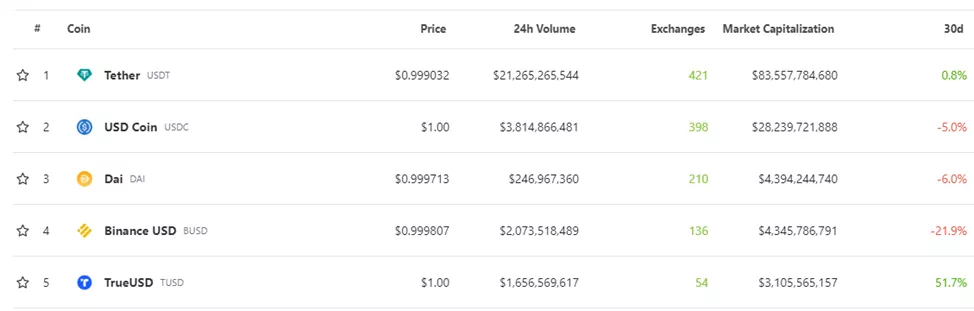

DAI overtakes BUSD in the stablecoins ranking

Binance USD (BUSD) market capitalization fell to $4.35 billion. In the stablecoins ranking, the asset ceded third place to DAI ($4.39 billion).

The reversal coincided with the collapse of FTX. The negative trend in February 2023 was amplified by an order to cease issuing the stablecoin, directed at Paxos, the exchange’s partner, by the NYDFS. The firm stopped issuing new coins and will continue to support buybacks and conversions at least through February 2024.

The negative momentum in BUSD capitalization continued amid pressure SEC on Binance. On June 5, the regulator brought 13 charges, including allegations of selling unregistered securities.

Subsequently the agency requested from a court an emergency freeze of Binance.US assets. The U.S. arm announced a halt of deposits in dollars from June 13.

According to Kaiko, after the filing of the suit, market depth for the 25 leading crypto assets on Binance.US fell by 78%. Experts said that many major market makers left the platform, including Wintermute and Keyrock.

In the week after the suit was filed, Binance’s stablecoins balance fell by $1.6 billion (~20%), according to Glassnode.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!