Analysts doubt an October rally as crypto markets slide

On 22 September bitcoin fell to $112,000

On 22 September, bitcoin fell to $112,000, and 24-hour liquidations on the crypto market reached $1.7bn. Amid the correction, analysts are split on the prospect of a seasonal October rise in digital assets.

Since 2013, digital gold has closed October in the green in ten of twelve years, according to CoinGlass. Hence its unofficial moniker Uptober.

10 days left until we enter Uptober.

Do you understand? pic.twitter.com/h4Su5W03u1

— Mister Crypto (@misterrcrypto) September 20, 2025

Over the past 24 hours, bitcoin has dropped by more than 2.5%. At the time of writing, the asset trades around $112,700.

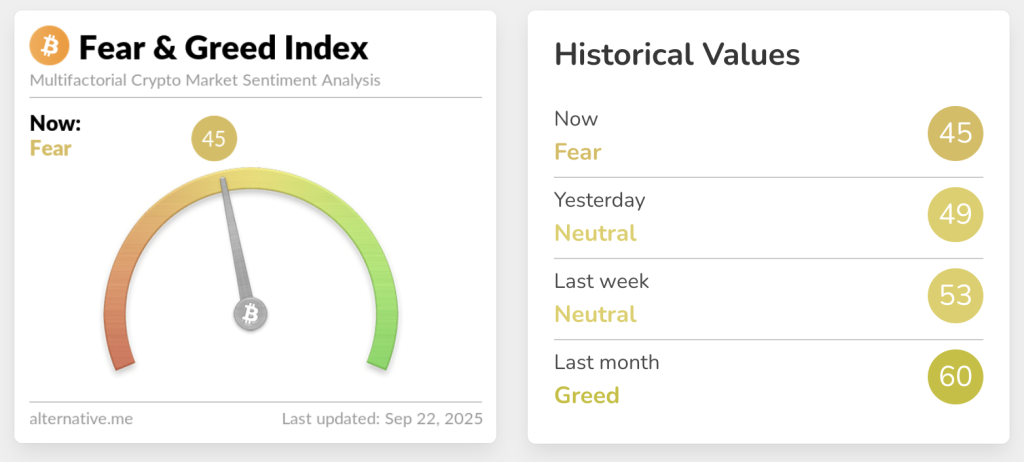

The Fear and Greed Index slipped into “fear” — to 45.

The case for Uptober

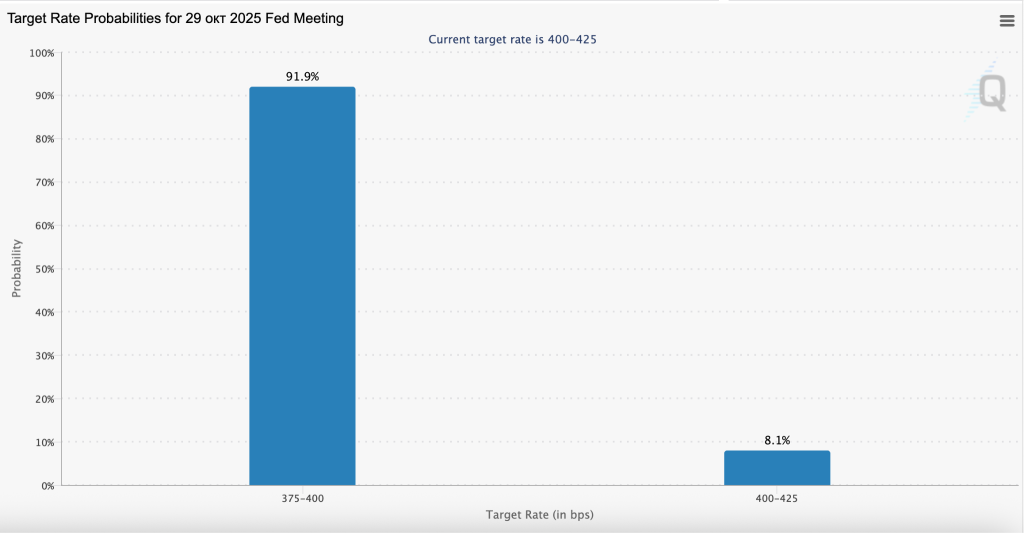

Some analysts expect 2025 to be no exception for the first cryptocurrency. Bitcoin enthusiast Kyle Chasse pointed to rising odds of another Fed rate cut next month.

He says monetary easing is already priced in, and new liquidity is the “fuel” for crypto’s advance.

An analyst under the pseudonym Sykodelic called the latest drop expected.

Lower is coming.

But then mucuuccuucchchhh higher sers.

And you can then breathe a sigh of relief because you wont have to bend over your wifes bf.

It’s ok…

Syko has got you 😉

In all seriousness, as Ive been saying for a wee while, $112.5k is the number and when we get… https://t.co/TZoZF7WyTp pic.twitter.com/vQpXGZkAQe

— Sykodelic 🔪 (@Sykodelic_) September 22, 2025

“As I have said, the target is $112,500. When we reach it, skeptics will once again talk about a market top. And once we power through that whining, we will immediately rip to new highs. That very powerful final phase will begin, the one that will take the market to euphoria: Ethereum will set fresh records, and altcoins will finally feel a surge of liquidity,” he wrote.

BitMEX co-founder Arthur Hayes said the crypto market will shift into growth mode once the US Treasury replenishes the TGA to its $850bn target. On 20 September, the balance stood at $807bn.

“Once the liquidity restoration is complete, the rally will resume,” the analyst noted.

What do the sceptics say?

The crypto trader CasiTrades believes bitcoin has topped this cycle. She says that on 18 September the first cryptocurrency reached the 0.618 Fibonacci retracement at around $117,900. She called it one of the most common bearish turning points in a market cycle.

🚨Is This the Top for Bitcoin?🚨

Bitcoin is reaching the .618 retracement at $117,900. The textbook target for a potential Wave 2 pivot. I’ve been mentioning this level for a long time. It’s one of the most common bearish turning points in the market cycle. All eyes should be… pic.twitter.com/HpNS9gStuw

— CasiTrades 🔥 (@CasiTrades) September 18, 2025

A break below $113,000 would be key confirmation of a deeper slide. CasiTrades stressed that in that case the price of digital gold could fall to $96,000 or even $90,000.

“The only thing that would invalidate this theory is if bitcoin breaks RSI resistance and makes new all-time highs. However, we are seeing all the classic signs that the market is peaking right here,” she added.

On 20 September, an on-chain analyst under the pseudonym Reflection pointed to a repeat of the 2021 pattern by the first cryptocurrency, when after reaching an ATH above $69,000 the price swiftly fell to $32,000.

Are you ready?$BTC pic.twitter.com/SLt9Fm0338

— Reflection🪩 (@0xReflection) September 20, 2025

Augustine Fan, head of research at SignalPlus, noted in comments to Cointelegraph that any potential pop would be weak amid record-low volatility and slowing ETF inflows. He also pointed to pressure from participants taking profits on the dip.

In his view, long-term investors should be patient before new highs.

BTSE’s chief operating officer Jeff Mei doubted the arrival of Uptober because of macroeconomic uncertainty and the absence of a September slump.

“However, if the Fed announces more aggressive measures to stimulate the economy, the situation could change,” he added.

Earlier, ITC Crypto founder Benjamin Cowen warned of a possible 70% bitcoin crash.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!