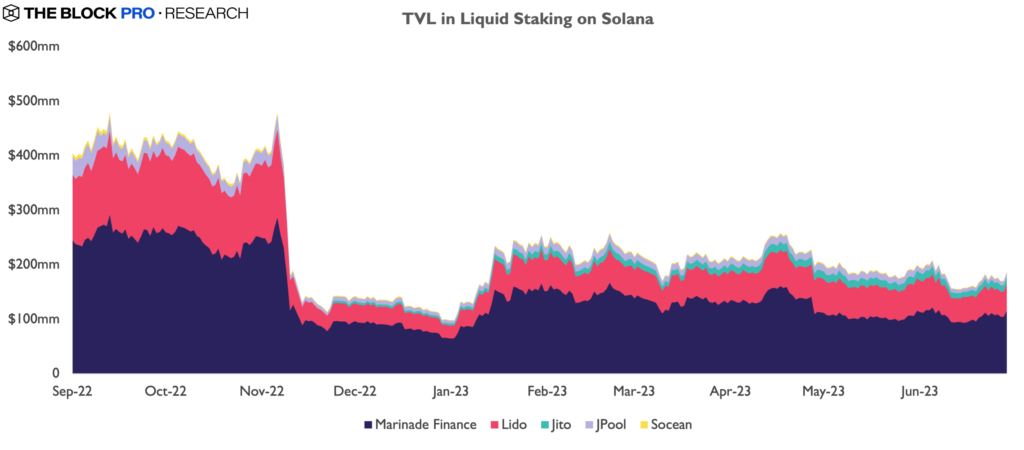

Solana liquid-staking TVL rises 91% in six months

The total value locked (TVL) in Solana liquid staking protocols since the start of the year has risen by 91% — from $98 million to $187 million. The data come from The Block.

According to DeFi Llama, the combined share of Marinade Finance, Lido Finance, Jito, JPool and Socea accounts for 69% of the blockchain’s total TVL, which is estimated at $273 million.

Marinade Finance leads, occupying 62% of the network’s share. Lido Finance follows with 27%, and Jito with 7%.

According to the publication’s analyst Kevin Pan, the inflows into liquid-staking derivatives (LSD) in the Solana ecosystem are presumably linked to the general rise in popularity of such instruments. In particular, Shapella hard fork in the Ethereum network contributed to this.

In 2023, around 1.66 million SOL (~$31 million) were locked in such contracts.

“In 2023, LSD as a category of digital assets grew substantially due to the uptick in staking activity on Ethereum. Demand for these products also spilled over into the Solana ecosystem,” explained Pan.

Another driver of the TVL rise was a robust rally in the SOL token. According to CoinGecko, the six months saw the coin rise 96%, from $9.90 to $19.40.

Analysts at Glassnode reported increased popularity of Ethereum staking on Lido Finance after the Shanghai upgrade.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!