Bitcoin’s share in crime is minimal: how money laundering happens on the blockchain today

One of the main arguments against digital assets is that they are used to launder money. This is true only to some extent. In reality, Bitcoin and other cryptocurrencies play a small role in criminal schemes. According to Chainalysis, in 2022 less than 1% of all transactions were linked to illicit addresses.

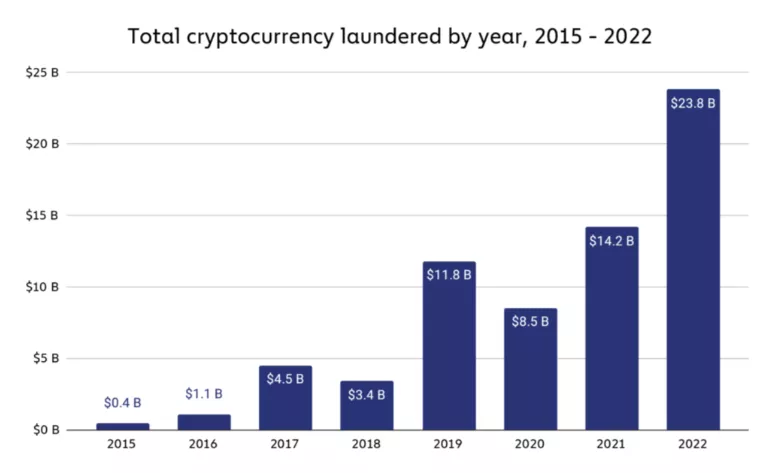

However, the volume laundered through crypto assets has grown year on year, and wrongdoing actors find new ways to hide their activities in blockchain networks that appear to be transparent. ForkLog studied the statistics and explains non-obvious methods of legitimising dirty profits.

The shadow crypto industry in numbers

Cryptocurrency makes it easy and fast to move large sums, and it can be accessed from anywhere in the world. In addition, many service providers lack the resources and tools to effectively track illicit activity.

In 2022, $23.8 billion was laundered through digital assets, up 68% from the previous year.

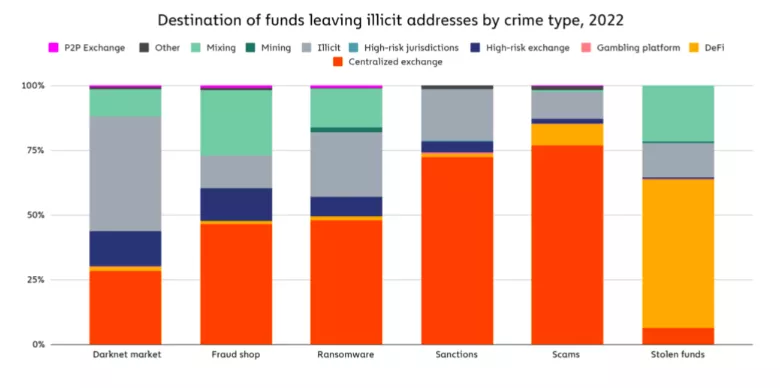

The main recipients of illicit funds were centralized exchanges (CEX) — around 50% of the entire “dirty” cryptocurrency turnover for the year. Trading platforms provide a direct avenue to convert digital assets into fiat, for example via P2P, which serves as an almost perfect tool for criminals.

Of course, not all crypto exchanges apply strict identity rules. However even the most stringent KYC procedures can be bypassed: buying fake passports or stolen data on the dark web using the same cryptocurrency.

Some organised crime groups use so-called “drops.” These are people who open a bank card, register and pass verification on an exchange, and then hand over all access to the client. With many such profiles, criminals split assets into relatively small sums to avoid arousing suspicion. They then convert them into fiat and cash them out.

In turn, hackers to launder stolen funds in 57% of cases use DeFi protocols. When hacking decentralised platforms they often withdraw tokens that are not listed on other exchanges, so they need to use DEX to exchange for more liquid assets, explained by Chainalysis analysts.

Often hackers exchange funds for ETH, which they then send to crypto mixers. Decentralised exchanges also help rapidly swap stolen stablecoins so they are not frozen by the issuer.

However such platforms do not enable converting funds from digital currency to fiat; for that, CEX or crypto exchangers are still required.

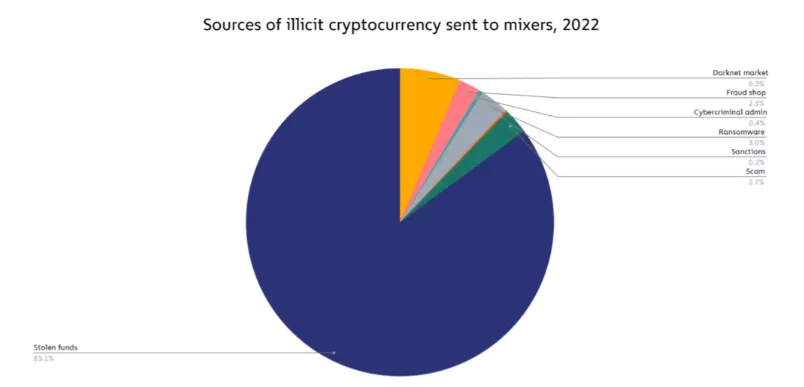

Returning to mixers, Chainalysis calculated that in 2022 such services processed assets worth $7.8 billion, of which 24% came from illicit addresses. A year earlier, the figure stood at 10% on $11.5 billion.

