Tether Seeks $20 Billion to Reach $500 Billion Valuation, Reports Suggest

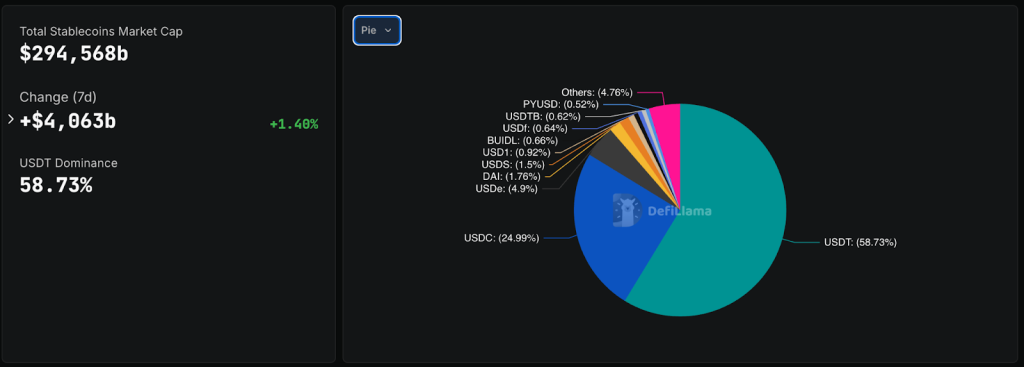

USDT issuer may join the world's largest private companies.

The company behind USDT, Tether, is reportedly in discussions with investors to raise $20 billion, potentially boosting its valuation to $500 billion, according to Bloomberg.

The final amount may be significantly less than stated, as the talks are preliminary. The discussions involve the sale of approximately 3% of the company’s shares, the report indicates.

Cantor Fitzgerald, which previously acquired 5% of the issuer’s securities, is advising on the deal.

If the information is confirmed and the company secures funding, Tether would join the ranks of the world’s largest private firms alongside OpenAI and SpaceX.

Tether’s main competitor, the company behind USDC, Circle, is valued at $30 billion. On June 5, the firm conducted an IPO, listing its shares on the NYSE.

The company has yet to comment on the emerging rumors. Earlier, at a conference in Seoul, the head of Tether’s American division, Bo Hines, stated that the issuer does not plan to raise additional capital.

However, Bloomberg sources mentioned the issuance of new shares rather than the sale of existing investors’ stakes.

Tether remains one of the most successful companies in the crypto industry. In the second quarter, the firm reported a net profit of $4.9 billion.

In July, Tether’s CEO Paolo Ardoino confirmed plans to introduce USDT to the American market. He announced Tether’s intention to obtain foreign issuer status for stablecoins under the GENIUS Act requirements. Ardoino estimated the implementation of these plans would take three years.

On September 12, Tether introduced a dollar-backed and fully regulated “stablecoin” in the US, USAT.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!