Week in Review: Bitcoin hits its yearly high, and Twitter threatens Meta with a lawsuit

The price of the leading cryptocurrency rose above $31,000 to a new yearly high. On the evening of July 6, the asset’s quotes fell below $30,000, breaking through a psychological support level.

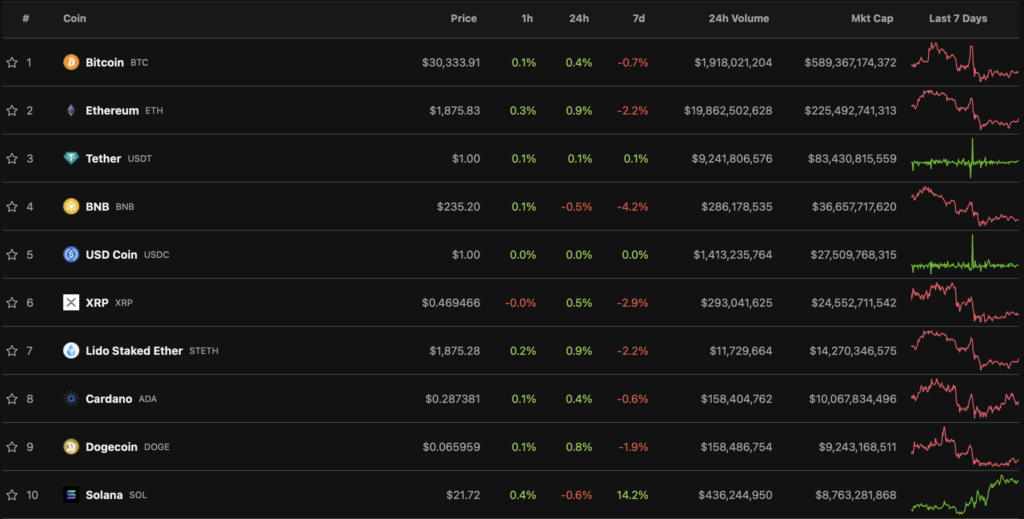

At the time of writing, Bitcoin trades at around $30,300.

Most top-10 cryptocurrencies by market cap finished the week in the red. The biggest loser was BNB (-4.2%), while Solana surged significantly (+14.2%).

The aggregate market capitalization exceeds $1.2 trillion. Bitcoin’s dominance index stands at 51.5%.

What’s going on with Binance?

According to Bloomberg, employees of the Australian Securities and Investments Commission conducted searches at Binance Australia as part of a derivatives investigation.

Staff at the local unit said they are “cooperating with authorities and focused on regulatory compliance.”

At the same time, Binance is looking for new specialists amid regulatory woes in Europe. Among the vacancies are an European policy affairs officer, a director of regulatory compliance in Thailand and an assistant to the head of government relations in Spain.

According to Fortune, several top executives left the company this week, including Chief Strategy Officer Patrick Hillmann, Senior Vice President for Regulatory Compliance Stephen Christie and General Counsel Han Ng.

CEO Changpeng Zhao said that the reasons cited by the press for the departures are “completely untrue.” He said the turnover is normal staff movement.

Experts say Bitcoin has lost its correlation with the US stock market

The 90-day moving average of Bitcoin’s correlation with traditional US stock indices—the S&P 500 and Nasdaq—has fallen almost to zero. This was reported by Block Scholes analysts.

This means crypto traders who rely solely on traditional market sentiment and macro events may face divergence between their forecasts.

CEO Binance says platform preparing for a new Bitcoin rally

Binance CEO Changpeng Zhao said the platform is undergoing “big preparation” for a period of heightened trading activity. He believes this could occur in the next 6–18 months.

Zhao suggested that the next bull market could begin in 2025. One driver of the rally will be Bitcoin halving, expected to take place around April 2024.

What to discuss with friends?

- Twitter threatened Meta with a lawsuit over the Threads launch.

- Justin Bieber lost $1.2 million on NFT investments.

- Arnold Schwarzenegger warned about the AI threat.

Hong Kong calls for a rival to USDT and USDC

The Hong Kong government proposed issuing its own “stablecoin” HKDG backed by the jurisdiction’s currency reserves to compete with the industry giants— USDT and USDC.

The document underscores the importance of stablecoins as a bridge between traditional finance and the digital economy. The government acknowledges potential risks, but the danger of a state-backed “stablecoin” remains lower than that of assets issued by private firms.

Peter Schiff predicted Bitcoin would fall to zero

Peter Schiff, president of Euro Pacific Capital, called the rapid decline of Bitcoin’s price merely a matter of time.

“I didn’t think it could become money, and I was right — it hasn’t succeeded yet,” he said.

Schiff said he underestimated the “potential of the Bitcoin bubble.” In his view, most investors do not believe in the cryptocurrency itself, but merely expect someone to buy it at a high price.

Also on ForkLog:

- In Russia explained the criminal liability framework for cryptocurrency operations.

- In Belarus announced a ban on cryptocurrency exchanges between individuals.

- In the Central Bank named the timeline for the large-scale launch of the digital ruble.

Bernstein: high likelihood of approval for spot Bitcoin ETFs

The U.S. Securities and Exchange Commission will not be able to hold its stance on Bitcoin-ETF for long. This, Bernstein analysts said.

Experts note that regulators have already approved Bitcoin-futures ETFs, including leveraged ones from Volatility Shares.

According to the report, the absence of spot ETFs based on Bitcoin drives growth in over-the-counter products (e.g., GBTC), which “are expensive, illiquid and inefficient.”

BlackRock CEO calls Bitcoin an “international asset”

Larry Fink, CEO of BlackRock, stated that investors can buy Bitcoin to hedge against inflation instead of precious metals.

“The role of cryptocurrencies, in many ways, is the tokenisation of gold,” he added.

In Fink’s view, Bitcoin represents an “international currency.” He also admitted that he was initially skeptical about digital assets but later changed his mind.

What else to read?

In recent weeks the market has been swept by a new wave of filings for spot Bitcoin ETFs. ForkLog and the experts surveyed explained the importance of this eagerly awaited investment instrument.

In the traditional digest we collected the week’s main events in cybersecurity.

The crypto industry is attracting an increasing number of institutional players. This is supported by new investments in infrastructure and the growing attention companies devote to Bitcoin as an asset class. The most important events of the past weeks are in the ForkLog review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!