DeFi Bulletin: TVL falls again as Aave launches GHO on Ethereum mainnet

The decentralized finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news from the past weeks in this digest.

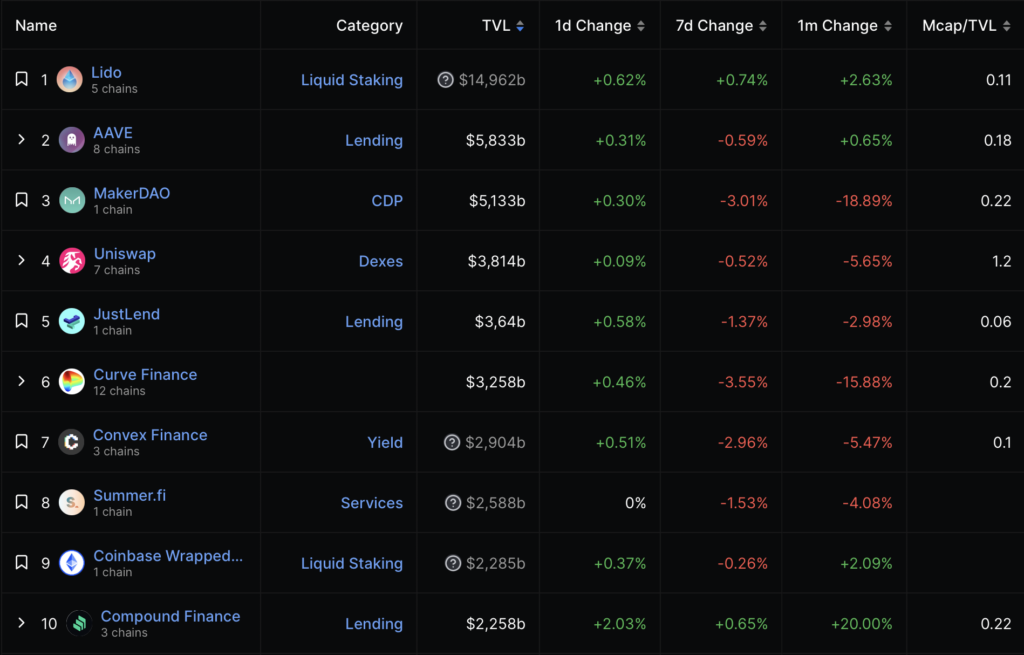

Key metrics of the DeFi segment

The total value locked (TVL) in DeFi protocols fell to $43.44 billion. Lido was the leader with $14.96 billion, while the second and third places are held by AAVE ($5.83 billion) and MakerDAO ($5.13 billion), respectively.

TVL in Ethereum applications fell to $25.2 billion. Trading volume on decentralised exchanges (DEXs) over the last 30 days stood at $50.4 billion.

Uniswap continues to dominate the non-custodial exchange market — accounting for 62.7% of total volume. The second DEX by volume is PancakeSwap (14.3%), the third Curve (6.7%).

Aave launches the GHO stablecoin on the Ethereum mainnet

DeFi-protocol Aave activated a decentralized stablecoin GHO on the Ethereum mainnet. The deployment has received 100% community support.

More than two years ago the Aave community recognised the need for a decentralized overcollateralized stablecoin that would broaden users’ capabilities and serve as a payments layer, the team said in a statement.

With activation on the Ethereum mainnet, there is now the ability to borrow GHO against crypto collateral. The coin is governed by DAO.

The architecture of the stablecoin relies on the Ethereum Facilitator smart-contract system. The coin is issued by community-approved intermediaries — “facilitators”. The first of them is the Aave v3 market on Ethereum. The third version of the protocol features expanded risk-control capabilities, the developers noted.

The team noted that the collateral backing the issue continues to generate income for users. Another feature of the stablecoin is that the interest on loans in it goes entirely to the Aave DAO treasury.

Senate panel proposes DeFi services comply with AML

DeFi protocols must implement strict AML-controls over their users, according to a bipartisan bill by a group of senators. Its authors include Senators Jack Reed, Mike Rounds, Mitt Romney and Mark Warner.

The bill is aimed at “fighting the growth of crime associated with the use of digital assets, as well as closing off opportunities to evade AML- and sanctions measures that are critical to national security”.

The bill would impose requirements on “anyone who controls” DeFi protocols or provides access to them [via an interface]. In the absence of such persons, liability extends to those who invested at least $25 million in the project’s development.

The designated authorities would be required to verify and collect information about users, maintain AML programmes, report suspicious activity to authorities, and block the use of the protocol by sanctioned individuals and organisations.

Conic Finance lost $3.2 million due to oracle manipulation

The attacker hacked the DeFi protocol Conic Finance, oriented on the Curve platform Curve. He withdrew about 1,700 ETH (~$3.26 million).

According to Beosin analysts, the hacker exploited a reentrancy vulnerability, gaining access to the protocol’s price oracle to manipulate the prices of tokens steCRV, cbETH/ETH-f, rETH-f and others.

This allowed the hacker to withdraw more liquidity tokens than he deposited. The attacker also borrowed 20,000 stETH to boost returns.

According to Conic representatives, the exploit affected only the Omnipool pool on the Ethereum network. The protocol team’s currently investigating the incident.

EraLend DeFi protocol hacked for $3.4 million

The attacker attacked the EraLend lending protocol on the zkSync Era network, stealing digital assets worth $3.4 million.

Likely, the hacker used a read-only reentrancy exploit on the DEX SynсSwap. This enabled the attacker to manipulate the price oracle to withdraw wrapped ETH and USDC.

Atlendis DeFi project secures €1 million loan from the French state bank

The French state investment bank BPI has allotted a €1 million loan for Atlendis, an institutional DeFi lending platform. The organisation has also obtained a local crypto-asset services provider licence.

The funds will be used to develop Atlendis Flow, which enables direct crypto-fiat transactions. The product serves as the link between the protocol and clients’ bank accounts, the project representatives clarified.

The Atlendis service is available only to accredited investors and requires completing a mandatory identity-verification process.

Also on ForkLog:

- Binance Labs invested $10 million in Radiant Capital.

- DeFi project Parrot offered to redeem PRT tokens at a loss of around 90% of the investment.

- 1inch launched beta version of its developer platform.

- Eco Protocol developers launched the Beam wallet for Optimism and Base.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!