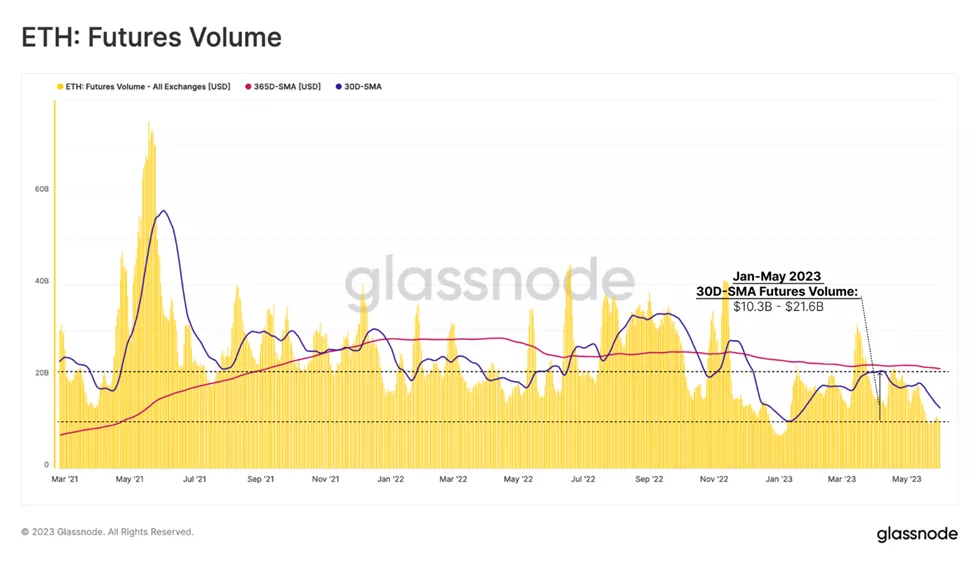

Analysts observed a rotation of crypto investors’ capital toward taking on less risk — into Bitcoin and stablecoins. They also noted a drop in daily Ethereum futures trading volumes to $12 billion, compared with the annual average of $21.5 billion.

“Unlike the spike in activity on Uniswap, derivative trades continued to shrink through May. This points to weak institutional interest,” the experts explained.

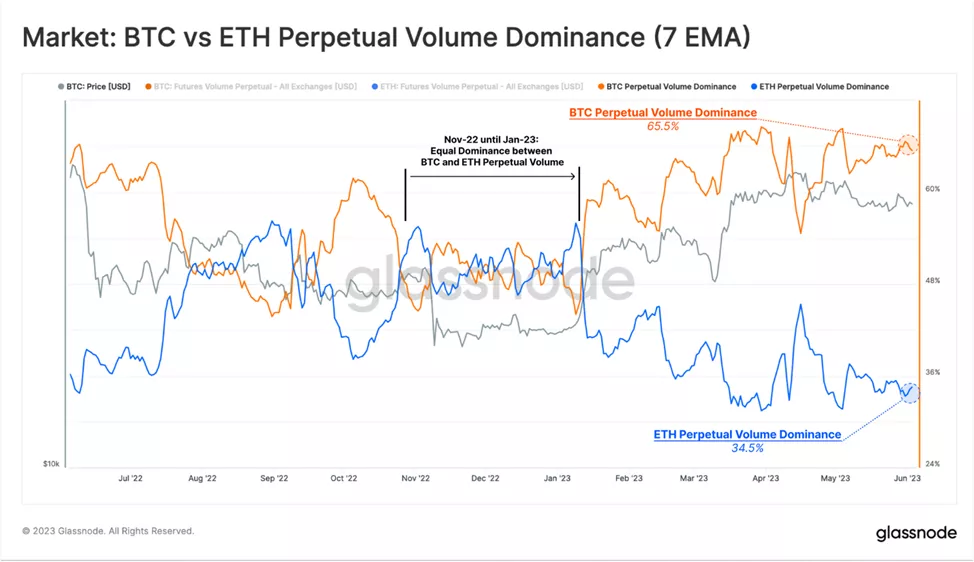

To substantiate the thesis, analysts cited the ratio of trading volume on the perpetual contracts market for Bitcoin and Ethereum. After parity at the end of 2022, Ethereum’s share has fallen and currently stands at 34.5%, signaling a tilt toward the more “defensive” Bitcoin, they noted.

