RWA market capitalisation tops $75bn for the first time

BlackRock plans to tokenise its ETFs

Over the past week, the market value of the RWA token sector rose by more than 8%, hitting a new record of $75.5bn, according to CoinMarketCap.

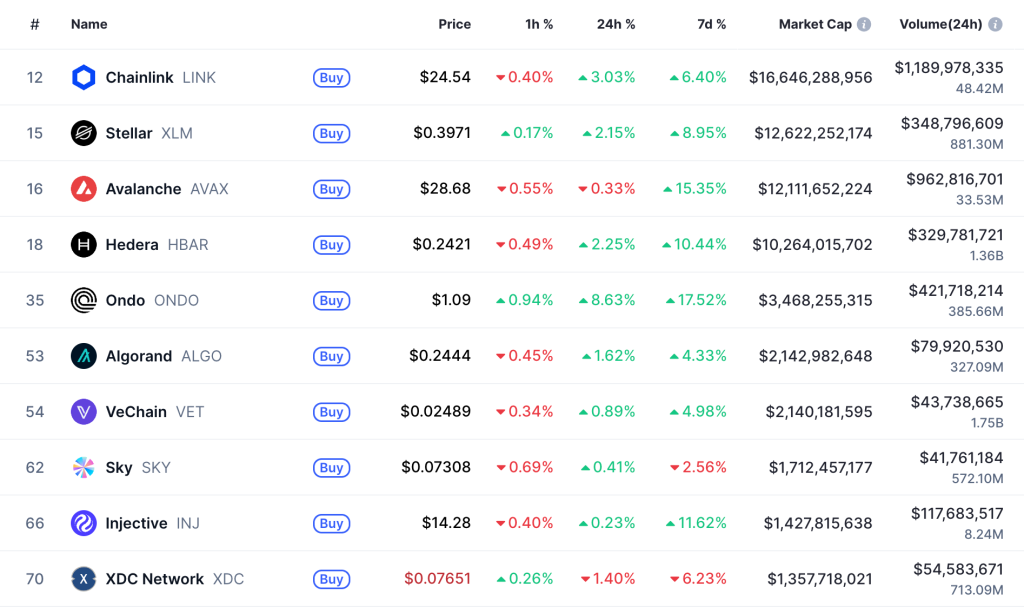

Chainlink’s LINK remains the sector leader, with a market capitalisation of $16.6bn. Stellar’s XLM and Avalanche’s AVAX round out the top three at $12.6bn and $12.1bn, respectively.

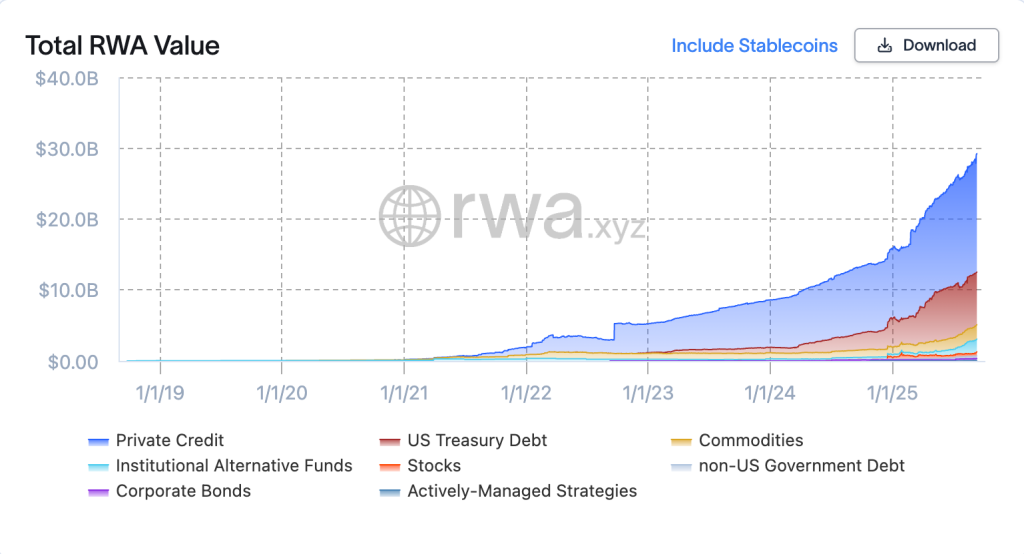

The rise in RWA tokens has coincided with a sharp increase in total value locked across protocols. Since the start of the year, the metric has doubled to a record $29bn.

Tokenised private credit and US Treasury securities command the largest share of the market. The remainder is made up of commodities, alternative funds and assorted securities.

