Analyst says Bitcoin’s bull cycle is running out of steam

He said altseason is imminent.

Bitcoin is showing signs of exhaustion in the current market cycle that most investors are missing, said Joao Wedson, founder of analytics platform Alphractal.

Bitcoin is already showing signs of cycle exhaustion — and very few are seeing it.

The SOPR Trend Signal is excellent at signaling when blockchain profitability is drying up.

Never in Bitcoin’s history have investors accumulated BTC so late and at such high prices.

Maybe only… pic.twitter.com/I1GBdEJH03— Joao Wedson (@joao_wedson) September 22, 2025

He said the indicator SOPR is signaling that on-chain profitability is drying up. Meanwhile, institutional players continue to accumulate the cryptocurrency at historically high price levels.

“The realized price of short-term holders is $111,400, which could become a critical level for large investors who should have been buying the asset at a lower rate,” the expert noted.

The Sharpe ratio for Bitcoin is weaker than in 2024. This points to reduced return potential for the same risks, making the first cryptocurrency less attractive to institutions. At the same time, Wedson recorded a sharp drop in public interest in digital gold.

“Many market makers act this way: they partially sell Bitcoin and channel stablecoins into altcoins. Even if the asset revisits all-time highs — which is quite possible — profitability will remain low, and the main focus will shift to ‘alternative coins’,” he said.

The expert reaffirmed his forecast that altseason is arriving, emphasizing that many cryptocurrencies have stronger fundamentals than Bitcoin. Their prices are further below peaks, opening more upside potential.

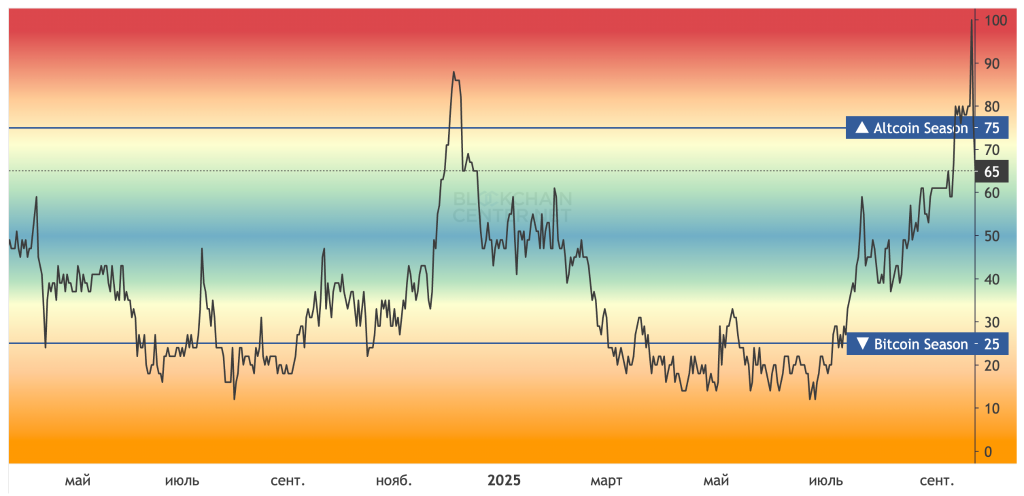

On 11 September, the altcoin-season index reached its highest since late 2024. Indicators from CoinGlass and Blockchain Center read 78. As the crypto market fell, the reading had pulled back to 65 at the time of writing.

Earlier, analysts identified three drivers of altseason.

Why did the crypto market fall?

