At the intersection of DeFi and CeFi: an overview of OKX’s Web3 ecosystem

In January 2022, the cryptocurrency exchange OKEx rebranded to OKX: the company noted that it had moved beyond the centralised platform, symbolised by the letters Ex (Exchange).

We report on changes in OKX’s ecosystem and test one of the platform’s main products — the updated Web3-wallet.

OKX Exchange and Wallet

After the rebranding, the exchange entered into partnerships with McLaren, “Manchester City” and TradingView, launched the Proof-of-Reserves initiative and several services built on the OKX Web3 Wallet.

The latter has become one of the company’s core products: the new version of OKX unites a centralised exchange and a non-custodial wallet.

“We wanted OKX to better reflect the essence of the crypto industry — the operation of complementary services and finding a balance between decentralisation, non-custodiality, security and convenience. You can literally switch between two modes — a centralised crypto exchange and a decentralised Web3 service,” — said an OKX spokesperson.

In the CEX mode, users buy and sell cryptocurrencies, earn passive income on the Earn platform, and use other services that are offered on major centralised exchanges. All assets are stored by OKX in a hot-and-cold-wallet system. The exchange also created the OKX Risk Shield insurance fund to protect users’ funds in case of a breach.

In wallet mode, clients interact with Web3 services through the OKX Wallet. They fully control their assets and can swap them via OKX DEX, trade on an NFT marketplace, and connect to DeFi protocols.

What makes up OKX’s Web3 ecosystem

The OKX team develops several Web3 products:

- OKX Wallet ― a non-custodial wallet with a dapp-browser and support for more than 60 blockchains;

- OKLink ― a blockchain explorer supporting more than 30 networks, including Bitcoin, Ethereum, Polygon and Tron;

- OKT Chain (OKTC) ― EVM-compatible L1 blockchain based on Cosmos. Built on the protocol, more than 25 DeFi protocols have been launched with TVL around $28 million;

- OKB Chain (OKBC) ― L2 solution based on zkEVM for launching dapps;

- OKX DEX ― decentralised exchange and cross-chain aggregator;

- NFT marketplace ― 31 marketplaces for trading non-fungible tokens across 17 networks, including Ethereum, Solana, OKTC, Polygon and zkSync Era;

- Ordinals marketplace ― a marketplace for trading NFT and BRC20 tokens on the Bitcoin blockchain;

- OKX Build ― an infrastructure Web3 platform for developers of decentralised applications.

In addition, the platform invests in various Web3 projects through its venture arm OKX Ventures.

How to create an OKX wallet

At the heart of OKX’s Web3 ecosystem lies a non-custodial wallet in the form of a mobile app for Android and iOS, and browser extensions.

Users have access to:

- Exchange ― cross‑chain swaps of more than 210,000 tokens across 20 blockchains and L2 solutions, including Tron, Polygon and zkSync Era;

- Marketplace ― P2P markets for trading cryptocurrencies, tokens and NFTs on the Ethereum and Bitcoin blockchains;

- DeFi ― integrated DeFi protocols such as Uniswap, Compound and MakerDAO;

- Discover ― a dapp browser from OKX with ratings of DeFi- and GameFi-projects, links to airdrops and analytical tools;

- Cryptopedia ― a learn-to-earn platform that pays rewards for studying new crypto projects.