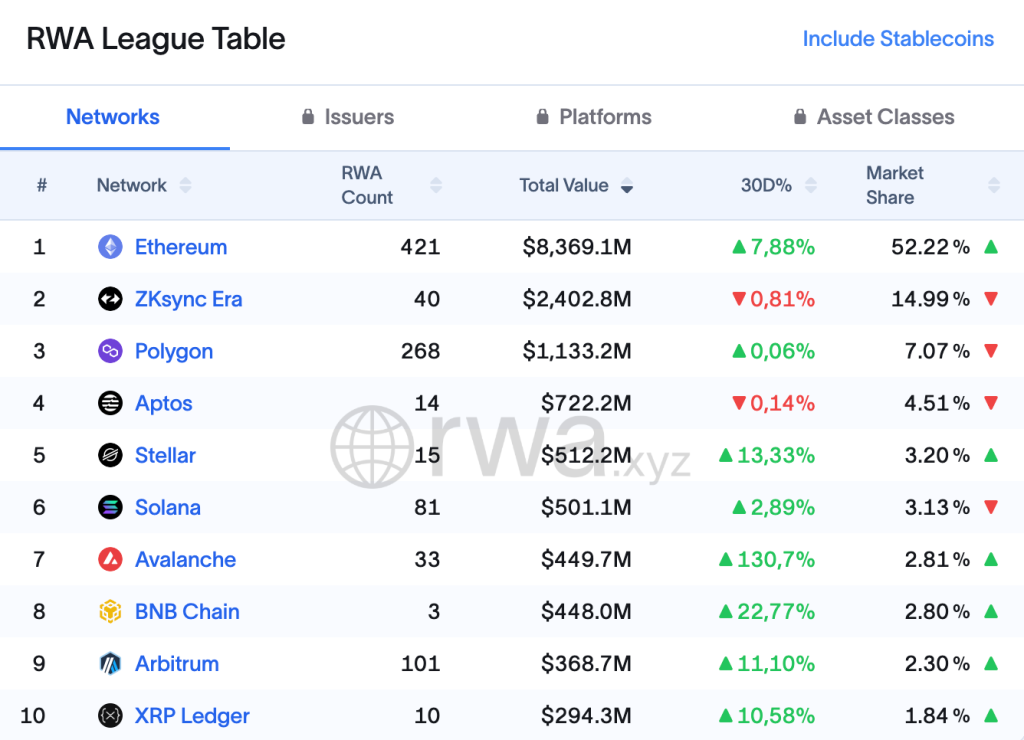

Ethereum is the most popular blockchain for tokenisation. The network of the second-largest cryptocurrency hosts 421 issuers that have brought $8.3bn of digital assets to market.

Crypto investor Ryan Sean Adams forecast further growth for the sector. In his words, tokenisation is “now being pushed even by the US government”. He added that Wall Street and major fintech firms are increasingly joining the trend.

People are still underestimating Ethereum.

They don’t know America is coming onchain and it’s using Ethereum as its ledger.

I demonstrated that Ethereum is leading in real world asset market share but let’s add another dimension.

Let’s talk Growth.

In the coming decades I… https://t.co/2A8TJKBgo2

— RYAN SΞAN ADAMS — rsa.eth 🦄 (@RyanSAdams) September 11, 2025

“American capital markets are moving on-chain. Nothing will stop this process,” he said.

BlackRock plans to tokenise its ETFs

According to Bloomberg, BlackRock, the world’s largest asset manager, is exploring the tokenisation of ETFs. Sources said the move is tied to the success of its bitcoin exchange-traded fund and will require addressing a number of “regulatory aspects”.

Since its approval in January 2024, the company’s product based on the first cryptocurrency has drawn $59.51bn. BlackRock’s IBIT became the fastest-growing ETF, overtaking the gold ETF GLD.

BlackRock also operates an Ethereum-focused ETF. At the time of writing, it has attracted $12.72bn.

The asset manager already has experience with tokenisation. In March 2024, together with Securitize, the company launched the BUIDL tokenised asset fund on the Ethereum network.

The vehicle is backed by US Treasury bills, repo agreements and fiat currency. According to RWA.xyz, its market capitalisation exceeds $2bn.

Bloomberg analyst Eric Balchunas questioned whether tokenising ETFs will deliver new advantages for investors. In his view, the step may only streamline internal processes in TradFi.

We need to define the trend better: If by ‘tokenization’ you mean the back office (plumbing) of TradFi will be slightly more efficient by utilizing blockchain technology? Then sure, fine, probably will but zzzz. What is implied tho by the hype is getting actual investors to sell… https://t.co/SzXROTB9oi

— Eric Balchunas (@EricBalchunas) September 11, 2025

“Tokenisation makes sense first and foremost for those who already actively use blockchain — much as ETFs once simplified access to assets for brokerage clients. But because the share of the blockchain audience globally is still small, the current hype around tokenisation does not yet match its real impact — at least over the next few years,” the expert explained.

In early September, Galaxy Digital announced a partnership with Superstate to tokenise GLXY securities on Solana.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!