Week in Review: Bitcoin tests $30,000 as BlackRock CEO explains the rally

The first cryptocurrency tested the $30,000 level, mining difficulty for digital gold hit a new high, and BlackRock’s CEO explained the reasons for the rally amid the ‘news’ about the approval of a Bitcoin ETF and other events from the past week.

Bitcoin price tests $30,000

On Monday, October 16, the quotes of the first cryptocurrency surpassed the $30,000 mark amid rumors of approval of a Bitcoin-ETF from BlackRock. The news proved fake, and digital gold sprinted back toward $28,000.

On Friday, October 20, the price of Bitcoin for the second time this week breached the psychological threshold, but could not hold it. At the time of writing the asset was trading below $30,000.

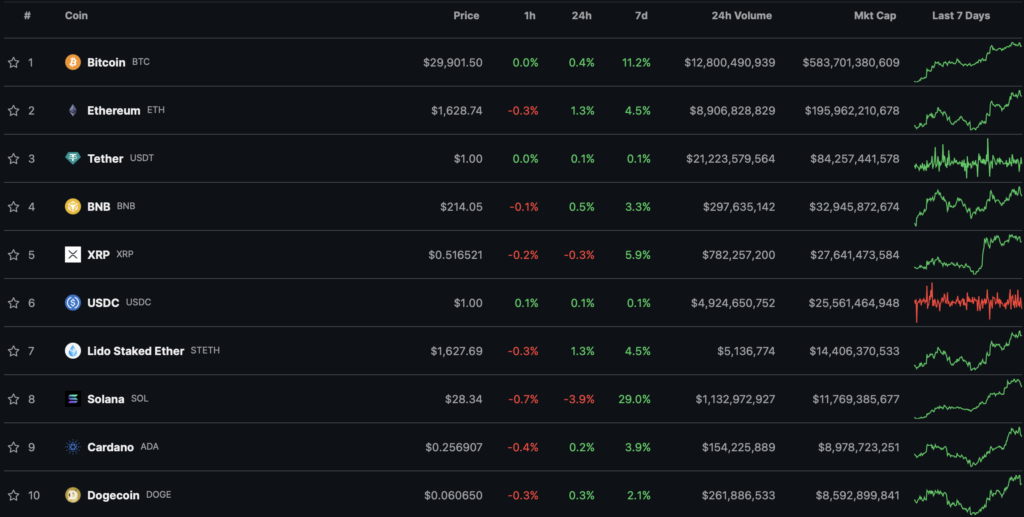

All top-10 assets by market capitalisation finished the week in the green. Solana led the gains (+29%).

The overall cryptocurrency market capitalisation remains below $1.2 trillion, while Bitcoin’s dominance index stands at 52.4%.

Bitcoin mining difficulty hits a new all-time high

As a result of another adjustment mining difficulty for the first cryptocurrency rose by 6.47%. The metric reached a record high of 61.03 T.

The average hash rate over the period since the previous change was 465.6 EH/s. The interval between mined blocks was under 9.5 minutes.

BlackRock CEO explains the Bitcoin rally amid ‘news’ of ETF approval

The Bitcoin rally on unconfirmed news regarding the approval of a spot ETF from BlackRock points to ‘unmet demand for digital assets’, said the CEO of the filing company, Larry Fink.

“Part of the rally goes far beyond the rumours. I think the jump is linked to investors fleeing into ‘quality’, given all the problems linked to the current Israeli war, global terrorism. More and more people are looking to buy Treasuries, gold or cryptocurrencies. […] I am convinced that digital assets will play the same role”, commented Fink.

The executive declined to discuss the progress of the review of the spot Bitcoin ETF application. The BlackRock CEO added that he has heard “from clients around the world about demand for cryptocurrency”.

What to discuss with friends?

- Opinion: Satoshi Nakamoto is not Hal Finney.

- U.S. authorities have emerged as among the largest holders of Bitcoin.

- A Chinese teacher handed over $546,000 to a scammer for an “investment in Bitcoin”.

SEC drops charges against Brad Garlinghouse and Chris Larsen

The U.S. Securities and Exchange Commission (SEC) dropped the suit against Ripple co-founder Chris Larsen and CEO Brad Garlinghouse on charges of violating securities laws.

The parties have reached a global settlement on the claims. This means that in the future the defendants cannot be sued on the same grounds.

“The SEC made a serious error pursuing Brad and Chris personally; now it has capitulated, dropping all charges against our leaders. This is not a settlement. This is a capitulation,” commented Ripple’s Chief Legal Officer Stewart Alderoty.

In El Salvador, Bitcoin’s role in the country’s revival

The adoption by El Salvador of the first cryptocurrency as legal tender in 2021 became a key element of the country’s escape from crisis, said Vice President Félix Ulloa.

The crackdown on street gangs to bolster security and Bitcoin proved to be among the most important drivers of the early tourist boom, the official noted. The cryptocurrency has simplified payments for visitors, removing currency-exchange hassles.

“Undoubtedly, tourism and the use of digital currencies go hand in hand and are a sign of the future and revival of our country,” he believes.

Bitcoin’s integration has attracted new investors to El Salvador. According to Ulloa, more than 80 bitcoin-industry companies operate in the country in some form.

He also pointed to the development of Bitcoin mining, one of the pioneers of which is the state-supported Volcano Energy project with the participation of Tether.

Also on ForkLog:

- Binance burned BNB worth over $453 million.

- The community criticised KYC-feature of Uniswap.

- The Trust Wallet team carried out a major rebranding.

- The number of searches for the term “spot Bitcoin ETF” reached a record high.

Mike Novogratz: the SEC will approve a Bitcoin ETF by the end of 2023

The SEC will approve the first exchange-traded fund based on the spot price of Bitcoin by the end of 2023. This view was expressed by Galaxy Digital CEO Mike Novogratz.

He cited the court ruling in late August, which granted Grayscale Investments’ petition against the SEC. Media reported that the Commission will not appeal it.

“The SEC lost in court […]. The judge said: ‘What are you talking about, SEC? You have a futures ETF [on Bitcoin], and you say there cannot be a spot one. That makes no sense.’ This puts the SEC at a disadvantage,” explained the founder of Galaxy Digital.

According to him, the American public wants it, and the world’s largest asset manager—BlackRock—will deliver.

Anthony Scaramucci envisions Bitcoin’s market cap at $15 trillion

The first cryptocurrency could easily become an asset with a market capitalisation of $15 trillion, thinks SkyBridge Capital founder Anthony Scaramucci.

The expert’s assessment implies a rise from the current $540.9 billion to 2,662%, and at such a cap the price of Bitcoin would reach around $700,000. The SkyBridge head believes Bitcoin is, in many respects, more valuable than gold and could become a store of value in the long term.

However, Bitcoin is unlikely to approach a universal standard of money, as some crypto maximalists would like, Scaramucci noted.

“But strange things can happen when you see countries hostile to the U.S. trading Bitcoin or something denominated in gold, distancing themselves from the dollar, as the United States has used its currency to assert its geopolitical will,” added the investor.

According to Scaramucci, the current financial system is ‘broken’, and it can only be fixed with proper leadership over a 15- to 20-year plan.

What else to read?

This week we covered Web3 social networks and the staking service PirateCash.

In our traditional digest, we collected the week’s main cybersecurity news and events.

The decentralized finance sector continues to attract heightened attention from crypto investors. ForkLog has gathered the most important events and news of recent weeks in the digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!