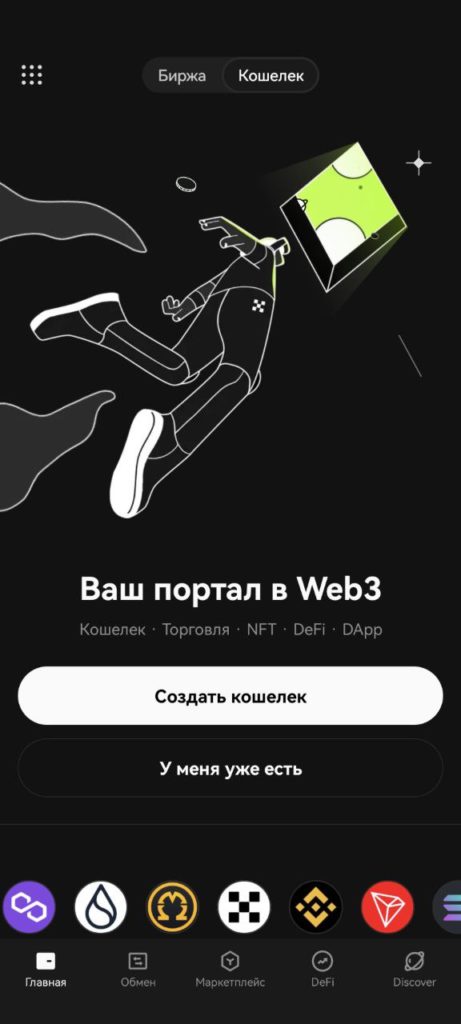

We tested OKX’s wallet on an Android smartphone. To do this, we switched the central slider to the “Wallet” mode.

On the home screen we chose the option “Create wallet”. OKX offered three options:

- keyless ― the wallet splits the private key into several parts, held by different parties;

- with mnemonic phrase ― the app generates a random sequence of 12 or more words, required to recover access to funds in case of loss or theft of the wallet;

- hardware ― the private key is stored on a separate device, Ledger or Keystone.

The latter options are familiar to users of non-custodial wallets like MetaMask, so we chose the “keyless” generation.

“Keyless wallet improves the user experience with the MPC (Multi-party computation) — splitting the private key into three shares (shares) between the exchange, the user and the cloud. To sign a transaction two of them are required,” — explained the OKX team.

After generating the wallet, you must back up the private key to Google Drive — without it you cannot receive or send cryptocurrencies.

Receiving crypto assets

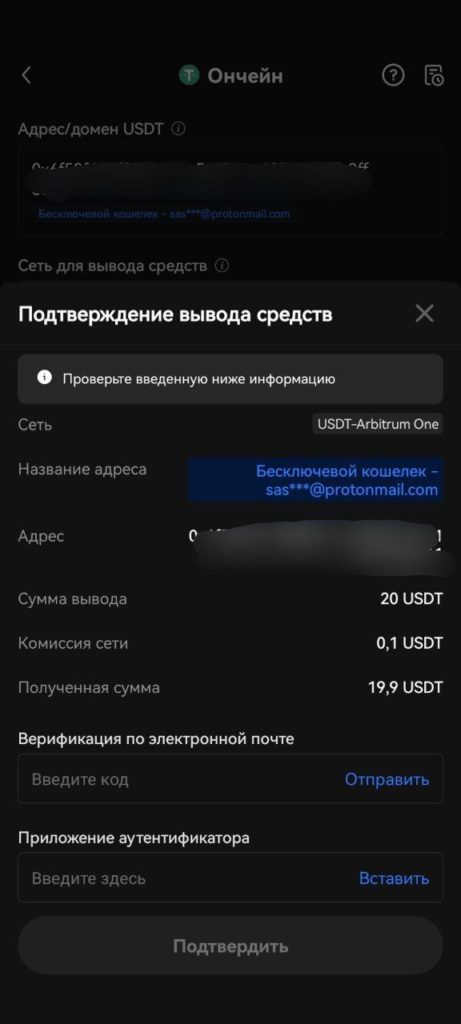

After backing up the private key we transferred 20 USDT to the wallet on the Arbitrum One network: we pressed the “Receive” button on the home page and selected OKX as the source of funds.

Funds should reside in the main or trading account of the exchange — assets in Earn services do not appear.

At the time of review, the Arbitrum One network, along with Optimism, offered the lowest withdrawal fee — 0.1 USDT.

The integration with OKX eliminated the need to manually input and verify addresses: the app added it automatically.

We specified only the amount and confirmed the transfer using email and the Google Authenticator app — funds arrived in the wallet account within a minute.

Sending funds

Withdrawals are also integrated with the centralised exchange — the account address immediately appears in the crypto-asset sending options. You can move funds to any external wallet or exchange.

