Expert: mining pools block transactions from sanctioned addresses

- ViaBTC, Foundry USA, and F2Pool blocked transactions involving addresses from the SDN-list OFAC.

- Filtering transactions by a single pool, in general, does not affect the network’s resilience to censorship, but the situation warrants ongoing monitoring.

Mining pools began to reject transactions from addresses, or to addresses on the OFAC SDN list, without including them in blocks. The matter drew the attention of a Bitcoin developer using the alias 0xB10C.

0xB10C Research reveals that F2Pool became the first Bitcoin mining pool to filter transactions based on U.S. OFAC sanctions. In September and October 2023, there are six bitcoin blocks missing an OFAC-sanctioned transaction and four by F2Pool. The transactions missing from…

— Wu Blockchain (@WuBlockchain) November 22, 2023

From September to October 2023, with the help of a special service, the expert recorded six such cases: one by ViaBTC, one by the Foundry USA pool, and four by F2Pool.

Subsequent, detailed analysis showed that filtering by the first two miners was erroneous due to software peculiarities. However, in the F2Pool case the blocking was intentional. 0xB10C reminded that the latter is Chinese.

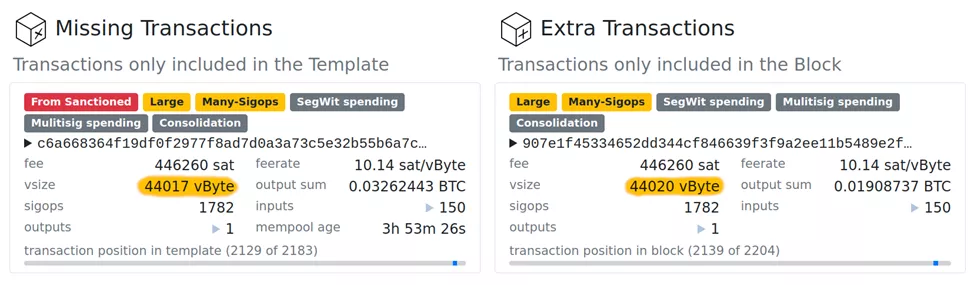

In each block there is one ‘sanctioned’ transaction missing. It aggregates 150 inputs with 2-of-3 multisignatures. For them, it is typical that funds obtained from 3PKiHs4GY4rFg8dpppNVPXGPqMX6K2cBML are spent.

OFAC added this address to the SDN list on 14 April 2023.

According to 0xB10C, given multisignatures in most of the 150 inputs, the ‘missing’ transaction weighs in at a hefty 43 842 bytes. The initiator provided the miner with sufficient fee to include it, the expert noted.

Before the block 810727 ..ccda1498 was created, the transaction resided in the analyst’s mempool for about four hours, but instead F2Pool added another (shown below, bottom-right). It also consolidates 150 inputs, but does not spend funds from the sanctioned address.

It carries the same fee of 446 260 sat, but it turns out to be 3 bytes larger than 11 at 44 020 bytes. This means that the missing transaction c6a66836. has a slightly higher coefficient than 907e1f45…

“With strict sorting by the coefficient, the pool should have included the missing transaction. In practice, it is unlikely that an extra 3 MB of space would affect the total fees”, — the expert said.

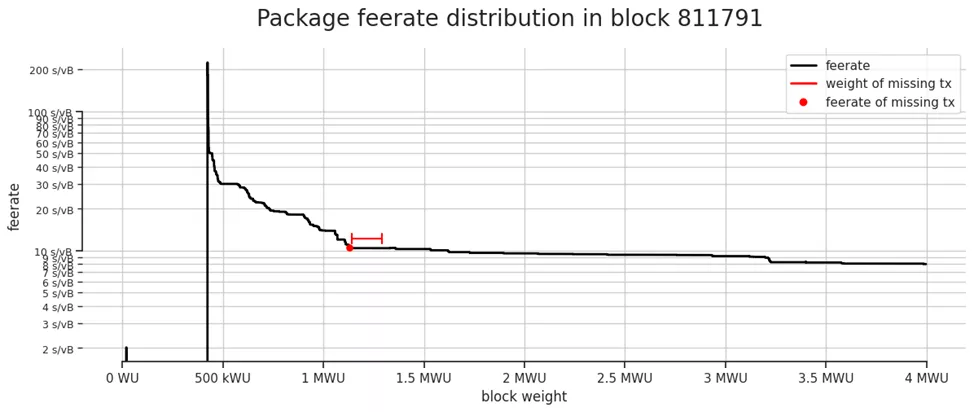

F2Pool did not include a similar 170 kWU-weighted transaction in block 811 791 ..af4453d6. Like the previous consolidation operations, this one measured 42 459 bytes with a fee of 446 260 sat based on 10.5 sat/byte. From mempool entry to block inclusion, four minutes elapsed, according to the service’s calculations.