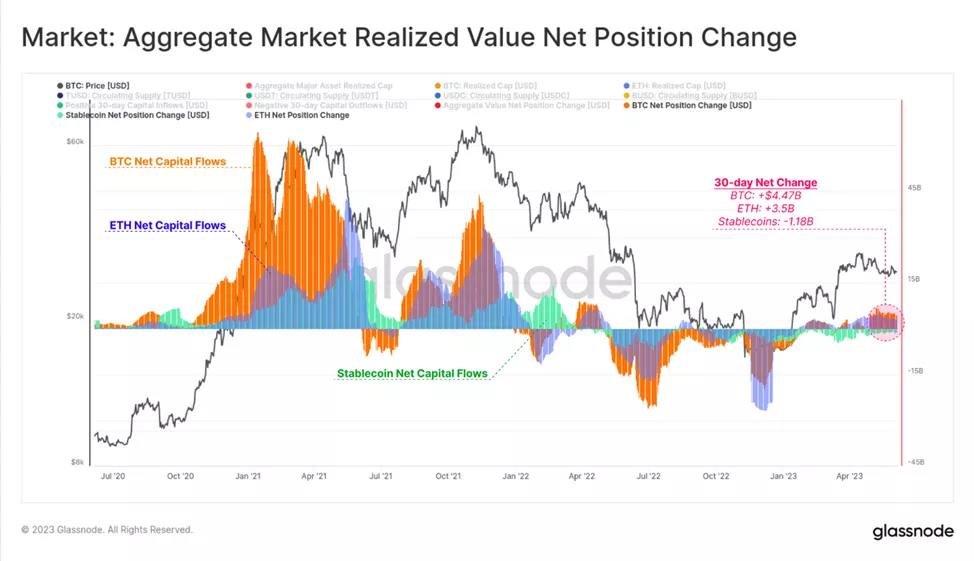

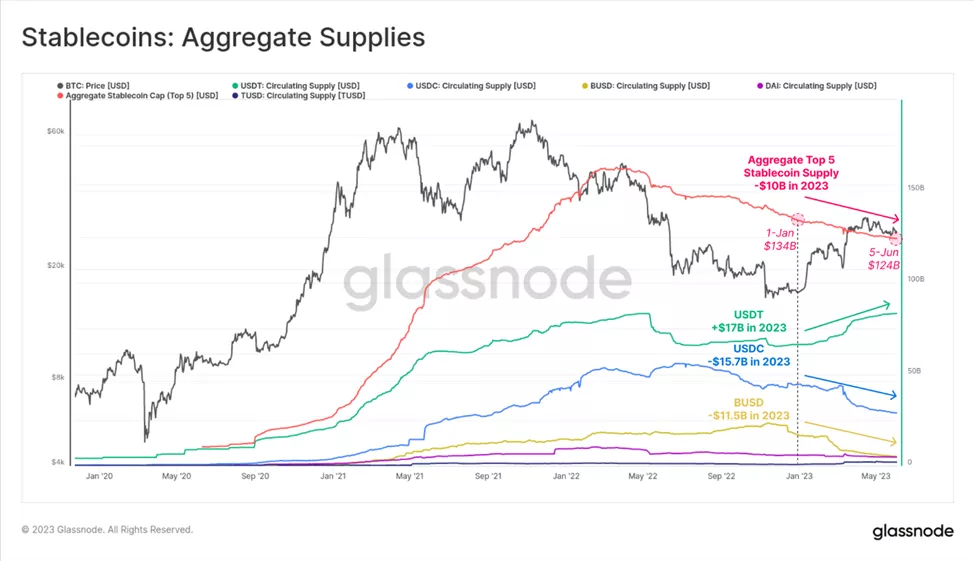

Experts assessed inflows into digital assets by analyzing the realized capitalization of Bitcoin and Ethereum and the volume of stablecoins in circulation. They found that monthly inflows into “digital gold” amounted to $4.47 billion, into the second-largest cryptocurrency by market cap — $3.5 billion. Meanwhile, investors withdrew $1.2 billion from the stablecoins sector.

The decline in the stablecoin capitalization was driven by falls in USDC and BUSD of $15.7 billion and $11.5 billion (year to date). The market leader — USDT — managed to reach a new ATH ($83.1 billion).

“This reflects a geographical divergence, as US-regulated companies have historically preferred USDC to USDT. Given that interest rates are now above 5%, stablecoins have become less attractive, especially for investors with access to American capital markets. Tether has historically achieved broader distribution in markets outside the United States, where national currencies are often weaker and access to dollars is less widespread,” the experts explained.

Analysts noted that as the United States builds an increasingly hostile regulatory framework, capital is moving east in the digital-asset space.

Earlier mentions: Earlier, Kaiko specialists drew attention to the weakening correlation between Bitcoin and Ethereum.

Earlier, LookIntoBitcoin founder Philip Swift pointed to prospects for resuming the rally in Bitcoin, citing its technical setup.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!