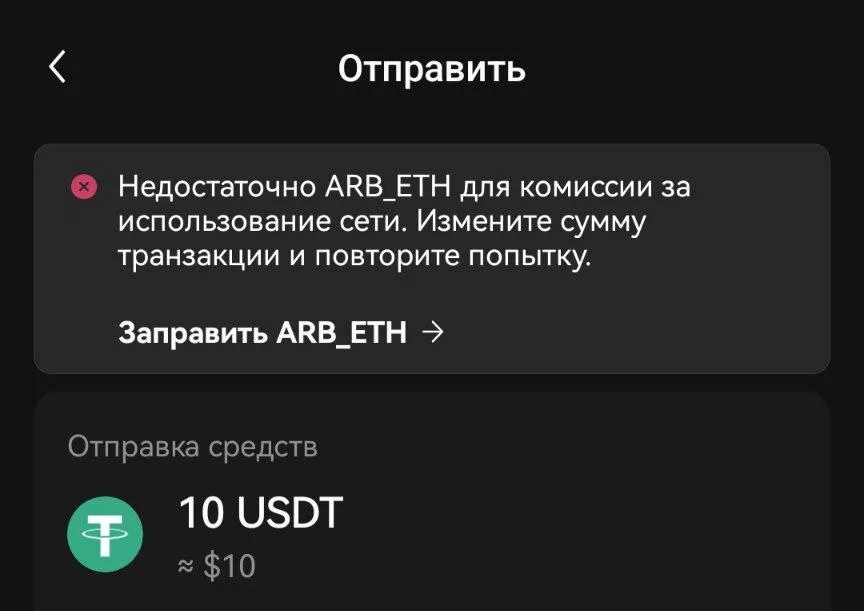

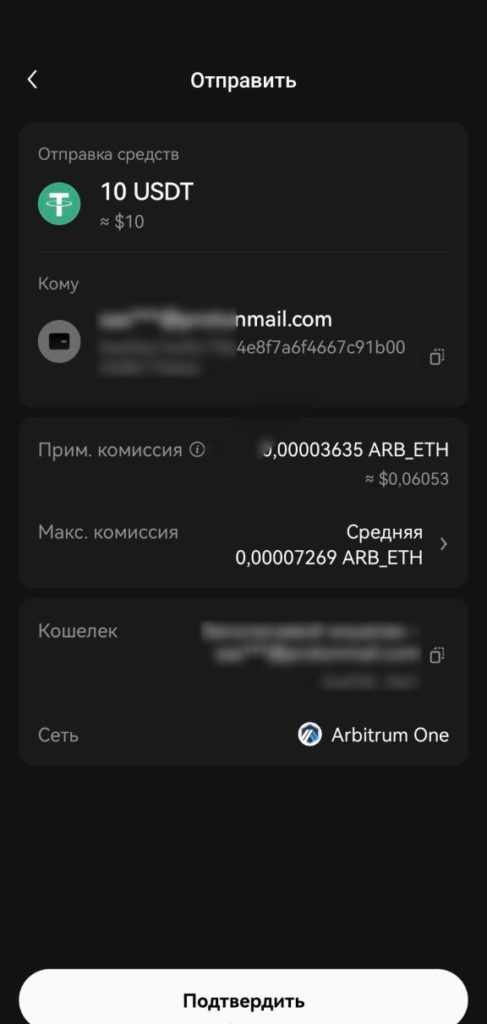

We sent 10 USDT to OKX via Arbitrum One: we pressed the “Send” button on the wallet’s home page, selected the crypto asset and the exchange address, and then specified the amount — 10 USDT.

For withdrawing stablecoins and other tokens, a fee currency is required — in our case Ethereum (ETH) on the Arbitrum One network (ARB-ETH).

The exchange warned that these funds were absent and offered three options:

- swap for gas — sell the available tokens (USDT) for the network currency (ARB-ETH). The minimum swap amount is 5 USDT;

- withdraw funds — buy ARB-ETH on OKX and send them to the wallet;

- receive — transfer ARB-ETH from any external wallet or exchange.

We tested the last option — transferred ARB-ETH from an exchange. The OKX wallet received them within a minute.

After that we again chose the address, the transaction amount and confirmed the withdrawal.

The funds arrived in the OKX account within a few seconds.

Conclusions

OKX offers one of the best tandems of a centralised exchange and a non-custodial wallet: customers can buy cryptocurrencies with fiat and withdraw them to external platforms in a single mobile app.

The OKX Wallet supports DeFi protocols, NFT marketplaces and other decentralised applications. Users do not need to verify addresses when sending and receiving assets thanks to native integration with the OKX CEX, and Ledger and Keystone owners can connect their devices to secure funds at the cold-wallet level.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!