Analyst warns bitcoin could drop 70%

Historical data point to a potential correction

Bitcoin could face a 70% decline in the next bear phase, said ITC Crypto founder Benjamin Cowen.

He pointed to historical data. In previous cycles the price of the digital gold fell 94%, 87% and 77% from the peak.

“I would say that a 70% drop from whatever absolute high bitcoin reaches is possible. Does it have to happen? No, but the lessons of history suggest that this possibility should be considered,” said Cowen.

Next ATH in two weeks?

The latest all-time high for the first cryptocurrency was recorded at $124,128 on August 14. At the time of writing, the asset trades around $116,900.

Researcher Axel Adler Jr. put the probability of bitcoin reaching an ATH in the next two weeks at 70%. He pointed to balanced investor sentiment.

STH MVRV Z-Scores (155D & 365D) are hovering near zero — the market is neither overheated nor oversold, essentially balanced.

BTC price sits just above STH Realized Price, setting the stage for 1–2 weeks of consolidation with a potential push to ATH.

Uptober incoming 🌊 pic.twitter.com/hFaycSGxRy

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 18, 2025

According to the expert, MVRV for short-term holders hovers near zero, while the cryptocurrency trades above this group’s realized price. That setup implies a one- to two-week consolidation before a “new push to ATH”.

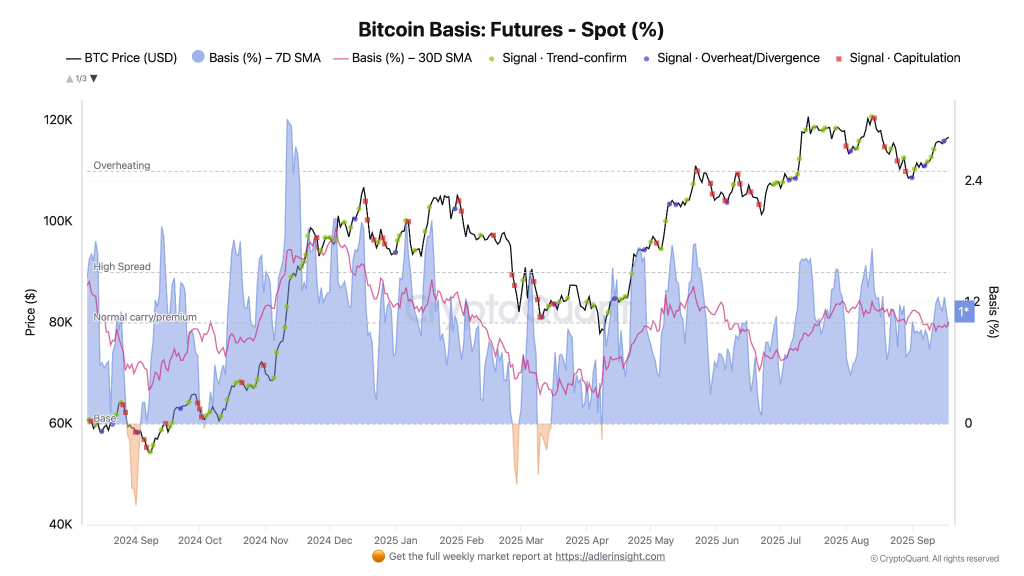

Derivatives data corroborate the upside. The analyst noted that bitcoin futures are steadily trading at a premium to spot. The seven-day basis exceeds the 30-day — a structure typically associated with bullish trends.

“Base case (~70%) for the next two weeks: a stair-step uptrend or sideways movement. If a cluster of green trend-confirmation signals appears in the next few days, it will indicate an influx of new long positions and increase the probability of reaching a new all-time high,” Adler Jr. wrote.