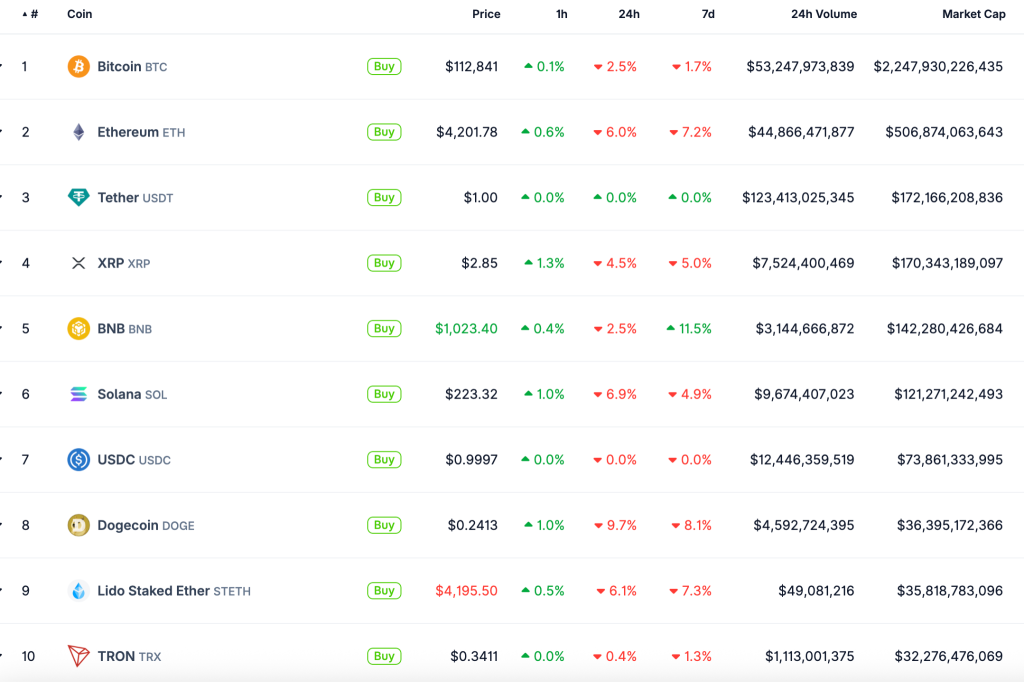

On 22 September, Bitcoin fell to $112,000, and Ethereum to $4,000. All top-10 cryptocurrencies by market capitalization traded lower.

Daily liquidations on the crypto market reached $1.7bn, and the fear and greed index slipped into the “fear” zone — to 45.

According to MN Capital founder Michaël van de Poppe, the correction is linked to a classic flushing of excess liquidity from the market.

“Today’s drop is not related to fundamental problems in projects. It is a classic ‘liquidity’ sell-off in the crypto market, because of which altcoins lose 10% or more. The reason is the mass closing of high-leverage positions amid low liquidity. Such events usually form a market bottom,” he noted.

The analyst stressed that the first cryptocurrency failed to break key resistance above $116,000. That exacerbated the downtrend.

We couldn’t break the resistance for #Bitcoin, and therefore we’re correcting back down.

I’m not sure if this is it, given the heavy wick on #Altcoins. I would say so, at least, we’re scanning for a potential massive buy-the-dip opportunity on the markets before the up-only… pic.twitter.com/SJAPJZqcFt

— Michaël van de Poppe (@CryptoMichNL) September 22, 2025

“Given the heavy wicks on altcoins, I am not sure the drop is over. But we are already looking for a ‘buy-the-dip’ entry before the next rally,” van de Poppe concluded.

Trader Ash Crypto agreed, saying the market had consolidated ahead of a “powerful move” next quarter.

Forecasts

According to analyst Captain Faibik, Bitcoin is gearing up for a new selling wave and a drop to $100,000.

$BTC Another Bearish Wave incoming Soon So Be Ready..⛔️

On the Daily TF, Rising Wedge has already broken and now a Bearish Flag pattern is forming.

I already warned back in August that buyers would get trapped & exactly that happened. Late buyers got trapped, & since then… pic.twitter.com/ZJx9b47tvD

— Captain Faibik 🐺 (@CryptoFaibik) September 22, 2025

“On the daily timeframe, the ‘rising wedge’ pattern has been broken, and now a ‘bearish flag’ is forming,” he said.

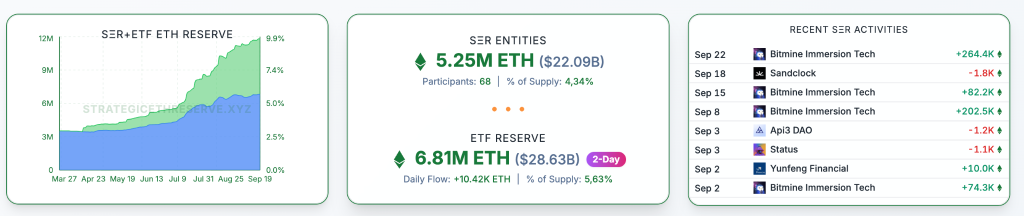

Pessimism prevails among crypto investors. Users note that even purchases via ETFs and by large companies are not saving Bitcoin from declines.

On 22 September, Michael Saylor’s Strategy reported buying another 850 BTC last week. The company’s balance in cryptocurrency rose to 639,835 coins (~$72bn).

Sean Yang, chief analyst at MEXC Research, expects digital gold to trade between $110,000 and $118,000 in the near term. In his words, the market has taken a wait-and-see stance ahead of the next Fed rate decision.

“If the regulator keeps a neutral tone, there is a chance of breaking $118,000. If the signals are tougher, Bitcoin could test support around $110,000-111,000,” he said in a comment to ForkLog.

The next Fed meeting will be held on 29 October. According to CME FedWatch, at the time of writing 89.8% of market participants expect further monetary easing.

Speaking about Ethereum, Yang noted that the cryptocurrency continues to see demand from institutional and retail investors. He identified key support at $4,200. If positive momentum persists, the analyst did not rule out a rise to $4,700.

If momentum weakens, the asset may return to the lower bound of the range.

“The main risks are macroeconomic: any unexpected Fed rhetoric or fresh inflation and employment data could trigger sharp volatility,” the expert warned.

Earlier, experts were divided on the seasonal rise of digital assets in October.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!