Glassnode: Lido-led Ethereum staking gains traction after Shanghai upgrade

After activation the Shanghai upgrade in the Ethereum network, inflows into LSD-protocols led by Lido Finance accelerated across the ecosystem. Analysts at Glassnode report.

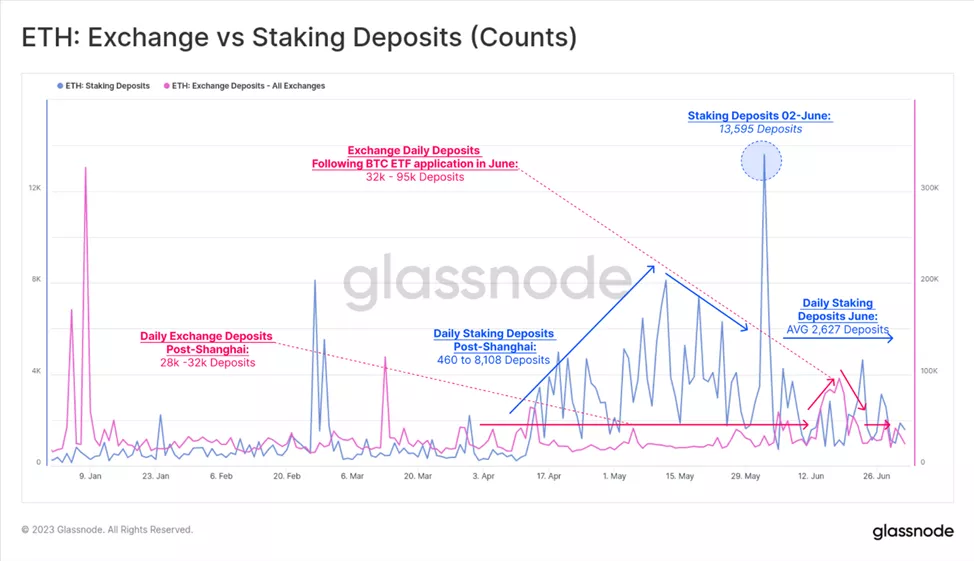

The hard fork unlocked the possibility of withdrawing blocked in staking coins. Instead of outflows, a new wave of deposits to the deposit contract from more conservative investors. Its peak occurred on June 2 (13,595 inflows). In June, the daily average stood at 2,627 deposits, according to analysts.

For comparison, inflows to CEX are 28,000-32,000, roughly on par with pre-Shanghai levels. At the peak, the figure jumped to 95,000.

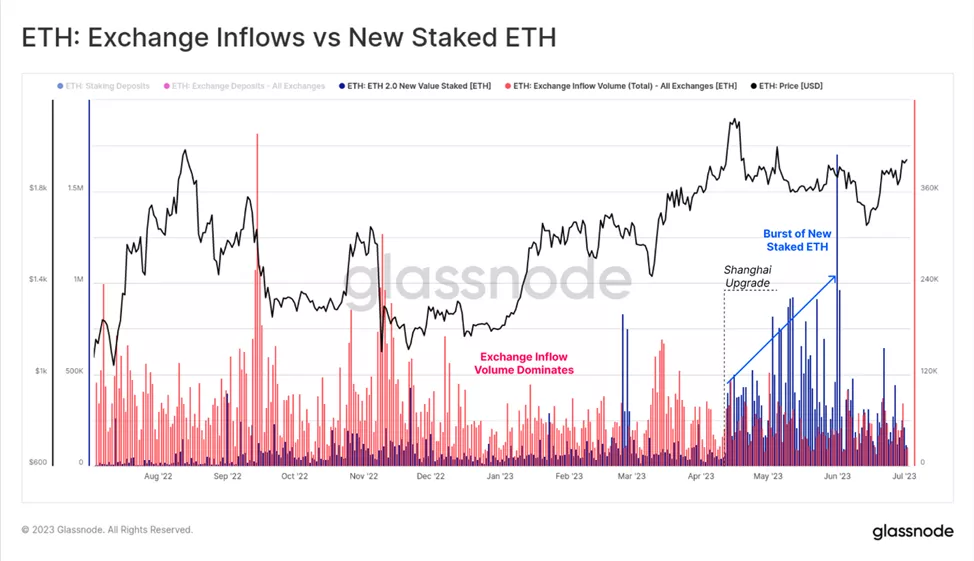

The inflow of Ethereum into staking (highlighted in blue) is best tracked by accumulated values. The figure below shows how the metric matches or exceeds the inflow to exchanges (highlighted in red).