Experts noted that the overwhelming majority of criminal proceeds channelled through mixers belonged to the North Korean Lazarus group, responsible for attacks on projects Ronin, Atomic Wallet, Alphapo and Horizon.

According to researchers TRM Labs, the share of Bitcoin in criminal turnover fell from 97% in 2016 to 19% in 2022. Originally, digital gold was the only cryptocurrency used to finance terrorism. Now it has been almost entirely displaced by assets on Tron (92%), mostly the stablecoin USDT from Tether.

In a ForkLog interview, blockchain expert, commercial director MobileUp Nayki Yeremenko confirmed the analysts’ trend.

“The share of criminalised Bitcoin has been minimal for a very long time. Criminals do not use it, as its blockchain is scanned by dozens, if not hundreds, of cybersecurity firms. If oversight and pressure were relaxed, criminal transactions would undoubtedly reappear, sensing freedom. If it were treated by the mass public as an immeasurable threat, regulatory laws bringing it into the legal framework would not be enacted, and ETF approvals on US exchanges would not be granted. It would simply be banned, like Monero,” says the expert.

Ways of laundering cryptocurrency

Anonymous tokens

Privacy coins such as Dash (DASH), Zcash (ZEC) and Monero (XMR) are often criticised by authorities for being almost impossible to trace when moved.

Criminals of course exploit this, for example by exchanging stolen cryptocurrency for XMR, and then for another like asset. Such a sequence completely breaks the network trace of the offender, making it very hard to trace.

Given the anonymity of tokens, it is impossible to determine precisely what share of illegal transactions they account for. Due to the lack of tools to monitor, authorities often prefer to ban or restrict such coins as much as possible.

On 31 May the European Banking Authority proposed amendments to the MiCA regulation — 20 April law — that anonymous cryptocurrencies hinder tracing potential money laundering and financing of terrorism.

Against the backdrop of regulatory risks many crypto exchanges, including Bittrex, ShapeShift, Huobi and Binance, announced delisting of some privacy tokens. However the latter soon reconsidered its decision.

Debit cards

Sometimes to launder digital assets criminals use prepaid debit cards with crypto deposit features. Funds from them can be converted into fiat, or used for other illicit activities. Many such products support anonymous tokens, so loading them with already “cleaned” funds is not difficult.

Crypto ATMs

In criminal circles crypto ATMs are also popular. Such machines have security systems and rules depending on the country. But in practice they are often used only nominally, and a knowing person can quite easily bypass them. Criminals simply employ the aforementioned “drops” and have them cash out small sums.

Online casinos

In a Bitrace study, which journalist Colin Wu reads, it is stated that many platforms support crypto deposits and, of course, do not require KYC.

Thus criminals send digital assets to play poker, wait a few rounds, and then walk away with nearly the same amount. They receive winnings in different coins. In addition, some gaming services have payment channels with certain centralised exchanges, allowing seamless withdrawals. According to experts, addresses affiliated with online casinos sent $7.6 billion to CEX in a year.

Street exchangers

Across many countries, including in the CIS, there are offline stores that exchange cryptocurrency for cash face-to-face.

Earlier Chainalysis found that several dozen cryptographic firms in Moscow-Cetralny Centre were linked to laundering by cybercriminals. Local platforms also helped cash out USDT in the United Kingdom.

According to experts, 21 crypto companies are located in the business centre. Fourteen of them are over-the-counter brokers dealing with rubles for stablecoins. Eight of them perform crypto-for-pound exchanges with cash in London.

Fighting the laundering of criminal proceeds

In recent years authorities have strengthened sanctions against AML-noncompliant crypto-service providers. This direction has become central to the regulatory framework for the industry. Many jurisdictions have already begun to apply strict measures.

Earlier the U.S. Office of Foreign Assets Control (OFAC) imposed sanctions on the crypto mixer Tornado Cash. Elliptic analysts say the platform was actively used to launder NFT-related proceeds.

Also the U.S. and Germany, with support from Belgium, Poland and Switzerland, seized servers of the crypto mixer ChipMixer. According to law enforcement, the service, founded in 2017, helped launder more than 152,000 BTC (~$2.88 billion) during its existence. Information following the shutdown of Hydra allowed investigators to establish its links to a dark-net marketplace.

Despite the U.S. lagging Europe in global crypto regulation, both jurisdictions take the fight against money laundering seriously.

In July 2023 the U.S. Senate adopted amendments to the NDAA that tighten oversight of crypto mixers, anonymous coins and digital asset trading venues. American officials also proposed a framework to impose strict AML standards on DeFi protocols.

European Parliament committees on Economic Affairs and Internal Affairs also approved a text extending AML requirements to DAOs and other Web3 platforms. The provisions would require tracking procedures for all transactions above €1000 ($1080).

The act applies to crypto firms if they are controlled directly or indirectly, including through smart contracts or voting protocols, by identifiable individuals or legal entities.

“AML standards are not about choking crypto, but about bringing it to the common standards of the financial world. On the one hand, that is good news; it marks greater institutionalisation of crypto. For supporters of decentralisation, this is bad news. The new standards will lead to broader use of crypto — just someone will be watching you,” summarises Nayki Yeremenko.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!