In 811 791 there was ample space; of 4 MWU, 2.86 MWU of the transaction paid less than the cited 10.5 sat/byte. In mempool.space this operation involving 3PKiHs4GY4rFg8dpppNVPXGPqMX6K2cBML was marked as ‘removed’.

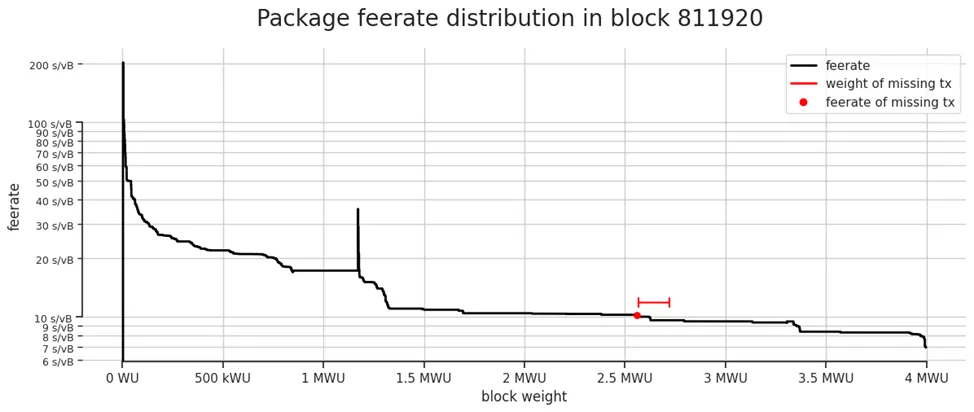

In block 811920 ..00badf62 a similar situation recurred. The 170 kWU-weighted transaction was skipped despite ample space and an acceptable fee (1.44 MWU out of 4 MWU turned out to be below the sat/byte calculation).

According to the analyst, F2Pool was highly likely to see it, since its node’s mempool held it for two minutes.

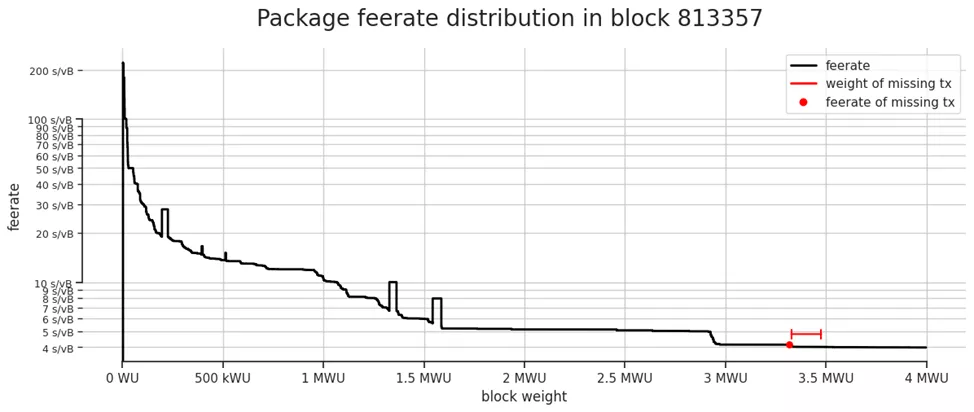

In the last of the detected blocks 813357 ..63ac1669 the transaction was not included after more than 25 minutes of waiting.

“Given such a long delay, it is unlikely that the transaction has not yet propagated to one of F2Pool’s nodes”, the expert noted.

As with the previous cases with a 172 kWU weight, it met the inclusion criteria (0.684 MWU out of 4 MWU were below the sat/byte calculation), he noted.

The expert declined to say whether F2Pool filters only 3PKiHs4GY4rFg8dpppNVPXGPqMX6K2cBML or all addresses on the OFAC SDN list.

In conclusion, 0xB10C noted that filtering transactions by a single pool does not affect the network’s resilience to censorship in general.

“Further monitoring will determine whether other players will resort to this practice. It will also provide an opportunity to make an informed decision about migrating to rivals if there is disagreement with such a policy”, the expert said.

As for the broader context, OFAC sanctions were imposed in November against Russian citizen Ekaterina Zhdanova, according to authorities. Later, the issuer of the stablecoin USDT, Tether blocked around $225 million in USDT as part of cooperation with the U.S. Department of Justice, the cryptocurrency exchange OKX, and analytics firm Chainalysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!