US inflation slows; Bitcoin rallies

US inflation slowed to 3% y/y in June; Bitcoin rose to about $31,000 before retracing.

US inflation slowed year-on-year in June, from 4% to 3%, undershooting economists’ forecast of 3.1%. Bitcoin jumped to around $31,000, lifting its daily gain to about 1%.

In month-on-month terms, prices rose 0.2% — twice the pace of May — but came in above economists’ expectations (0.3%).

Core inflation, which excludes food and energy, was 4.8% year-on-year and 0.2% month-on-month. The previous readings were 5.3% and 0.4% respectively.

Analysts had anticipated figures around 5% y/y and 0.3% m/m.

Data published by the U.S. Bureau of Labor Statistics raises the likelihood that the Fed may be limited to a single rate hike rather than two before year-end.

The release boosted risk appetite in global markets. S&P 500 futures rose about 0.67%. The euro added around 0.4% against the dollar. Against a softer greenback, gold rose about 0.6%.

Initial positive reaction in Bitcoin was followed by selling. BTC prices, 30 minutes after the data release, retraced to pre-release levels.

A similar dynamic appeared in Ethereum. The second-largest cryptocurrency’s price rose to around $1,900, before retreating to levels observed before the macro data release.

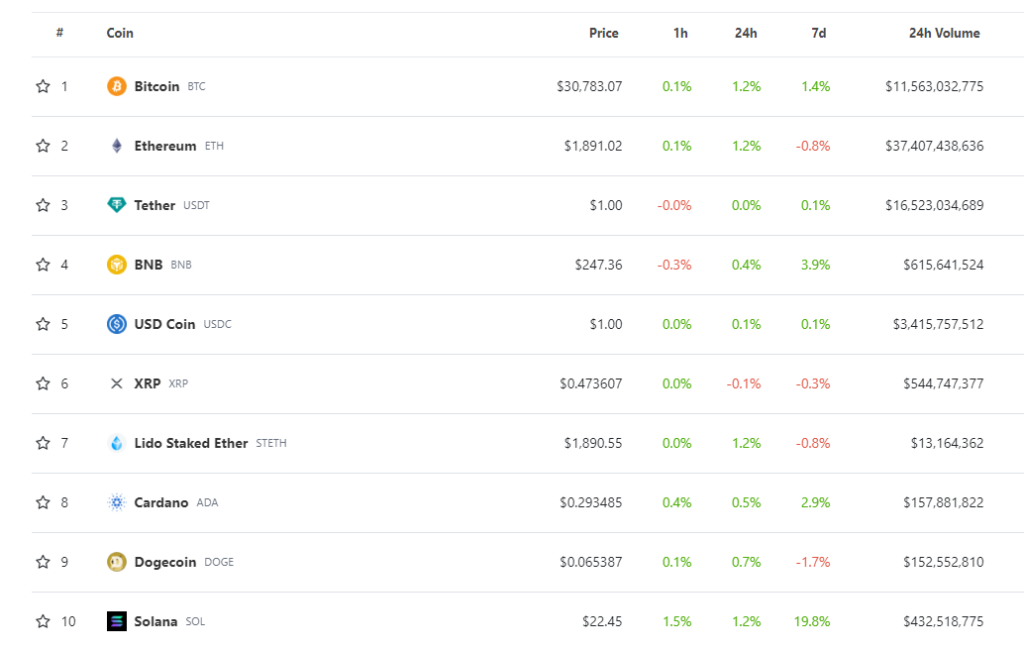

According to CoinGecko, all top-10 cryptocurrencies by market cap over the past hour showed a muted reaction — down 0.3% for BNB to up 1.5% for Solana.

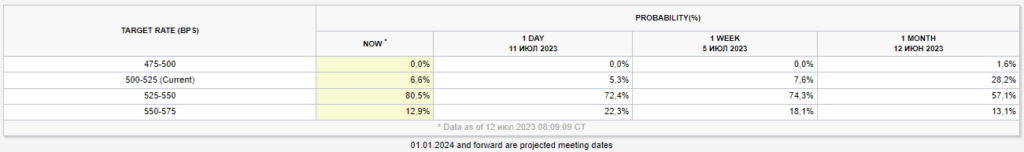

Data from the release did not materially alter expectations for a potential Fed rate hike at the July 25–26 meeting. The probability of such a move slipped from 93% on the eve to 92.4%, according to the CME Fed Watch.

The prospect of further tightening this year became even less certain. In September, the odds of such a scenario fell from 1:3 to 1:7.

Analysts at Nansen concluded that for the start of a Bitcoin bull market regulatory clarity in the United States and a sustained decline in core inflation are required.

Earlier, Standard Chartered predicted the price of the first cryptocurrency to rise to $50,000 this year and $120,000 — by the end of next year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!