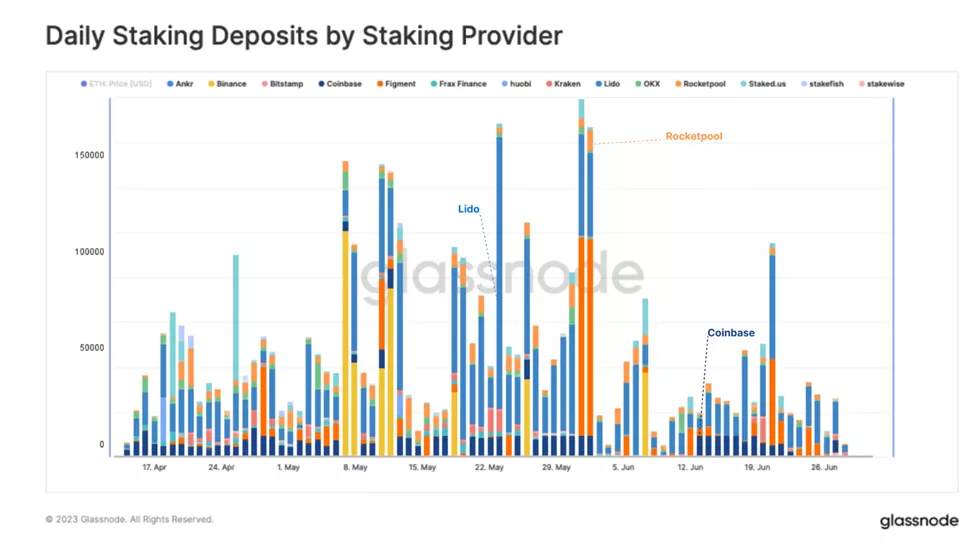

On closer inspection, analysts fixed a preference for LSD protocols, led primarily by Lido Finance.

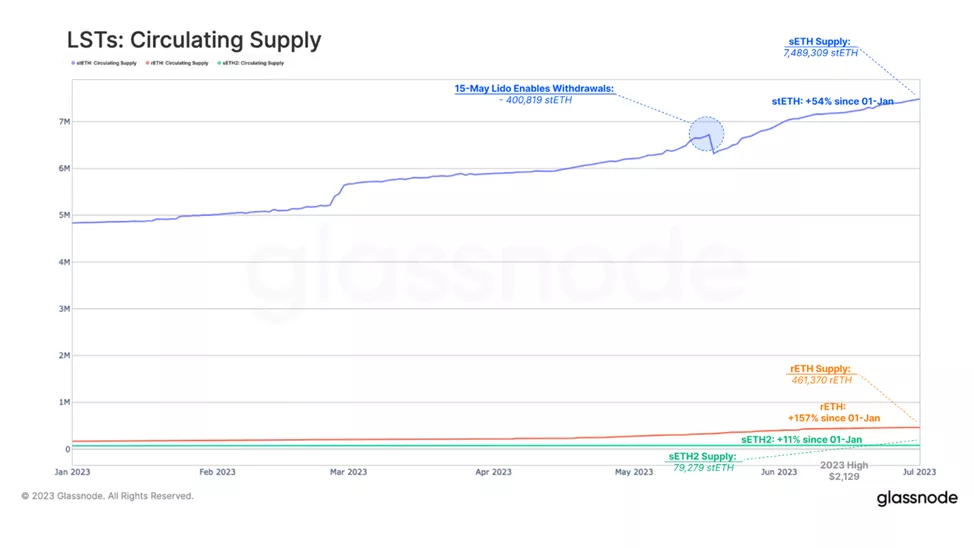

After the Lido Finance upgrade to the second version, node operators gained the ability to withdraw blocked ETH. On that day, the project’s TVL fell by 400 819 stETH (~$721 million). However, a renewed wave of deposits subsequently pushed the figure to a fresh ATH of 7.49 million stETH.

In this regard, Lido Finance eclipses its nearest competitor by 16x. Analysts note that since the start of the year, the growth rate of rETH from Rocket Pool has tripled the pace of stETH.