A key resistance level

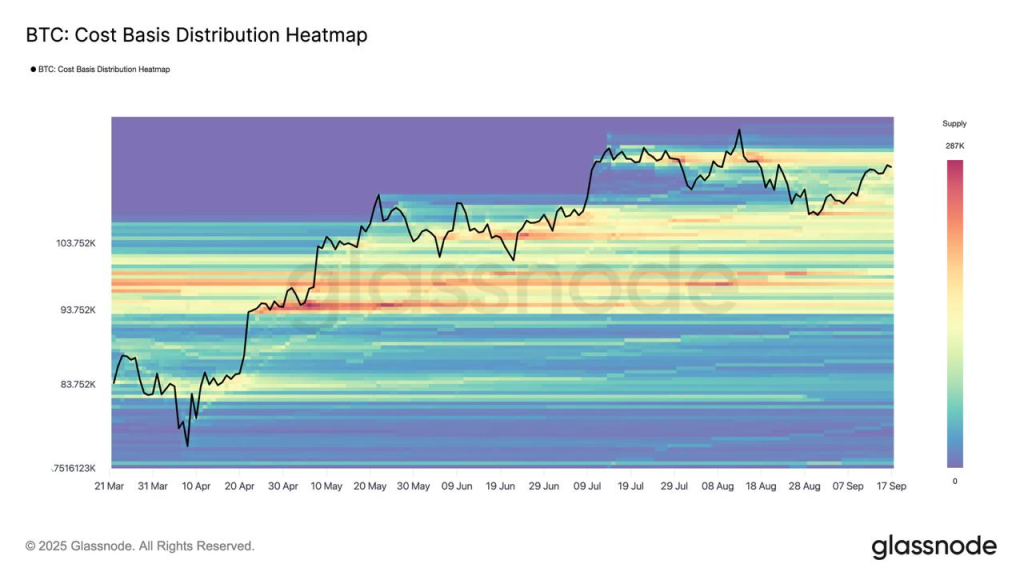

According to Glassnode, bitcoin’s heat map shows a concentration of supply around $117,000. Analysts called this a key resistance zone.

A move above that level would signal further gains and potentially new highs. Otherwise, bitcoin faces prolonged consolidation or compression.

What could support the price?

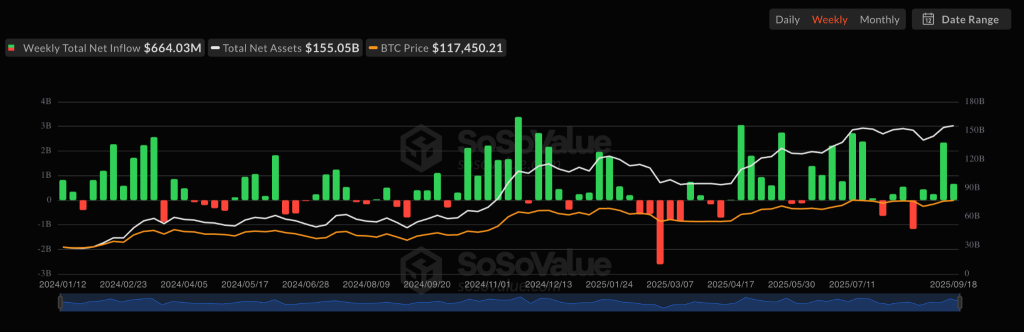

Glassnode also pointed to positive inflows into spot bitcoin ETFs. They said this underscores institutional demand as a key factor supporting the market.

On September 18 the vehicles attracted $163m, bringing total investment over four trading sessions to $664m. Last week total inflows exceeded $2.3bn — the highest since mid-July.

CryptoQuant analysts drew attention to rising reserves of bitcoin and Ethereum at the Coinbase exchange. The figure has reached $112bn for the first time in four years.

Coinbase Reserves Hit $112B in BTC, ETH & Stablecoins — Highest in 4 Years

“In past cycles, rising reserves on major exchanges like Coinbase have often coincided with higher market liquidity and bullish price momentum.” – By @CryptoOnchain pic.twitter.com/64VDXP51i5

— CryptoQuant.com (@cryptoquant_com) September 19, 2025

“In past cycles, rising reserves on major exchanges like Coinbase have often coincided with higher market liquidity and bullish price momentum,” the experts stressed.

Earlier, macro analyst Luke Gromen explained bitcoin’s philosophy as digital gold. According to him, the cryptocurrency’s key advantage is the absence of yield.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!