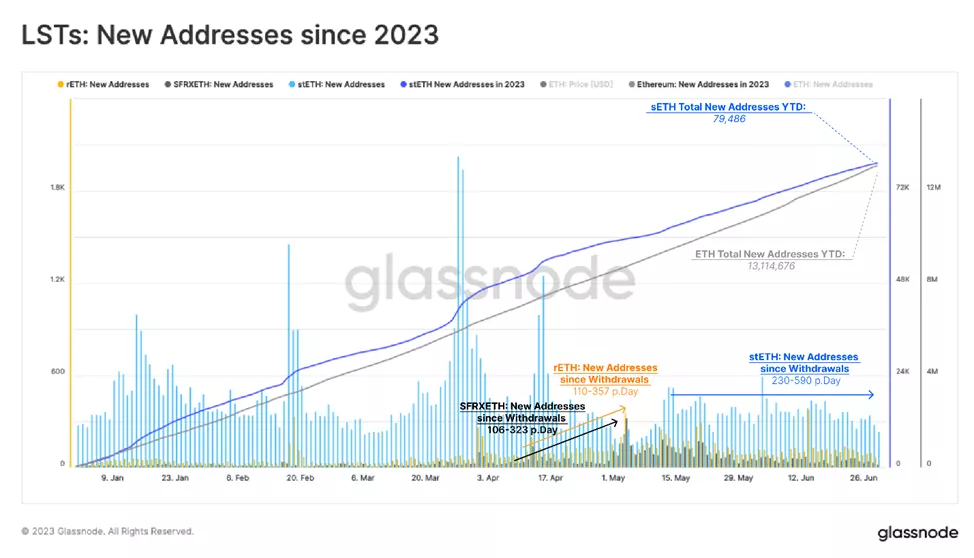

The rise in Ether held in liquid staking does not translate to more holders. This pattern is observed only for Rocket Pool and Frax Finance, while no such trend has been seen with Lido Finance. The daily number of new addresses with stETH ranges between 230 and 590, in line with early-year levels.

“This leads us to conclude that many new deposits through Lido are driven by increased leverage among current stETH holders”, — noted by analysts.

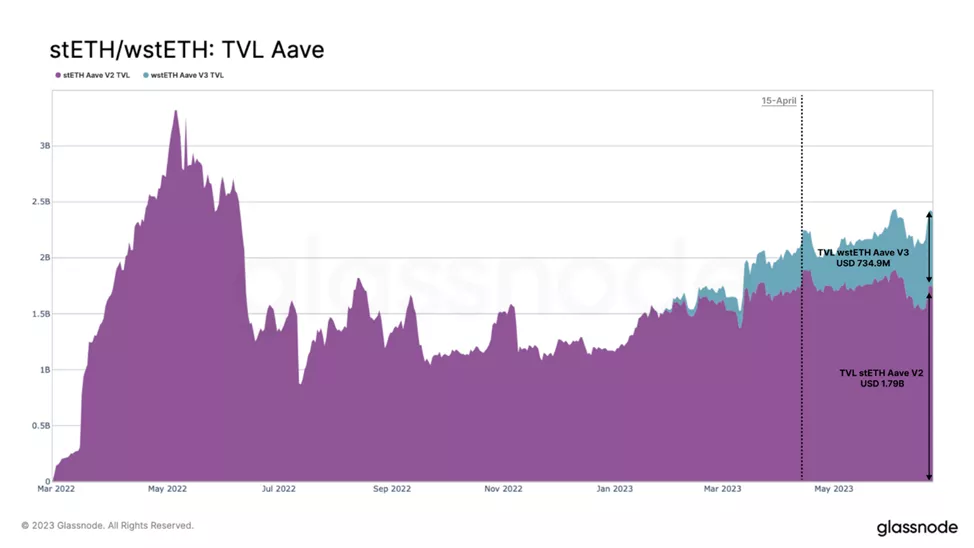

In the DeFi context among LSD-token holders, analysts note a decline in the popularity of DEX in favour of lending platforms, where they are used as collateral. They argue this allows asset yields to be maximised by increasing leverage up to 3x.

Specifically, TVL of wstETH in Aave V3 since launch at the end of January 2023 has exceeded $734.9 million. The stETH pool TVL in Aave V2 reached $1.79 billion.

As a reminder, Coinbase’s share in the Ethereum staking market has fallen amid US regulatory pressure, according to Dune Analytics.

Earlier, Gemini expanded the Staking Pro program for affluent clients in the United Kingdom.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!